Clark, C., Lalit, H. & Rockefeller Asset Management. (2021, 8. Oktober). ESG Improvers: An Alpha Enhancing Factor. Rockefeller Asset Management. Abgerufen am 17. Mai 2022, von https://rcm.rockco.com/insights_item/esg-improvers-an-alpha-enhancing-factor/

Comaroff, J. & Comaroff, J. L. (2002). Privatizing the Millennium: New Protestant Ethics and Spirits of Capitalism In Africa, and elsewhere. Journal for the Study of Religion, 15(2). https://doi.org/10.4314/jsr.v15i2.6126

Egli, F. & Maule, S. (2020, 26. Mai). Missing in Action – The lack of ESG capacity at leading investors. E3G. Abgerufen am 17. Mai 2022, von https://www.e3g.org/publications/missing-in-action-the-lack-of-esg-capacity-at-leading-investors/

Gallardo-Vázquez, D., Barroso-Méndez, M., Pajuelo-Moreno, M. & Sánchez-Meca, J. (2019). Corporate Social Responsibility Disclosure and Performance: A Meta-Analytic Approach. Sustainability, 11(4), 1115. https://doi.org/10.3390/su11041115

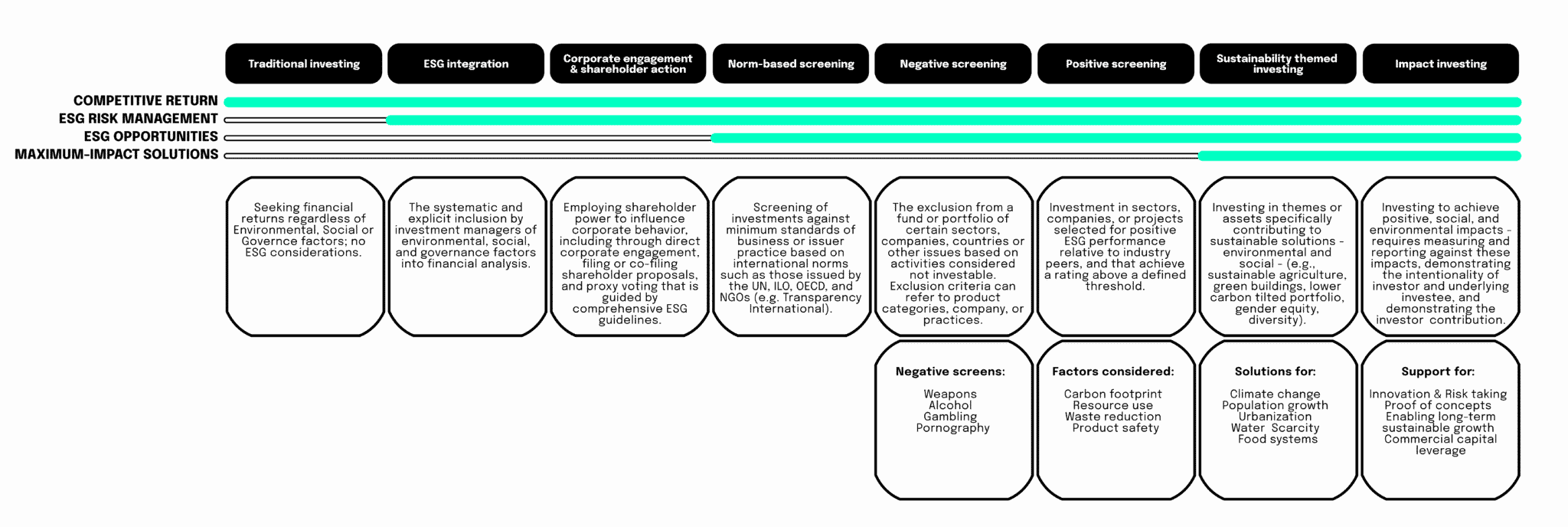

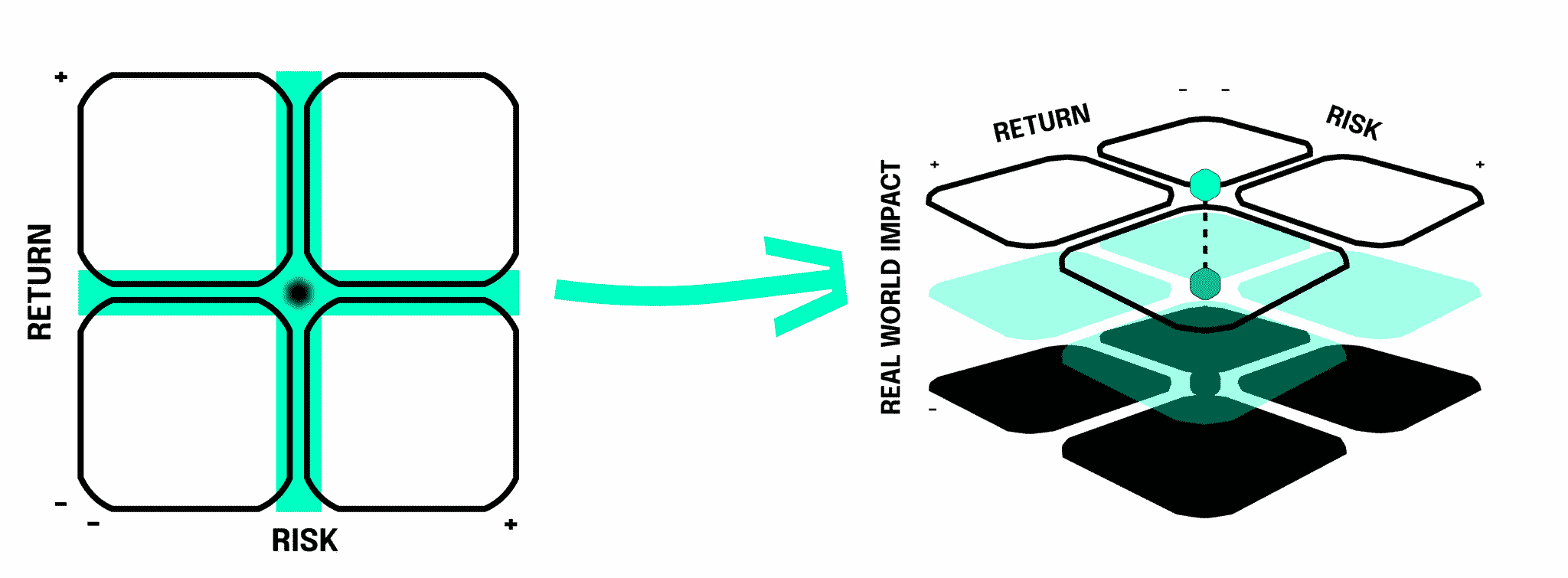

Grim, D. M. & Berkowitz, D. B. (2020). ESG, SRI, and Impact Investing: A Primer for Decision-Making. The Journal of Impact and ESG Investing, 1(1), 47–65. https://doi.org/10.3905/jesg.2020.1.1.047

Groß, M. (2011). Handbuch Umweltsoziologie (2011. Aufl.). VS Verlag für Sozialwissenschaften.

