As 2024 comes to an end, we look forward to an exciting glimpse into the upcoming banking trends. What will shape the financial industry in 2025? In this article, Matthias and Kai, the leadership duo at neosfer, share their personal insights on six key topics that will captivate banks and financial service providers in the new year. From the tangible use of artificial intelligence to the digital Euro and new regulatory developments, discover the trends you can’t afford to miss next year.

Banking Trends 2025: Six Strategic Topics in Focus

Our Perspective on Banking Trends 2025

As 2024 draws to a close, we eagerly look ahead to the banking trends of the coming year. As the leadership team at neosfer, we, Matthias and Kai, take pleasure in contemplating what lies ahead: the future of the financial economy, banking, Commerzbank, and neosfer. This includes innovations we brought back from major events in Las Vegas and Bangkok earlier this year, as detailed in our earlier blog.

Now, as the year wraps up, we’ve taken the time to reflect on the trends that 2025 might bring for banking.

Did we order a crystal ball? Of course not. And we don’t need one. We’re not here to predict the future but to share our personal take on what’s likely to come next year.

Here they are: our six most exciting banking trends for 2025.

Banking Trend #1: Banking Customers to Experience AI Firsthand

2025 will be the year artificial intelligence (AI) becomes truly tangible and experiential in banking – not as an abstract technology but as a visible enhancement to customer experiences.

In 2024, not only did banks intensively engage with the technology, but the EU’s AI Act clarified which AI applications are allowed. These developments create the perfect conditions to fully leverage AI’s advantages next year.

Banking customers will experience AI firsthand, whether through more efficient responses to inquiries or faster loan decisions. Ideally, the technology will remain in the background: customers won’t notice the AI itself but will appreciate the improved usability.

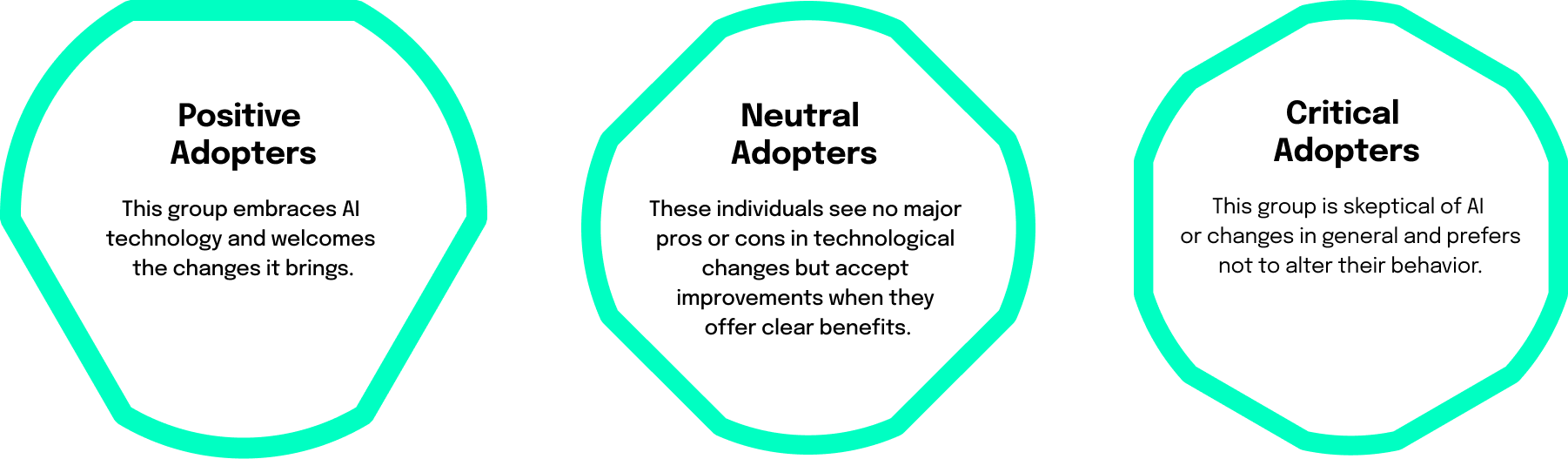

To better understand customer reactions, it helps to distinguish three groups:

For banking in 2025, it makes sense to focus AI applications on the first two groups to maximize the new technology’s advantages.

Banking Trend #2: Embedded Finance – Seamlessly Integrated and Ever More Present

Embedded finance will remain a significant trend in 2025 – and for good reason. More and more non-financial companies are seamlessly integrating financial services into their offerings, making banking part of a broader, non-financial ecosystem. For customers, this means an even more convenient experience as they access financial services directly in familiar environments.

For banks, this is an exciting opportunity to prepare technically for third-party integration: modularizing their products so they can be easily embedded into other platforms.

Of course, the challenge lies in maintaining brand visibility when their products are used by others. However, this also opens the door to new customer retention strategies through smart partnerships and innovative solutions.

Market potential predictions for embedded finance are promising: McKinsey estimates that revenue from embedded finance in Europe could exceed 100 billion Euros by the end of the decade (source).

2025 offers the perfect opportunity for banks to make strategic decisions and establish the technical groundwork to fully exploit this market’s immense potential and shape tomorrow’s financial services.

