Financial Wellbeing sounds like a feel-good label, but it is a measurable outcome that shapes resilience, stress, and real decision-making room in everyday financial life. This post maps the key concepts and introduces the neosfer Financial Wellbeing Pyramid as a practical model for aligning innovation with impact. It also highlights two examples: earned wage access via WageBeam and family banking via Bling.

Financial Wellbeing sounds like a feel-good label, but it is a measurable outcome that shapes resilience, stress, and real decision-making room in everyday financial life. This post maps the key concepts and introduces the neosfer Financial Wellbeing Pyramid as a practical model for aligning innovation with impact. It also highlights two examples: earned wage access via WageBeam and family banking via Bling.

Financial Wellbeing as a Compass for Financial Innovation That Makes a Difference

Four takeaways from the FinWell Summit

Over the past year, I have been hearing the term Financial Wellbeing more and more often. It sounds like “wellness” at first: relaxation, self-care, and a calmer life. But combined with finance? For many people, money topics do not feel calming. They feel like a chore. So do “financial” and “wellbeing” really go together?

Last December I attended the FinWell Summit, a Financial Wellbeing event hosted by the House of Finance and Tech in Berlin. neosfer supported the summit as a partner, and I made a brief contribution to the program. That day, the term clicked for me. I not only understood the concept more clearly, I also understood why it is gaining momentum right now.

A helpful starting point is the working definition by the US Consumer Financial Protection Bureau, CFPB: Financial Wellbeing is present when people can meet ongoing obligations, feel secure about their financial future, and can make choices that enable them to enjoy life. In practice, this shows up as:

- control over day-to-day finances,

- resilience against financial shocks,

- freedom to make life decisions, and

- a sense of being on track toward personal goals.

At the FinWell Summit, especially in the keynote by Professor Annamaria Lusardi of Stanford University, I walked away with four takeaways that have stuck with me ever since.