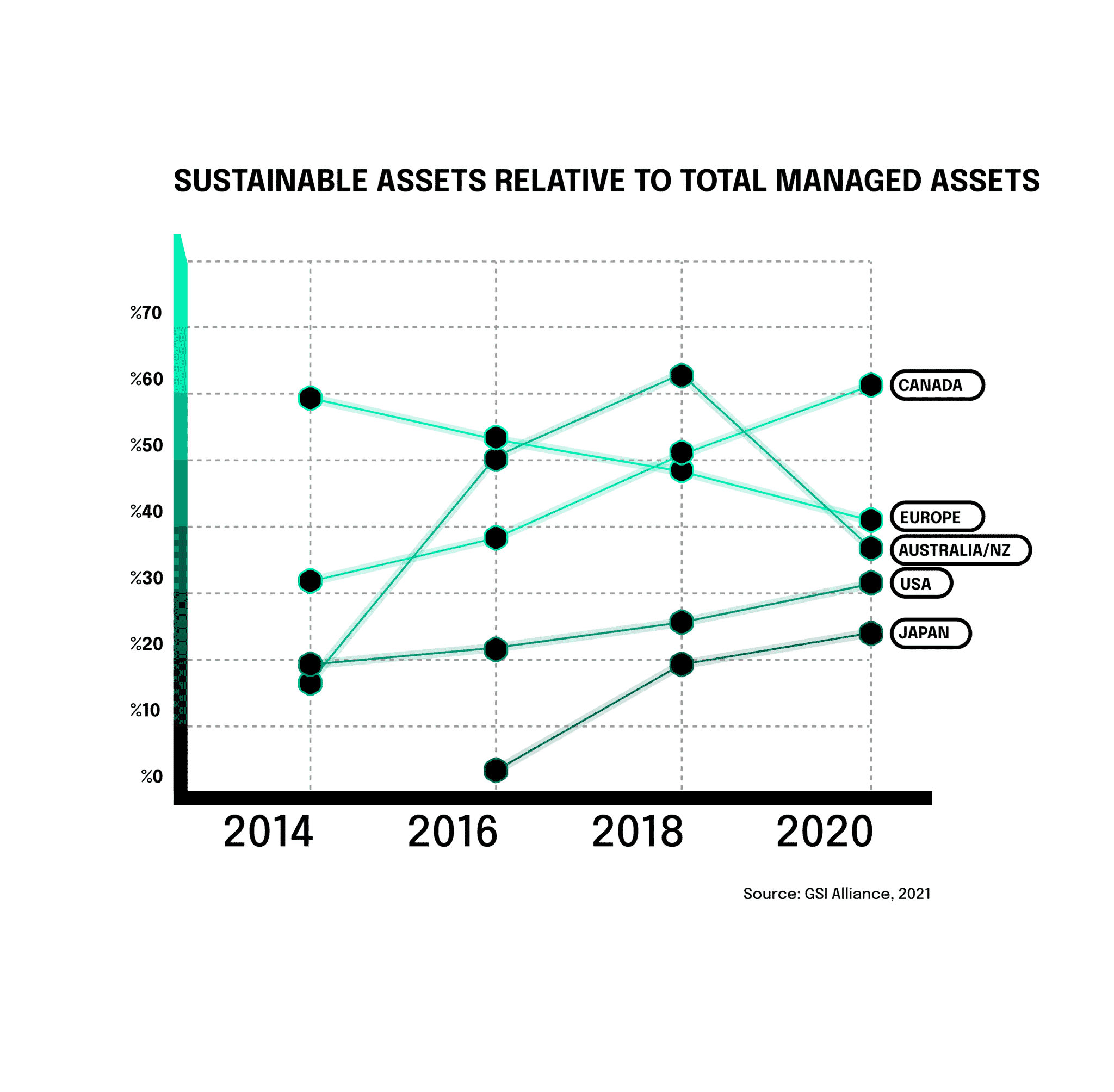

GSI Alliance. (2019, 31. Dezember). Global Sustainable Investment Review. GSIA. Abgerufen am 17. Mai 2022, von http://www.gsi-alliance.org/

Khan, M., Serafeim, G. & Yoon, A. (2016). Corporate Sustainability: First Evidence on Materiality. The Accounting Review, 91(6), 1697–1724. https://doi.org/10.2308/accr-51383

López-Arceiz, F. J., Bellostas-Pérezgrueso, A. J. & Moneva, J. M. (2016). Evaluation of the Cultural Environment’s Impact on the Performance of the Socially Responsible Investment Funds. Journal of Business Ethics, 150(1), 259–278. https://doi.org/10.1007/s10551-016-3189-4

Lu, L. W. & Taylor, M. E. (2018). A study of the relationships among environmental performance, environmental disclosure, and financial performance. Asian Review of Accounting, 26(1), 107–130. https://doi.org/10.1108/ara-01-2016-0010