Banking Trend #3: Stablecoins – Bridging the Gap Between Crypto and Banks

The EU’s “Markets in Crypto-Assets” – MiCA – regulation will take effect in 2025, fundamentally transforming banking. Stablecoins, in particular, will play a crucial role in bridging the gap between the traditional banking world and the crypto ecosystem. Stablecoins are cryptocurrencies pegged to fiat currencies to avoid volatility. They overcome the primary disadvantage of cryptocurrencies, offering customers benefits like lower fees and faster cross-border payments.

The new regulation gives banks the chance to regain a prominent role in the crypto segment and actively harness the potential of this growing market. The challenge lies in developing innovative business models that meet regulatory requirements while catering to customer needs.

Banking Trend #4: The Digital Euro’s Underestimated Impact

While the digital Euro won’t be introduced in 2025, its arrival is already casting long shadows, motivating forward-thinking banks to act now.

The digital Euro represents a significant opportunity for the European economy and holds immense potential for innovative payment solutions.

For banks and credit card providers, it presents new challenges: functioning like digital cash, transactions will occur directly through the central bank. However, this also opens up room for creativity. Although these transactions may no longer generate direct revenue, the digital Euro offers an opportunity to create new services and added value for customers.

Unlike earlier payment systems like Paydirekt, which failed due to a lack of network effects, the digital Euro, as legal tender, will achieve broad acceptance.

Now is the ideal time for banks to refine their strategies to remain the central interface for their customers – for instance, by integrating the digital Euro into their wallet solutions. While few banks currently offer their own wallets, this gap presents a unique opportunity: to close it and further enhance the customer experience. Striking the right balance between being an efficient payment processor and a trusted partner for customers will be critical.

Jetzt ist der ideale Zeitpunkt für Banken, ihre Strategien weiterzuentwickeln, um die zentrale Schnittstelle zu ihren Kund:innen zu bleiben – etwa durch die Integration des digitalen Euros in ihre Wallet-Lösungen. Auch wenn bisher nur wenige Banken über eigene Wallets verfügen, bietet genau das eine wunderbare Chance: Diese Lücke zu schließen und die Kund:innenerfahrung noch weiter zu verbessern. Entscheidend wird dabei sein, die Balance zu finden zwischen der Rolle als effizienter Zahlungsabwickler und als vertrauenswürdiger Partner für die Kund:innen.

Banking Trend #5: FIDA – A New Regulatory Initiative for Financial Data Access

FIDA, short for Financial Data Access, will also cast its shadow in the coming year. This European regulatory initiative aims to simplify and standardize access to financial data. By introducing open data interfaces, it promises seamless integration between various financial services, potentially revolutionizing the financial industry.

Unlike Open Banking, FIDA isn’t limited to transaction data from checking accounts but extends to all financial products. This opens up vast opportunities for banks and third parties to develop innovative financial solutions tailored to customers’ specific needs.

The impact of FIDA will be far-reaching—for both customers and banks. We’re convinced that FIDA is much more than a compliance issue. It offers a unique opportunity to significantly enhance customer value through innovative products while unlocking substantial business potential. To fully capitalize on these opportunities, banks must rethink their approach to data and embrace strategic partnerships. This way, they can harness the advantages of open interfaces and actively shape the future.

Banking Trend #6: Venture Capital Market – Hope for Recovery

The venture capital market stabilized somewhat in 2024, and there’s cautious optimism for 2025. Early signs indicate that activity might pick up again, extending beyond top-tier startups. Successful IPOs in capital markets could spark positive momentum, cascading down to early-stage startups.

While the market won’t reach the record highs of 2021, there’s enough potential for healthy growth. Many startups that weathered this challenging period remain innovative and investment-worthy. Long-term, the foundation remains stable, and the trend points upward.

Conclusion: 2025 Will Be a Year of Strategic Decisions

The pressure to innovate will remain high for banks in 2025, offering exciting opportunities. AI as an innovative technology is becoming increasingly familiar, with growing clarity around what is permissible and how to use it optimally. AI has gained rapid traction because its benefits for customers are immediately apparent and directly experiential. We expect similar dynamics with AI innovations in banking in 2025: significantly enhanced benefits that are instantly noticeable – without delay.

For topics like embedded finance, stablecoins, the digital Euro, or FIDA, decision-makers in banks will need more patience and imagination. But this is where the big opportunities lie: evolving existing business models and positioning themselves for the future. Waiting is not an option – now is the right time to act. Once the digital Euro is introduced, the embedded finance market matures, or FIDA opens data interfaces, it is going to be too late to jump in. Implementing these changes requires long-term technological groundwork that must begin today.

2025 will therefore be the year of strategic decisions regarding embedded finance, FIDA, and the digital Euro. While these decisions are often made behind closed doors in boardrooms, they are key to a successful future.

What will emerge? Even without a crystal ball, we’re full of optimism and excitement about what the future holds. We look forward to 2025 and the upcoming topics – and will actively shape them through our investments and prototypes.

Discover similar topics: More about trends in banking, transformation and innovation in the banking sector!