So far, we have talked a lot about the imbalances and the challenges to female entrepreneurship. But why exactly is it so important to eliminate these imbalances? To put it in simple terms, it would just create a lot of additional value.

VC firm First Round reported that its investments in female-founded companies performed 63 percent better than those in all-male venture teams. Women also run more capital-efficient companies achieving 35 percent higher ROI. Additionally, women-owned businesses are growing much faster. A study conducted by BCG found a statistically significant correlation between the diversity of management teams and overall innovation. This trend is not only visible when observing the startup ecosystem. Companies in the MSCI World Index with strong women leadership generated a Return on Equity of 10.1% per year versus 7.4% for those without.

But how can we eliminate these differences exactly?

Debiasing the VC world

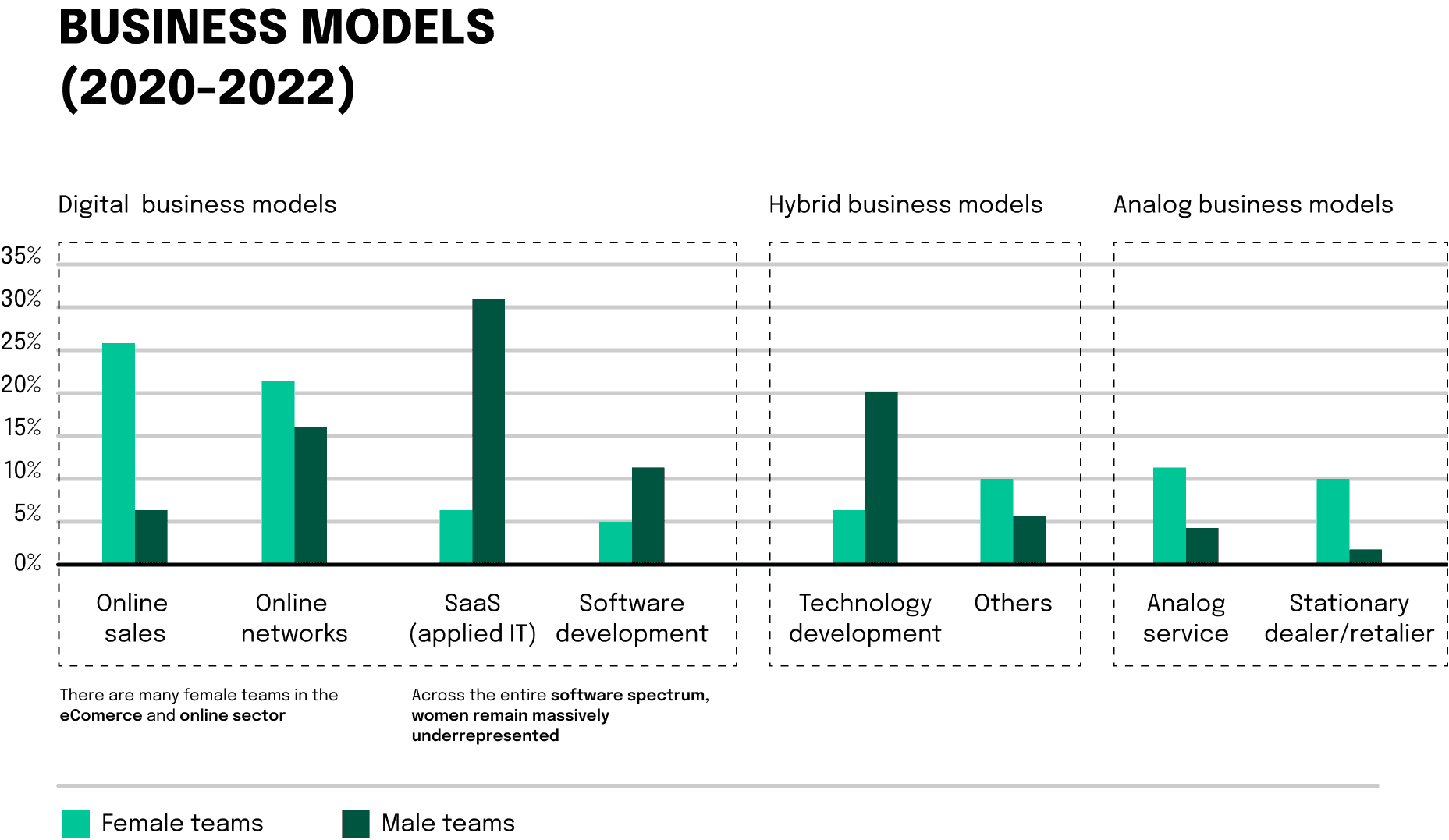

We have already established that female lead start-ups receive a lot less money compared to male founders. But, male decision-makers largely drive the VC world. So obviously, the VC decisions are then primarily based on heuristics derived by men. Indeed, less than 10% of decision-makers at VC firms are women and 74% of U.S. VC firms have no female investors. For other European countries, it does not look more promising. Consider the U.K.: just 11% of senior investment roles at UK firms and their European offices are held by women.

