The startup Pliant and Commerzbank are celebrating a year of successful collaboration, driven by the investment and work of neosfer. Such best practices demonstrate how corporate venture capital creates concrete innovations in banking and delivers real added value for corporate customers. Neosfer project lead Samuel Speicher looks back on his expertise—and ahead to the future.

1 year of Pliant x Commerzbank: Best practice for corporate venture capital

Corporate innovation through startups: A digital corporate credit card for Commerzbank

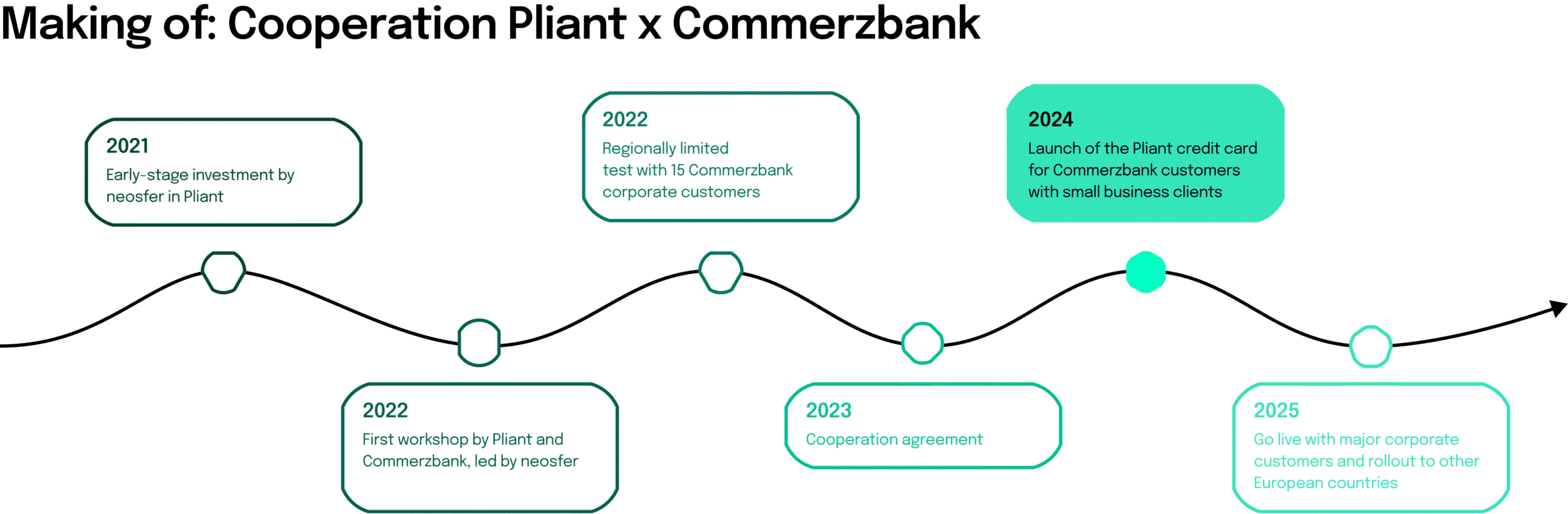

These days mark the anniversary of the cooperation between Commerzbank and the Berlin-based startup Pliant, through which our parent company Commerzbank has gained a valuable additional digital offering for its corporate customers. What began with an early-stage investment by us in Pliant has developed into a win-win situation for all involved. Pliant x Commerzbank is a best case scenario in the field of corporate venture capital (CVC).

What it’s all about: Pliant’s business model comprises an efficient solution for processing corporate expenses. Companies can issue their employees with a virtual and/or physical corporate credit card quickly, easily and in a completely digital process. The cards are managed via an app or the web. Thanks to full integration with various existing accounting systems, companies can easily keep track of expenses and have a structured overview. This saves time and reduces errors.

At neosfer, we recognized the added value of a solution like Pliant for the financial industry, and especially for conservative banks, very early on and invested in the startup in 2021 in our role as an early-stage investor. Since last year, Pliant’s product has been available as a white-label solution for Commerzbank’s corporate customers as part of a cooperation agreement – and after the first twelve months, both partners consider the collaboration a complete success.