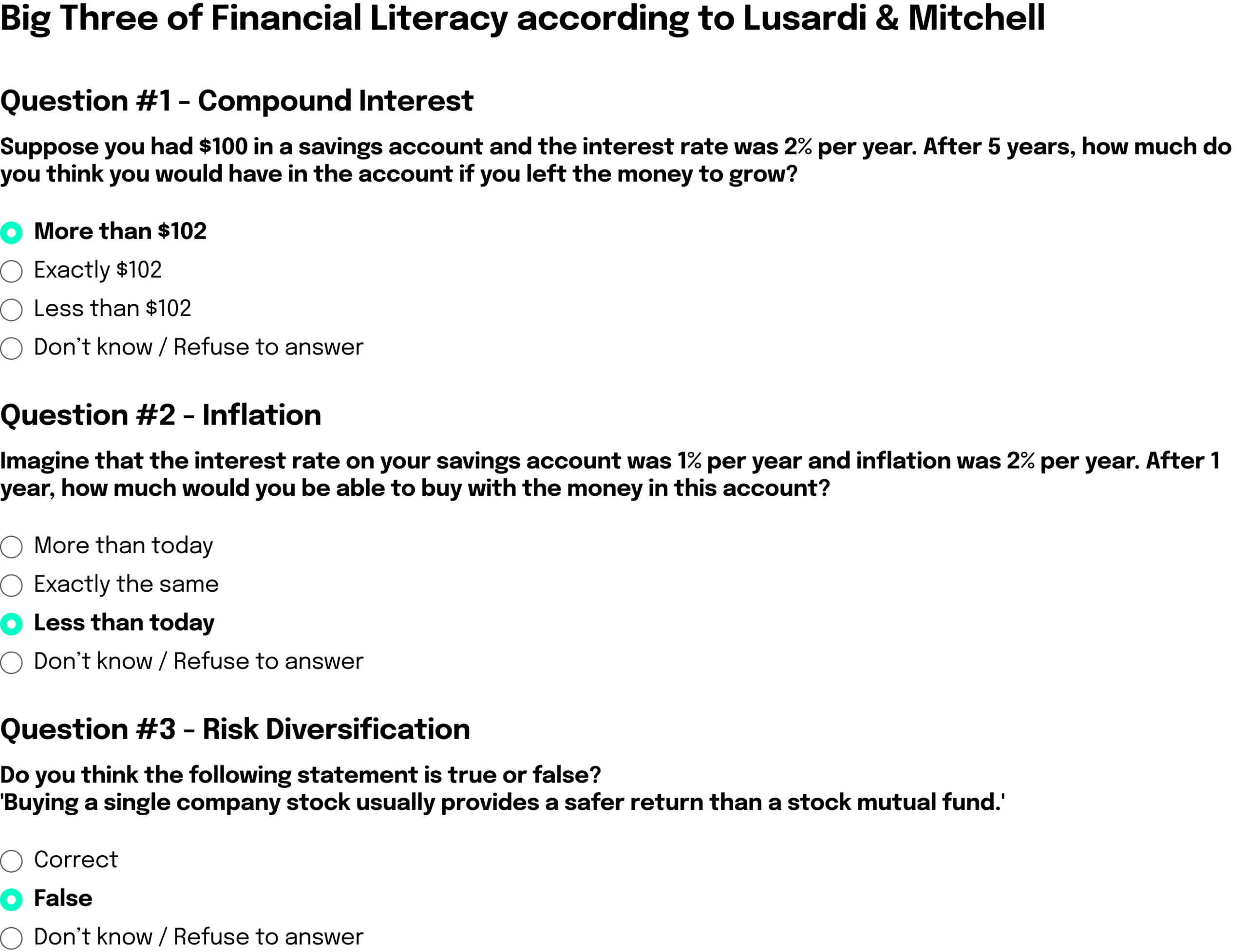

Takeaway #1: Even basic financial literacy is strikingly low worldwide. Lusardi measures financial literacy with three questions on compound interest, inflation, and risk diversification. Only around a third answer all three correctly (Stanford Report, 2025). When so many people struggle with fundamentals, it is not surprising that complex products and volatile everyday realities can quickly lead to overload.

Takeaway #2: The gender gap is less a knowledge gap but rather an execution gap. Across many conversations, one pattern was clear: the barrier is often not a lack of information, but a lack of financial confidence. When people feel uncertain, decisions are made too late, not made at all, or delegated.

Takeaway #3: Many people use financial products they do not understand. This is not a fringe phenomenon. It is a structural risk for individual households and, in aggregate, for markets.

Takeaway #4: Financial literacy remains weak. The OECD and its International Network on Financial Education, OECD INFE, has been measuring financial literacy internationally for years. Across the surveys from 2016, 2020, and 2023, the overall picture is consistent: too many adults still fall short of target levels, and financial resilience remains a challenge. That is frustrating, because we have been talking about financial education for years, yet broad-based impact is hard to see.

These four observations make it tangible why Financial Wellbeing is more than a new buzzword. It is not just about “having finances in order.” It is about financial security and agency as a foundation for a good life.