This all can lead to a similarity bias: the tendency to prefer people who are similar to oneself. In the context of VC, this can lead investors to favor founders who have similar backgrounds, educations, or experiences similiar to their own, even if these factors are not directly related to the success of the startup.

But what are some tactics to debias the VC ecosystem? Well, a start would be to have a diverse team. Made up of different ethnic and cultural backgrounds, with a better-than-average gender split, a diverse team typically outperforms the market average in terms of their decision-making. A more comprehensive list of 10 other methods of how VCs can debias themselves can be found here. But there are other tools out there that help to rationalize the investment process: Founders Factory, a U.K. startup accelerator, has developed an AI platform that identifies high-potential entrepreneurs. The software crawls Google, CrunchBase, and LinkedIn, looking for characteristics that push entrepreneurs to succeed. That includes their education, awards, whether they started businesses at school, their extracurricular activities, their pace of career advancement, and their ability to do cross-disciplinary roles. Without being biased by attractiveness or gender. Perhaps these AI-based venture scouting tools can bring more balance to the VC ecosystem.

Female angel investors as drivers of equality

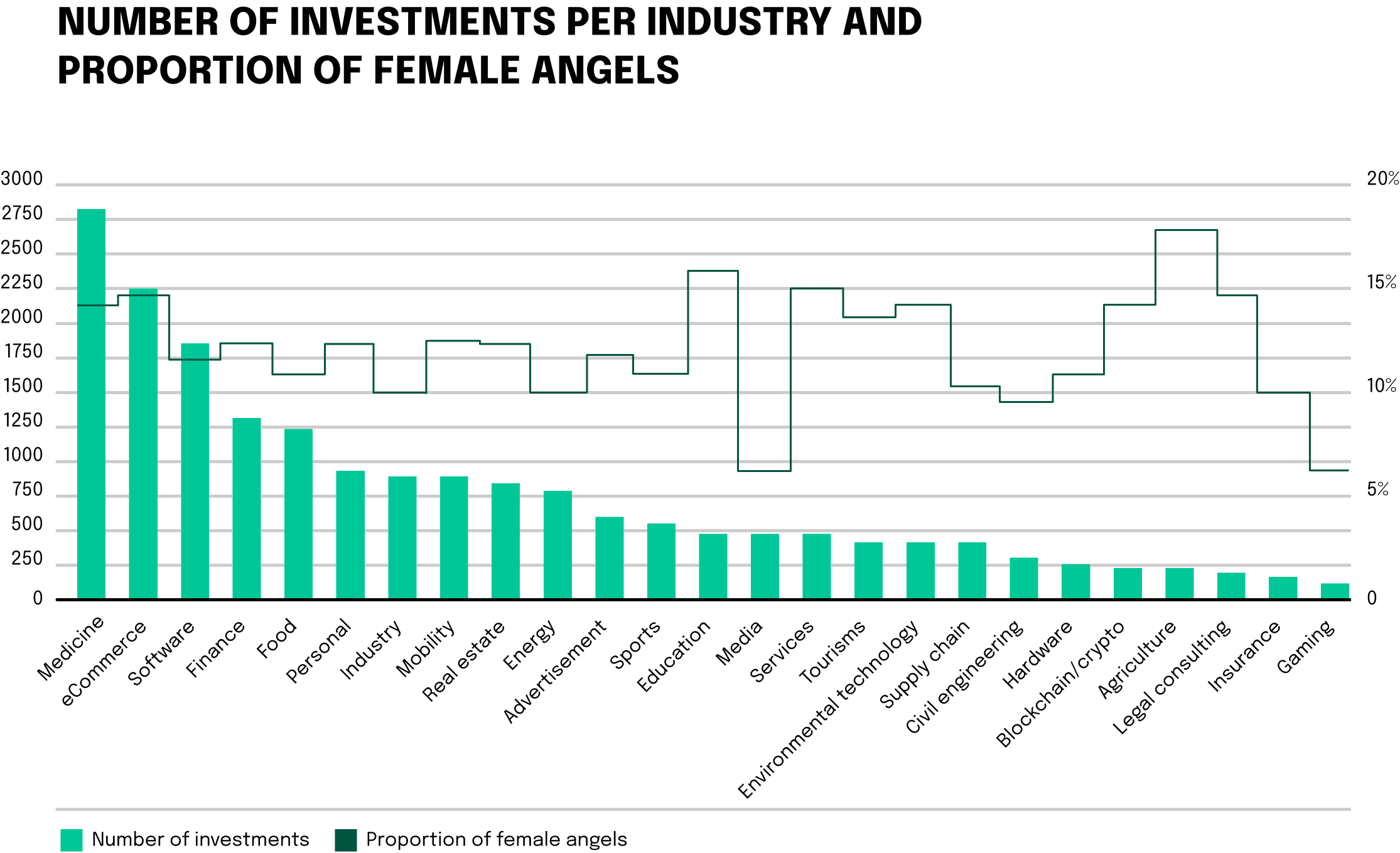

At present, the investor landscape remains significantly male-biased, with 86.2% of business angels being men. These individuals are typically well-educated, middle-aged, and, in many cases, highly qualified, with an above-average 11.4% possessing a doctorate or professional degree.

Organizations like the Business Angels Deutschland e.V. (BAND) are spearheading initiatives to change this narrative. Their Women Angels Mission ’25 is an ambitious endeavor that aims to elevate the percentage of female business angels to 25% by 2025. Indeed, female business angels have shown a distinct inclination towards backing female-led startups, with 26% of their investments supporting such ventures. This is a marked contrast to their male counterparts and provides a more accurate reflection of the ratio of male- and female-led startups in the ecosystem.

