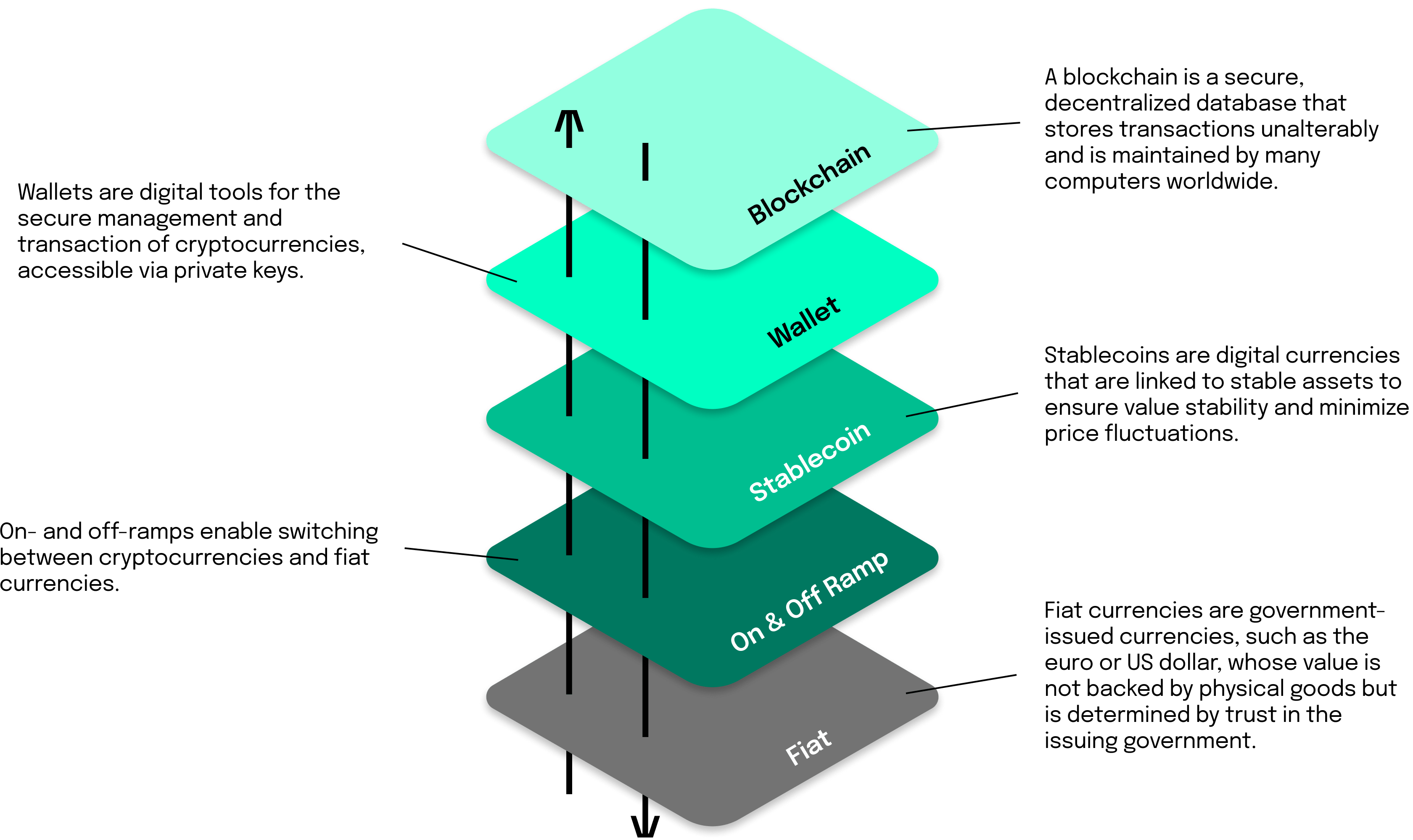

To be honest, those are still quite a few steps and a lot of know-how is required to make an international transfer via stablecoin. Skype has revolutionized international telephony calls because you didn’t have to be an expert to make a call.