Financial education is not the same as Financial Wellbeing

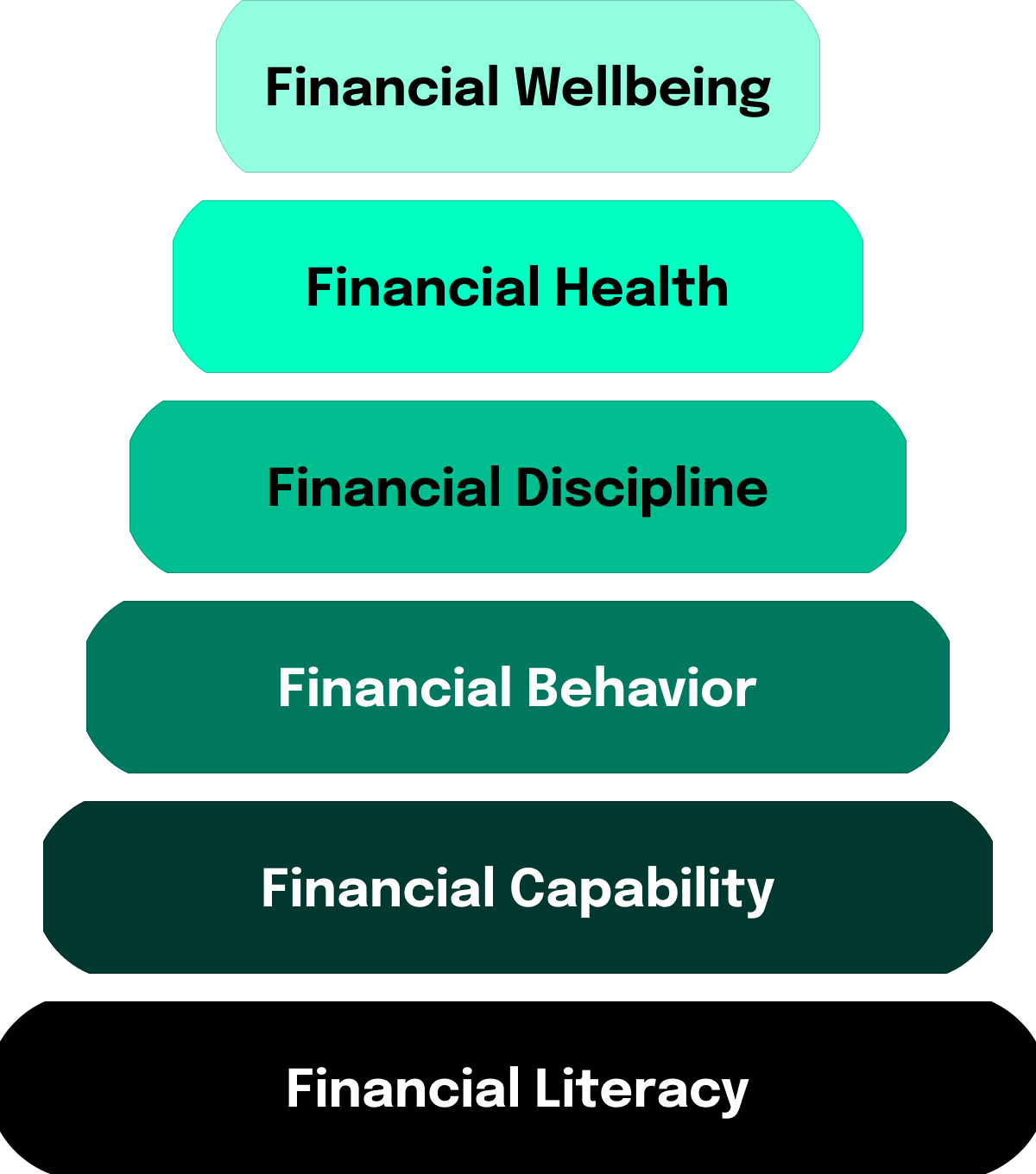

To stay on the same page, it helps to do a quick terminology check. Financial education, financial capability, and financial behavior can sound similar, but they mean different things. In simple terms, it is about three layers: what people know, what they do in everyday life, and what outcomes they actually experience.

- Financial Literacy: knowledge and understanding of basic concepts such as inflation, compound interest, and risk diversification.

- Financial Capability: skills, attitudes, and routines that translate literacy into the ability to act.

- Financial Behavior: the lived practice, for example budgeting, saving, securing against risks, managing debt, and making decisions.

- Financial Discipline: a subset of behavior that focuses on reliability and self-regulation, such as sticking to spending limits, building reserves, or following a repayment plan.

- Financial Health: the state. Are income and expenses balanced? Is there a buffer? Is debt sustainable? How resilient is a household to shocks?

- Financial Wellbeing: the outcome. The felt sense of financial security, agency, and the ability to pursue goals without constant stress.

These concepts form a cause-and-effect sequence: literacy can strengthen capability, capability can enable healthier behavior, and sustained behavior supports discipline and financial health. At the top sits Financial Wellbeing as the experienced outcome. At neosfer, we have turned this logic into a pyramid. We use it as a thinking tool to locate ideas, prototypes, and investments along the path to Financial Wellbeing.

Financial Wellbeing is not just an individual issue

Financial Wellbeing may sound soft, but it has a very real, everyday impact. Under pressure, predictable chains of events emerge: overdrafts instead of buffers, expensive short-term fixes instead of planning, or postponed retirement savings. The root cause is rarely pure “lack of discipline.” Often, what is missing is orientation in critical moments.

Financial Wellbeing therefore means more than “having finances organized.” It combines objective stability, such as buffers, obligations that remain affordable over time, and resilience against unexpected expenses, with the subjective sense of understanding the situation and being able to make decisions without constant stress.

The effects go beyond individual households. For employers, financial strain can translate into stress, absenteeism, and productivity loss. For financial providers, it shapes trust, risk, and whether products create clarity in tough situations or amplify friction and misunderstanding.

The implications extend beyond individuals to society at large. Low resilience can deepen inequality, reduce upward mobility, and touches questions of fairness. At the macro level, spending power for consumption, education, and investment can shrink while the downstream costs of financial crises rise.