To boost the participation of women in angel investing, we must adopt multifaceted strategies:

- Promotion and Advocacy: Introduce educational programs and mentorship schemes that provide women with the necessary tools and confidence to become angel investors.

- Building Community: Develop networking spaces that allow female angels to collaborate, share experiences, and offer mutual support. Existing angel networks should strive to be more inclusive and diverse.

- Investment Channels: Creating dedicated platforms that connect female angels with female entrepreneurs seeking investment. This reciprocal approach not only boosts funding for female-led ventures but also encourages more women to step into investing roles.

Enriching the entrepreneurial experience: networking and mentorship for more equality

Creating a thriving entrepreneurial ecosystem hinges on connections. They are the lifeblood that nurtures success stories, fostering crucial relationships, facilitating knowledge transfer, and opening doors to untapped opportunities. However, for many women at the helm of startups, these vital networking and mentorship avenues remain distressingly out of reach. Addressing this gap involves not just forging new paths, but making the old ones accessible to all.

Reinventing Networks for Female Founders

Women-centric business networks serve as a beacon of support and a hub for collective growth. These platforms provide much-needed space where women in business can pool their experiences, learn, and collaborate. But merely existing isn’t enough — these networks need to be not just reachable but also responsive, precipitating tangible opportunities for their members.

1. Digital Convergence: The creation of comprehensive digital platforms can unite female founders across the globe, enabling them to exchange insights, pool resources, and form strategic alliances.

2. Linking Opportunities: Implementing programs that pair female founders with potential investors, collaborators, and clients can open new doors. Such initiatives can take the form of pitching events, online networking hubs, or business exhibitions.