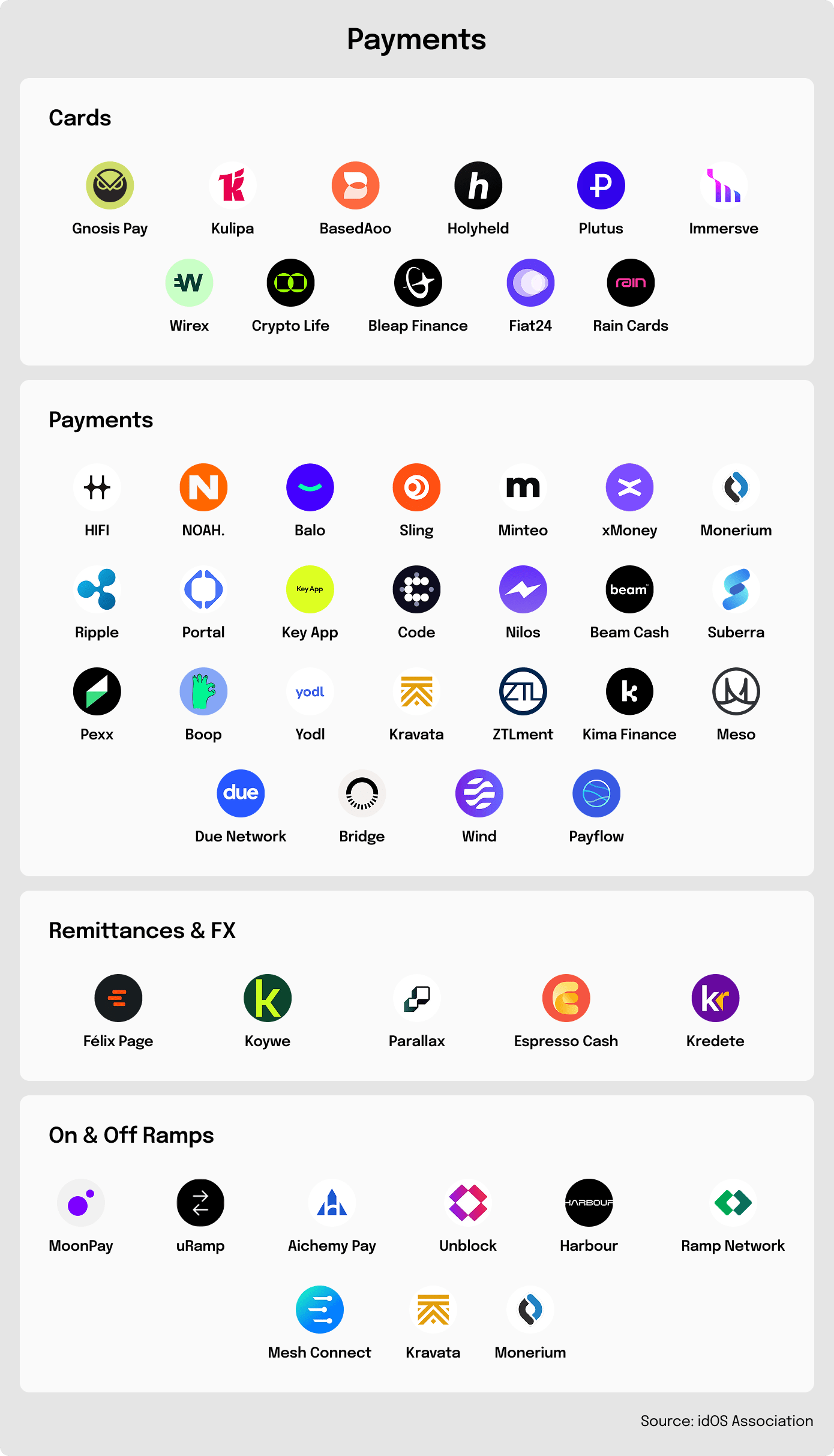

However, there are already companies that make stablecoin transfers abroad almost seamless and simple, much like video calling in a messenger app. Espresso Cash, for example, is a user-friendly and easy-to-understand stablecoin-based payment platform for African markets. Senders can make payments in the app using USDC, which is pegged to the US dollar, and recipients can either take out the money in Fiat-currency. Or they leave the money in the app until they really need it which means that Espresso Cash even indirectly has built-in inflation protection.

Payments are even more seamless with Félix Pago, a start-up for payments between the United States and Latin America. Latin American immigrants can use it to send money to their home country via WhatsApp bot. The structure behind this is exactly as shown above: wallets are opened in the background (on the Latin American cryptocurrency platform Bitso) and then money is sent in stablecoin – all without users having to open a bank account themselves or first understanding the details.