At the same time, money has become more “productized” and more digital. BNPL, instant credit, wallets, and subscription models reduce friction at the point of sale and can accelerate poor decisions. The easier the access, the higher the demands on product clarity, timing, and protective guardrails.

From an innovation perspective, Financial Wellbeing becomes a design question. What matters is the decision environment: what information shows up when and how, which defaults are set, which guardrails prevent overload, and which offers build resilience.

Money worries are everyday reality, not the exception

Money worries are a constant companion for many people. This is not just anecdotal. In the long-running study “Die Ängste der Deutschen 2025” by R+V Insurance, rising living costs have been among the top concerns for years. In the consumer survey “Banking on Banks” by CRIF, 80% of respondents in Germany say they look with uncertainty at their financial future over the next twelve months.

If Financial Wellbeing is understood as subjectively experienced financial security, it quickly becomes clear that it cannot be achieved through product features alone, or through education campaigns alone. A complex starting point needs differentiated solutions.

What the financial industry can do, and what it cannot

The financial industry can and should contribute to stronger Financial Wellbeing. But responsibility does not sit with banks alone. It is distributed across many stakeholders. A common misconception is that banks are responsible for their customers’ overall financial situation. That is too simplistic, because key drivers sit outside the industry’s direct impact sphere. At the same time, there are real leverage that financial institutions can exert and should use consistently.

Product design and clarity

Good product design reduces the chance that a product is used in the wrong way. This starts with language, pricing logic, and transparency. It extends to clear standards and guardrails, and to understandable simulations, such as interest-rate risk scenarios or just-in-time nudges.

Timing and context

Financial decisions do not happen in a vacuum. They happen around major life events such as moving, separation, job changes, the birth of a child, or illness. Low-friction support in those moments can increase impact on the path to Financial Wellbeing.

Resilience, not just returns

A core driver of wellbeing is resilience: buffers, risk protection, and sustainable debt. Offers that make micro-saving easier, enable flexible reserves, or create low-risk onramps can have disproportionate impact. In many financial ecosystems, this is where features and products are still missing.

Gender gaps

Strictly speaking, there is not one single gender gap but several, depending on the financial topic. Differences show up along the path: from financial literacy to financial confidence to saving and investing behavior. For product providers, gender gaps should not be side issues. They are a design brief. Depending on language, flows, and feature design, products can lower barriers or unintentionally reinforce them.

Listening tip: Last summer, Martin Granig, founder of Monkee, and Anne Connelly, founder of hermoney, joined our podcast “Talk Between the Towers.” Monkee started as an alternative to BNPL with a “save now, pay later” approach and ended up with an unexpectedly high share of female users. One observation from their work: even the choice of identity verification flow can affect conversion rates differently across genders. Here is the episode on Spotify (in German): https://open.spotify.com/episode/2VfnL2OXxFDgpr2t9sddNC

Banks and FinTechs can work on this leverage. Their influence ends where structural factors dominate: income gaps and life circumstances cannot be designed away, the education system is a policy mandate, and consumer protection and regulation remain essential to limit predatory offers, fraud, and information asymmetries. That is why the right mindset is collaboration, not blame. Financial Wellbeing emerges through coordination across financial services, policy, education, employers, and civil society.

The neosfer perspective: treat Financial Wellbeing as an outcome and find pragmatic leverage

Financial Wellbeing sits at the top of the pyramid. For an innovation unit like neosfer, it is the measurable outcome of people’s own financial efforts to improve their Financial Wellbeing. Many people aim for it, but it does not appear overnight. It is built on the layers below: literacy, capability, behavior, discipline, and financial health. Building that foundation takes time, attention, and persistence.

This is exactly why the pyramid is useful as a thinking model for neosfer. It helps locate where an offer starts and how far its impact can realistically reach toward Financial Wellbeing. Two cases illustrate this in practice.

Earned Wage Access via WageBeam

If a washing machine breaks down and there is no buffer, the issue might be related to financial literacy. But more literacy does not solve an immediate liquidity gap. In that moment, what matters is staying able to act.

One tool can be Earned Wage Access, EWA. The principle is that employees can access the portion of their salary they have already earned before the regular payday. The key distinction is important: as long as only earned wages are advanced, this is not a loan.

