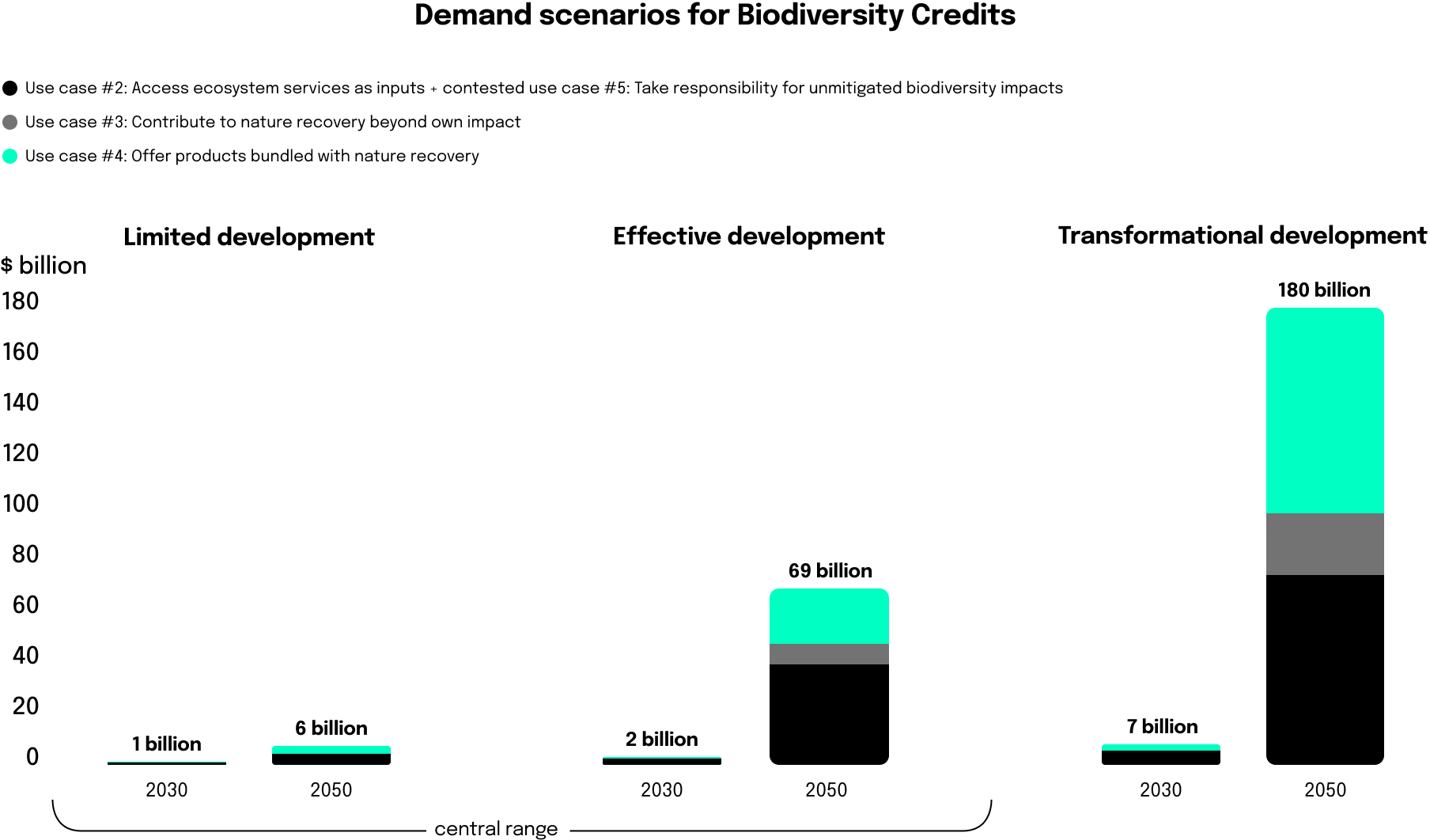

Sustainability is more than just CO₂ reduction. And yet the economic discourse has revolved very much around just that in recent years. Companies have concentrated on NetZero certificates. New business models based around the carbon footprint and offsetting have sprung up like mushrooms.

Biodiversity, however, is a topic that has received little attention to date. It comprises three key aspects: genetic diversity, species diversity and the diversity of ecosystems as well as the structures within and between life forms. Biodiversity ensures stable ecosystems that provide us with essential goods and services such as food, clean water and wood. It regulates the climate, water quality, natural pest control and much more. There is even a collective term for the various contributions that ecosystems make to human well-being: ecosystem services.