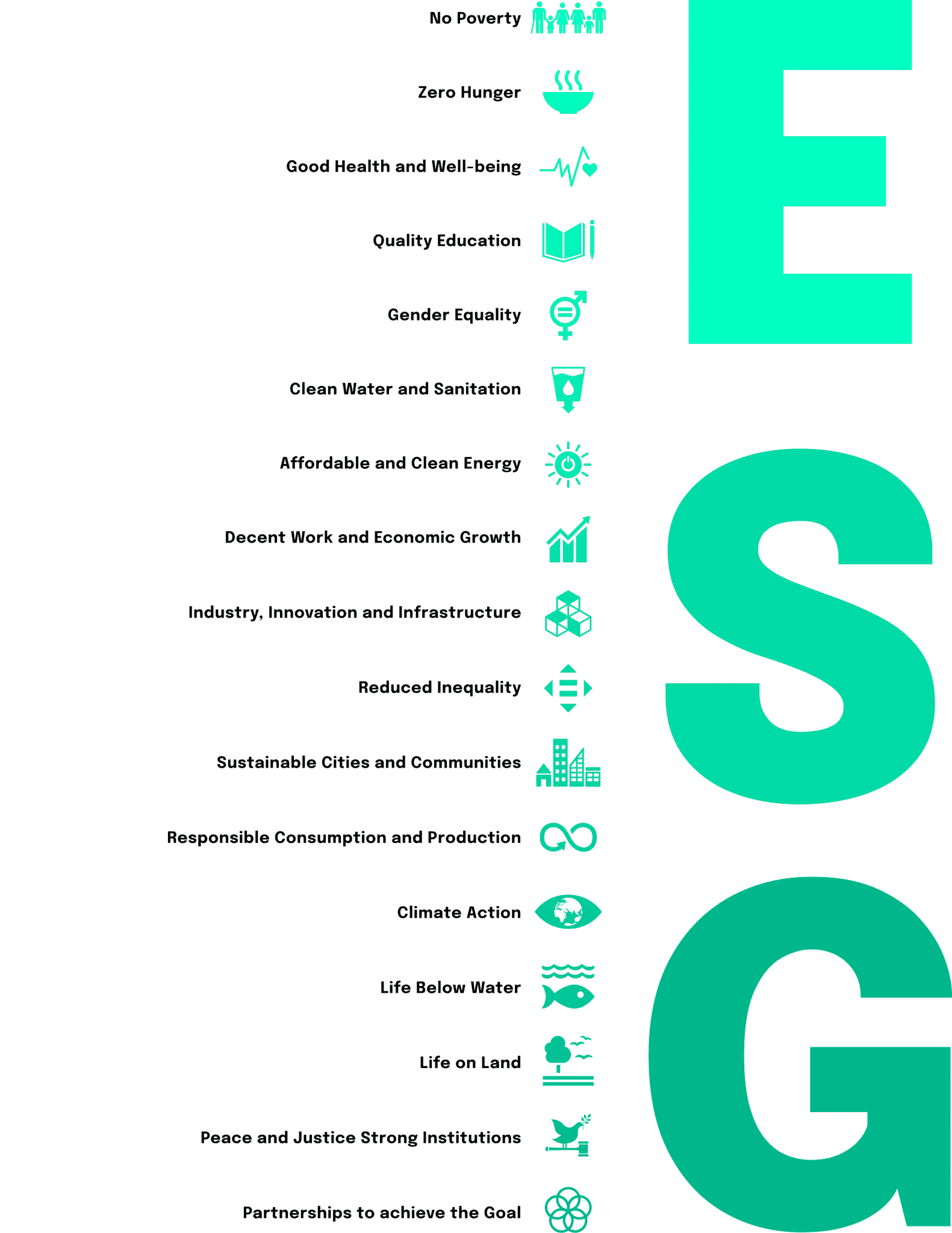

Milante, G. & Jang, S. (2016). Measuring Peacebuilding and Statebuilding in the New SDG Framework. Journal of Peacebuilding & Development, 11(1), 110–119. https://doi.org/10.1080/15423166.2016.1150690

Murray, D., Bilski, B., Verkerk, M., (Ch.), B. H. V. D., Peres, S., der Veer, V. J., Cortese, D. A., Bolkestein, F., Noseworthy, J. H. & Klink, A. (2014). Breakthrough: From Innovation to Impact. The Owls Foundation.

Parker, F. J. (2021). Achieving Goals While Making an Impact: Balancing Financial Goals with Impact Investing. The Journal of Impact and ESG Investing, 1(3), 27–38. https://doi.org/10.3905/jesg.2021.1.014

Puaschunder, J. M. (2016). On the Emergence, Current State and Future Perspectives of Socially Responsible Investment (Sri). SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2720686

Stolz, D. (2013). Nachhaltiges Kalkül. Univ.-Bibliothek Frankfurt am Main.

Taparia, H. (2021, 14. Juli). The World May Be Better Off Without ESG Investing (SSIR). SSIR. Abgerufen am 17. Mai 2022, von https://ssir.org/articles/entry/the_world_may_be_better_off_without_esg_investing

The Global Impact Investing Network. (2017, 17. Mai). Annual Impact Investor Survey 2017. The GIIN. Abgerufen am 17. Mai 2022, von https://thegiin.org/research/publication/annualsurvey2017

Uzsoki, D. (2020, 3. August). Sustainable Investing: Shaping the future of finance. International Institute for Sustainable Development. Abgerufen am 17. Mai 2022, von https://www.iisd.org/publications/report/sustainable-investing-shaping-future-finance

van Duuren, E., Plantinga, A. & Scholtens, B. (2015). ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. Journal of Business Ethics, 138(3), 525–533. https://doi.org/10.1007/s10551-015-2610-8