WageBeam is a neosfer build project that aims to rethink payroll for the German market with EWA. The goal is a flexible system that enables employees to access already earned, and in the future potentially also upcoming, salary at any time. It is complemented by learning content intended to support better financial decisions.

EWA is debated critically. Fees can be perceived as high, and there is often a stereotype that users lack financial discipline. From a Financial Wellbeing lens, the picture is more nuanced. EWA can strengthen resilience if costs are transparent, guardrails are clear, and the product is designed to bridge shortfalls rather than accelerate consumption.

Whether people use it frequently or simply feel safer knowing the option exists, WageBeam can be a useful piece on the path toward stronger Financial Wellbeing.

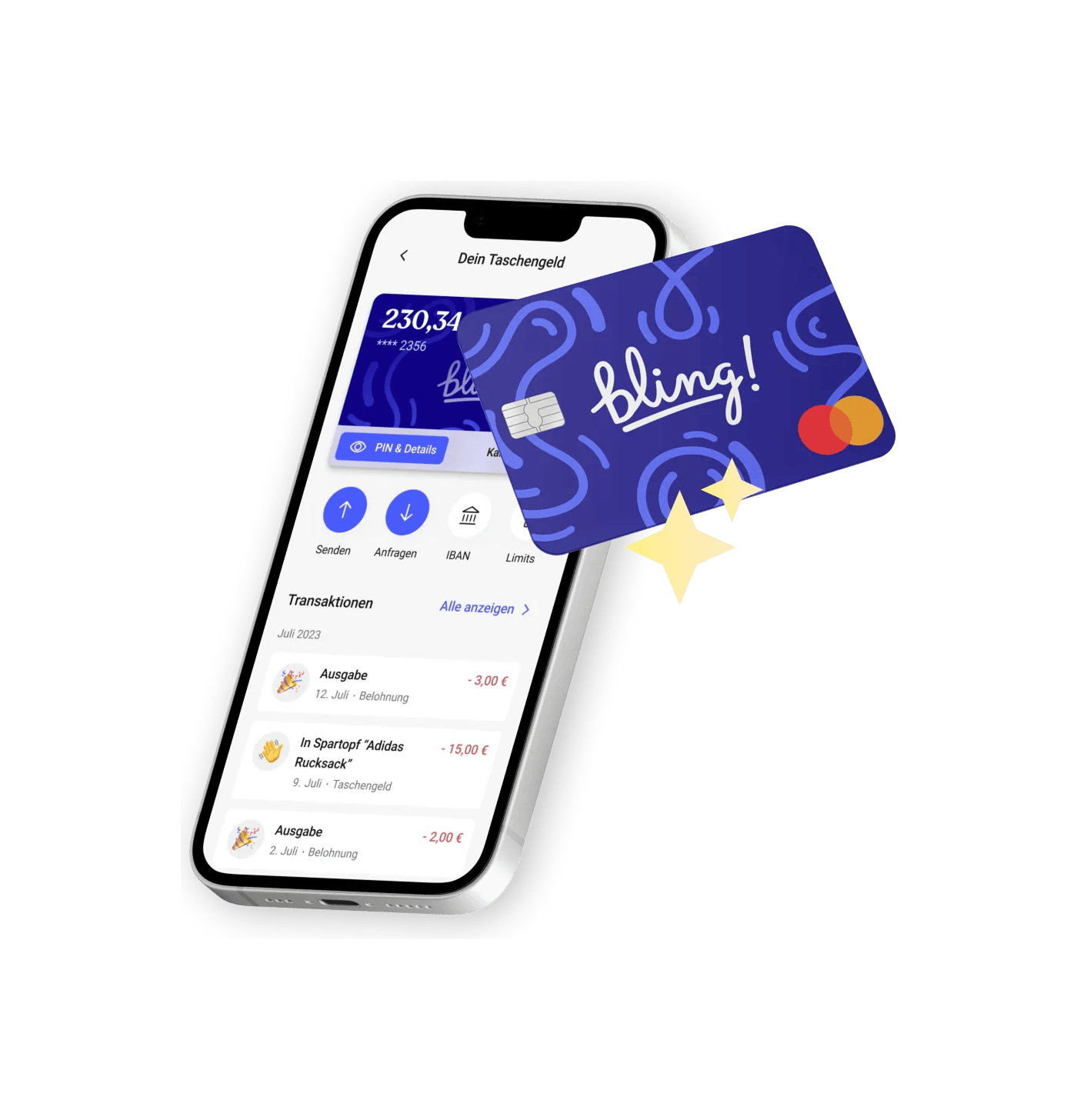

Family Banking via Bling

Bling is a banking app that offers a pocket-money account and payment card for children, teenagers, and their parents or guardians. Families can set rules and limits. Overdrafts are not possible. This makes digital payments accessible early, while keeping them within a safe frame. neosfer has been involved as a co-investor since Bling’s Series A.