Summary after one year: a complete success

Our colleagues at Commerzbank are very satisfied after the first year. The Pliant solution has made it possible to offer “a modern, scalable credit card platform” with “the look and feel of Commerzbank.” Thanks to the partnership, the bank has been able to quickly and profitably serve a niche market and increase customer loyalty.

Partner Pliant is also very satisfied with the number of active corporate customers, the ever-increasing growth in interested parties, and the “outstanding” customer feedback. Lukas Gottschick, Chief Commercial Officer at Pliant, says:

This cooperation is a prime example of why corporate venture capital investing is a good innovation tool for banking. Through the strategic use of venture capital, neosfer provides its parent company with access to innovative people, technology, and products with real added value. In this case, the cooperation with Pliant has created enormous customer benefits for Commerzbank and has brought success much faster and more cost-effectively than would have been possible with an in-house development with the same product scope.

The path to cooperation: From potential corporate venture capital investment to integration

The history of the collaboration dates back to 2021, when neosfer participated as an investor in Pliant’s pre-seed round and subsequent investments. In 2022, we brought the two current partners together for the first time. We conducted an initial test with a small unit of Commerzbank’s sales department: 15 external Commerzbank customers were given access to the startup’s offering. The aim was to find out how the solution would be received by selected customers and what added value they would see for their daily operations.

The cooperation was officially agreed at the beginning of 2024, and just a few months later, small businesses from the bank’s customer base were able to use the product for the first time. Our colleagues at Commerzbank were quickly convinced by both the product and the people behind it. According to Tobias Knoll, Managing Director at Commerzbank, the positive results of the joint pilot project were a real eye-opener in terms of the potential for scaling up Commerzbank’s credit card business.

At the start of the collaboration, a workshop was held to define the expectations of both sides and set out a clear timetable for implementation. From the outset, Neosfer acted as a bridge between Commerzbank and Pliant. One of the first steps at that time was to define important KPIs and milestones, including the number of leads generated and contracts concluded. This laid the foundation for a structured and goal-oriented cooperation. At the same time, these targets were important for orientation and helped us to measure the progress of this partnership.

I am proud that we have been able to create such a trusting basis for cooperation over the past few years. An important factor in this success was our transparent communication: we at neosfer ensured that all parties involved had clear insights into the respective goals, roles, and responsibilities at all times in order to minimize misunderstandings and enable cooperation on an equal footing.

My neutral position certainly helped in this regard: I knew both partners from the outset and acted in an advisory capacity as a sparring partner. Among other things, my tasks included helping to select the right stakeholders, supporting the vendor onboarding process, and ensuring the efficient use of resources to maximize the success of the cooperation.

What the partners learned

The integration of the Pliant solution into the Commerzbank world has shown that, with the right partner, it is more efficient and cost-effective to use a third-party product than to build one yourself, especially in a niche such as corporate credit cards for employees. With the successful integration, Commerzbank has once again proven that fintechs should not be seen as competition to the core business of banks per se, but that they can offer an excellent complement to their own traditional financial services.

It was also very helpful that the collaboration received support from top management at an early stage. A strong and committed project team within Commerzbank actively promoted the topic internally.

From CVC to new challenges: Here are the next steps

The target group is growing steadily: After initially starting with smaller companies, the Pliant-Commerzbank solution is now also available to Commerzbank’s global corporate customers.

And in terms of processes, after a successful first year, we are now doing the “handshake,” i.e., the handover from the product team to sales. This transfer of responsibilities is the important next step in ensuring that the existing product is marketed across all regions in Germany and can thus generate added value for even more corporate customers.

People always say that trust is one of the key factors in banking, and I think that has really been demonstrated very clearly in this project. It started with our trust in Pliant at a very early stage of the start-up and in the people who built the company and are still building it. The partnership now thrives on the trust of corporate customers in Commerzbank, trust in the product, and, last but not least, trust between the teams at Pliant and Commerzbank—now and in the future.