Expanding Mentorship Horizons

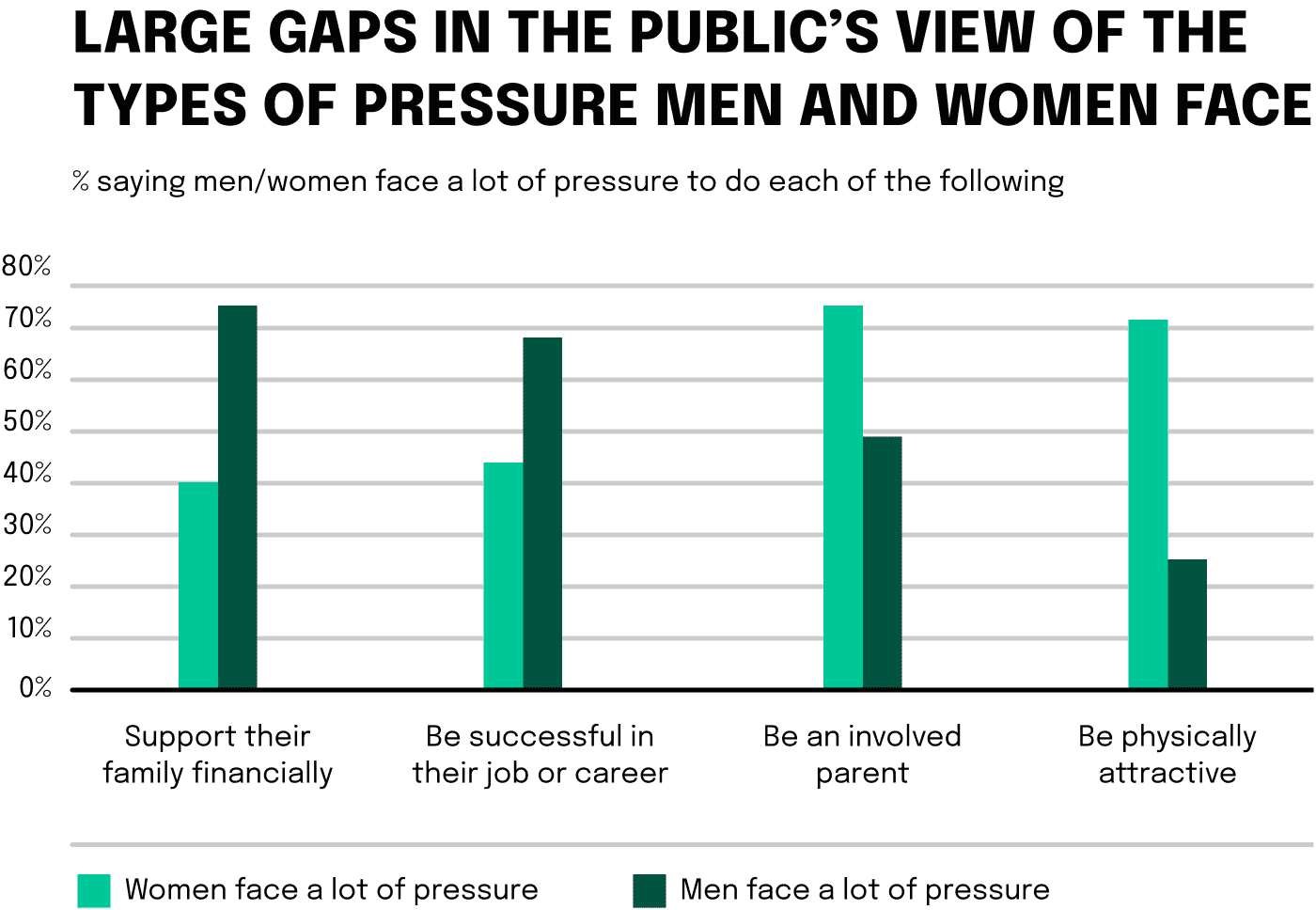

Mentorship can act as a guiding light, offering a wealth of advice, industry-specific wisdom, and support. But the majority of such programs remain rooted in male-dominated perspectives. To usher in change, we need to infuse inclusivity into these programs, making them responsive to the requirements of female founders.

1. Mosaic of Mentors: Inviting a broad spectrum of mentors, including successful female entrepreneurs, industry experts, and investors, can inject diversity into the pool of available advice and perspectives.

2. Customized Guidance: Designing mentorship schemes that take into account the unique trials faced by women — from balancing familial responsibilities with work to circumventing funding biases — can help them navigate their journey more confidently.

Breaching Established Networks

Many of the traditional business networks have been skewed towards males. These well-entrenched networks, brimming with invaluable experiences and connections, can offer a treasure trove of benefits to female founders if made accessible.

1. Inclusive Shifts: Advocacy for these long-established networks to evolve their policies, encouraging a surge in female memberships and active participation.

2. Bridging Divides: Initiatives that link women entrepreneurs with members of these networks can prove beneficial. Collaborative programs, shared events, or reciprocal projects could serve this purpose.

A holistic approach to entrepreneurial parity involves equal access to networking and mentorship opportunities. By diversifying these spaces, we can bolster the prospects of female founders, paving the way for an innovative, vibrant, and balanced entrepreneurial landscape.