Bling also has its critics. If accounts and cards are available early, some worry that impulsiv purchases become easier. At the same time, children are growing up in a world of digital payments anyway. In that context, it can be more effective to learn money management in practice rather than through abstract lessons. A personal account, real pocket money, and real decisions create relevance and motivation. This is where literacy can turn into capability and, ideally, into healthy behavior and discipline. For Financial Wellbeing, this matters because confidence and routines often form early.

For neosfer, this leads to a simple guideline. Our customer-centered perspective can be sharpened further by the Financial Wellbeing pyramid. It adds orientation and makes visible which layer a product or feature targets. What matters in the end is measurable improvement in everyday life: stronger resilience, more financial confidence, and greater room to make decisions without constant stress.

Becoming more effective together

Financial Wellbeing is more than a new label. It is a measurable outcome that captures whether people are not only financially healthy, but also experience real financial security and agency.

Basic literacy often remains patchy, digital finance increases complexity, and money worries are real for many. That is why it is not enough to call for “more financial education.” What matters is which offers provide orientation at the right moment, reduce overload, and strengthen resilience in practical ways.

Financial providers should focus on the levers they can control: clear design, transparent pricing, strong timing, guardrails, and formats that build financial confidence.

At the same time, Financial Wellbeing needs a shared effort, because income, the education system, and social safety nets cannot be fixed by financial institutions alone.

If we use Financial Wellbeing as a common compass, we can shape an ecosystem that is experienced by millions in everyday life so that it creates less stress and more room for what truly matters in life.

Annex

State of the art: three key studies on Financial Wellbeing

Financial Wellbeing is subjective, but it can still be measured objectively. Researchers now do this regularly and at scale. These three studies were especially helpful to us in framing the current state.