In short: We could not survive without biodiversity. In addition, the loss of biodiversity is one of the most relevant financial risks for many companies, since more than half of global value creation is moderately or heavily dependent on ecosystem services, which corresponds to around 44 trillion US dollars per year.

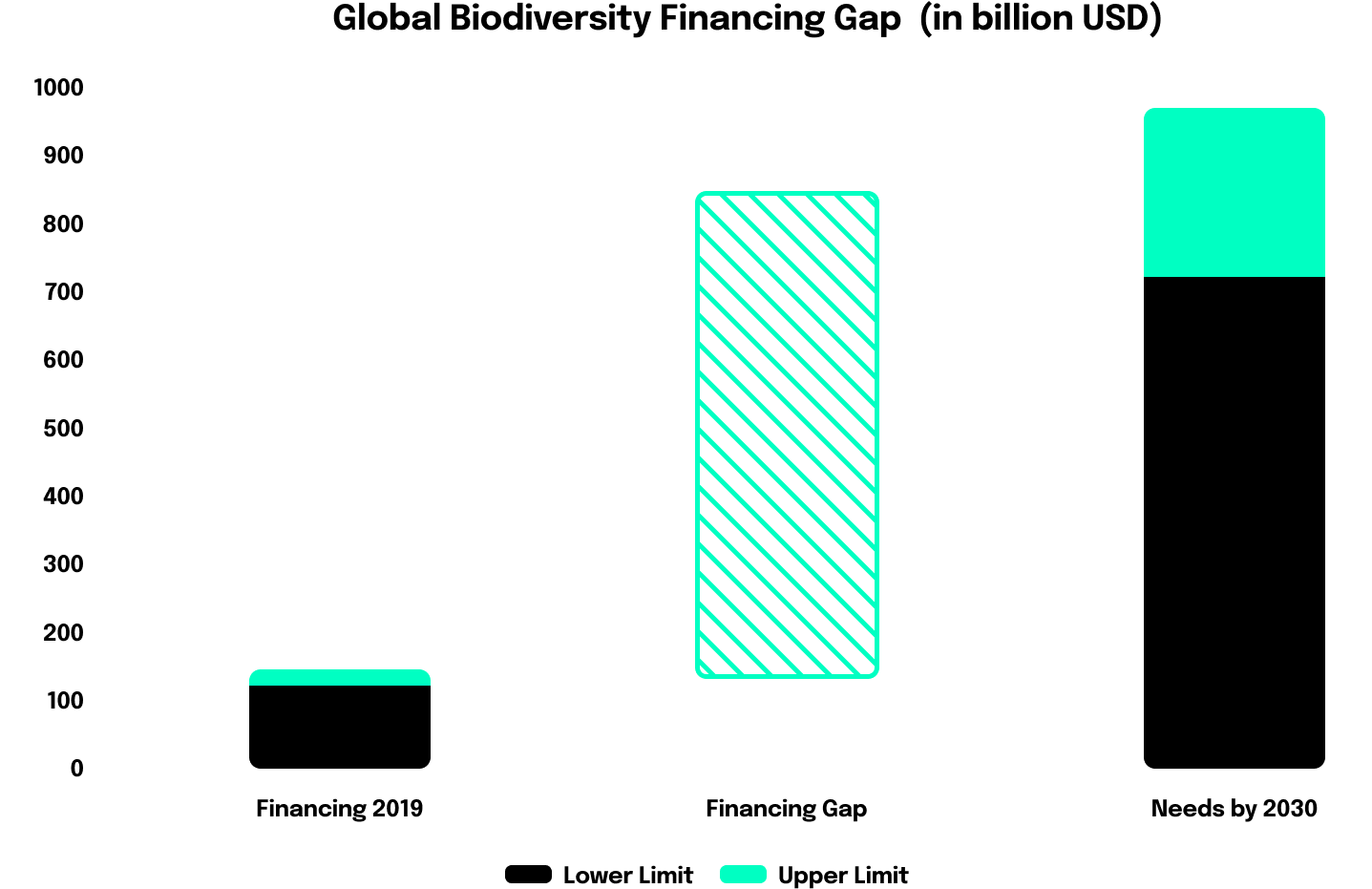

In order to understand the importance of systems such as biodiversity credits for the conservation of nature, it is important to first realize that even a partial loss of ecosystem services would have fatal consequences, i.e. massive losses for sectors such as agriculture, construction and the food industry. The World Bank estimates that this could lead to a global GDP loss of 2.3 percent – or in absolute figures: around 2.7 trillion US dollars by 2030.