There is currently a big question mark behind the German economy. Compared to other economic regions, it is more dependent than average, but at the same time has received disproportionately high levels of state aid.

It is clear that the world is in the midst of an economic and geopolitical transformation. Away from fossil fuels, towards more digitalization and personal responsibility with higher demands on supply chains.

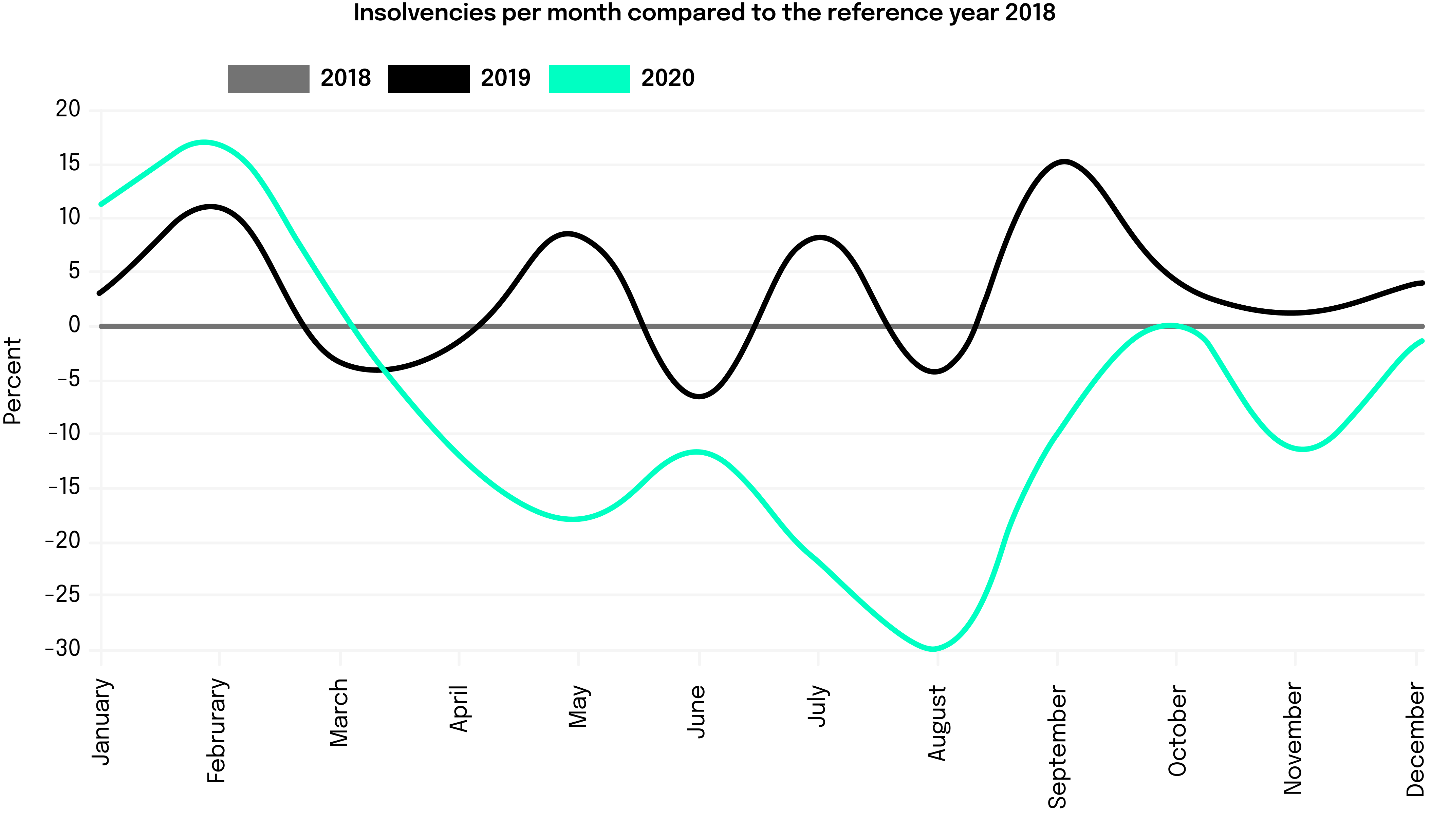

Germany is facing major challenges. The above-average dependence on other economic areas, combined with high levels of state aid, raises questions about long-term economic stability. In addition, the period of state intervention was not used to initiate necessary structural change and drive forward reforms towards digitalization and sustainable transformation. Instead, subsidies were applied for to keep outdated business models alive in order to avoid insolvency courts. There is a lack of clear guidelines and publication of the strategic direction on the part of politicians.

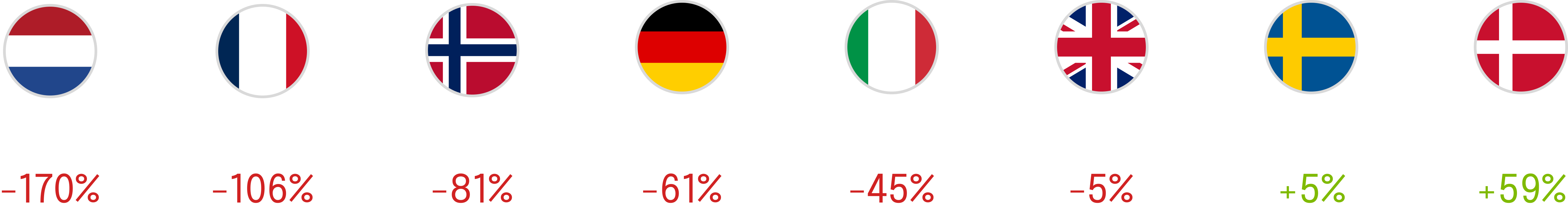

Many of the necessary resources are simply not currently available to the extent required or are tied up in companies that are not fit for the future. There is also a clear need to catch up in terms of transparency and publication deadlines. In most European countries, companies of all sizes are required by law to disclose their economic situation, including their profit and loss account (P&L), in a timely manner. In Germany, however, less than 2 percent of registered companies have a profit and loss account. A third are completely exempt from the disclosure obligations or are not afraid of the relatively minor consequences of failing to do so. Existing deadlines are also often not met: On average, the publication deadline of 12 months after the end of the financial year is exceeded by more than five months. Companies in other European countries would probably have been liquidated or at least closed down long ago if such violations had occurred. The EU, the federal government and the federal states need to take a more concerted approach here.

In order to protect your company in times of economic uncertainty and avoid insolvency proceedings and the court, it is essential to protect your own business riskmanagement and strengthen it. By precisely assessing long-term risks and taking appropriate measures, potential dangers can be identified at an early stage and negative effects on the business can be minimized. International crises in particular require a distributed strategy and an up-to-date data basis in order to make well-founded decisions. This is the only way to master the economic challenges ahead and enable sustainable growth.