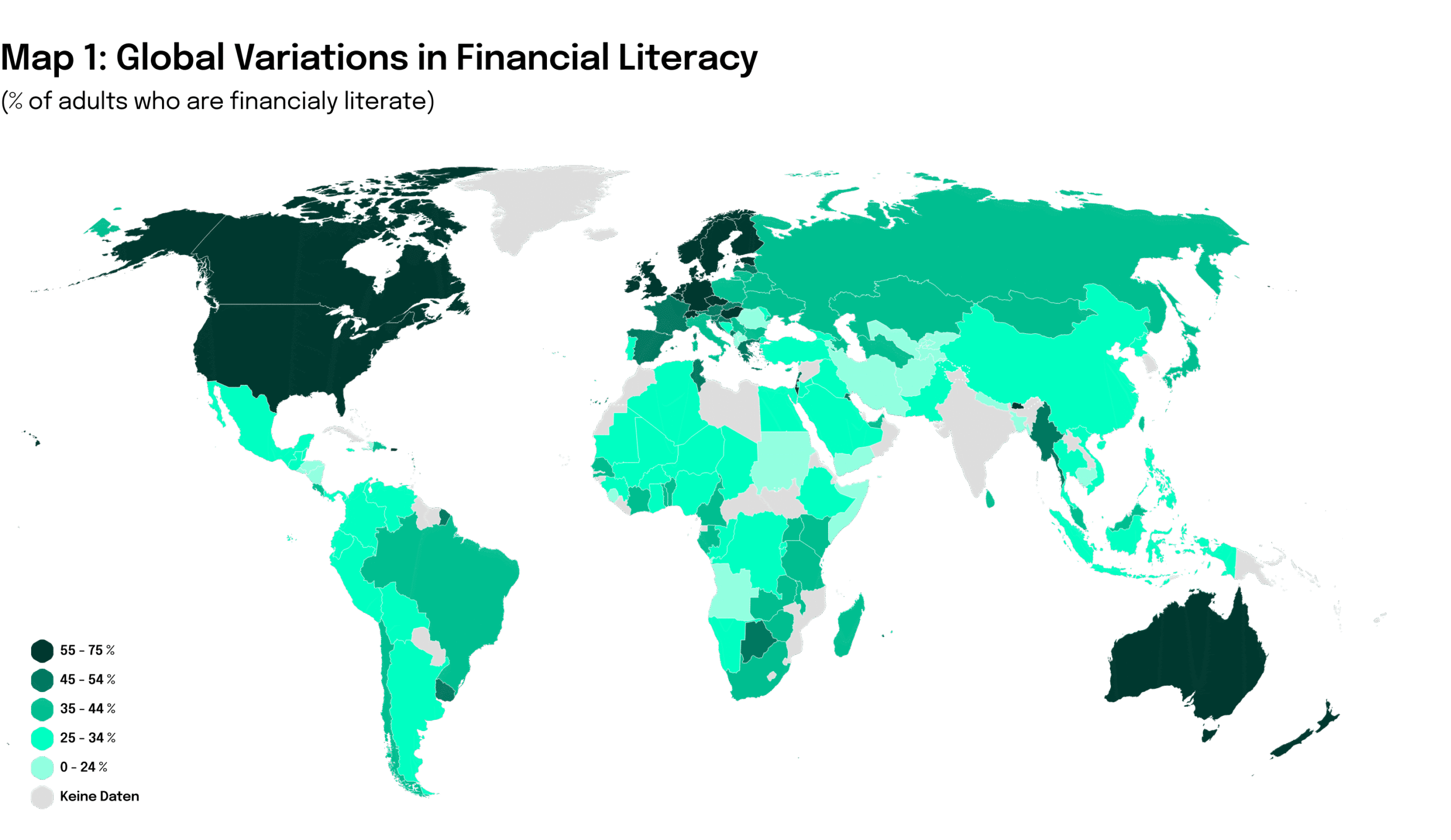

1) S&P Global FinLit Survey: basic financial literacy remains low globally

Study: S&P Global FinLit SS&P Global FinLit Surveyurvey: “Financial Literacy Around the World”

Authors and sponsor: The analysis is associated with researchers including Leora Klapper, Annamaria Lusardi, and Peter van Oudheusden. The sponsor was Standard & Poor’s.

When and where: Conducted as part of the Gallup World Poll 2014, covering data from more than 140 countries and economies.

Key findings: Only around 33% of adults worldwide qualify as financially literate by the survey standard, meaning at least three out of four basic questions are answered correctly. The largest gaps appear in understanding risk diversification. Beyond the average, the dispersion is important: large differences across countries, and substantial gaps within societies.

2) OECD INFE: financial literacy combines knowledge, behavior, and digital capability

Study: OECD INFE 2023 International Survey of Adult Financial Literacy

Sponsor: Led by the OECD and its International Network on Financial Education, OECD INFE. In many countries, the fieldwork is commissioned by public institutions such as central banks, regulators, or ministries.

When and where: Fieldwork mainly in 2023 across 39 countries and economies.

Key findings: The OECD approach defines financial literacy as a bundle of knowledge, attitudes, and behavior. Many adults do not reach the target level of 70 out of 100 points. Inflation questions are often answered more successfully, while compound interest and risk logic are more frequent stumbling blocks. The OECD also highlights digital financial literacy, because digital products accelerate decisions while making consequences harder to see in everyday life.

3) Financial Health Report 2025 Germany: Financial Wellbeing as a measurable outcome

Study: Financial Health Report 2025 Germany

Authors and publisher: The authors are Simon Hochstraßer, Moritz Nardini, Emanuel Renkl, and Andreas Wittmann. The report is published by Financial Health Initiative e.V.

When and where: Germany. Online interviews in 2024. Sample size 1,509, weighted to represent the resident population aged 18 and over.

Key findings: The average Financial Health Score is 52.83 on a scale from 0 to 100 and falls into the “medium-high” category, defined as 50 to 57 points. Financial health rises sharply with age, education, income, and wealth. Lower scores are concentrated in vulnerable life situations. The value of the report is that it makes Financial Wellbeing measurable as an outcome: shifting attention away from literacy alone and toward impact on resilience, stress, and everyday room to act.

Listening tip: Emanuel Renkl and Markus Lehleiter from the Financial Health Initiative recently joined our podcast “Talk Between the Towers.” The episode on Spotify (in German): https://open.spotify.com/episode/2wfgUI32q2YBjowTccBGoH

More about financial health and finance!