Banks play an important role in financing the measures needed to achieve climate neutrality by 2050. This goal was defined as part of the EU Green Deal. Against this backdrop, energy-efficient residential building refurbishment is currently one of the top issues for us as a venture capital investor at Commerzbank. Especially when it comes to investing sustainably in industries with a lot of potential. In this article we share our view on the market, our current focus on investments and our goal to invest sustainably as a venture capital investor.

Banks play an important role in financing the measures needed to achieve climate neutrality by 2050. This goal was defined as part of the EU Green Deal. Against this backdrop, energy-efficient residential building refurbishment is currently one of the top issues for us as a venture capital investor at Commerzbank. Especially when it comes to investing sustainably in industries with a lot of potential. In this article we share our view on the market, our current focus on investments and our goal to invest sustainably as a venture capital investor.

Sustainable investment as a venture capital investor: Energy-efficient residential building refurbishment has potential

Regulatory tailwind for energy-efficient building refurbishment

As part of the European Green Deal, the EU has taken pioneering steps to achieve complete decarbonization of the economy by 2050. Germany has set itself even more ambitious targets with the amendment to the Climate Protection Act adopted in 2021 and aims to be climate-neutral as early as 2045. Achieving this goal will require the decarbonization of all major sectors of the economy and society – from manufacturing and processing industries to the mobility sector and private consumption.

One area that particularly catches the eye is the building sector. It currently generates around 30% of all CO2 emissions in Germany. A large part of this is due to the heating of buildings. The reasons can be quickly identified on closer inspection. Of the approximately 19 million residential buildings in Germany, around 90% were built before the year 2000 and have not been renovated since then, or only to a very limited extent. 74% of the residential building stock has a final energy demand of >100 kWh/m2/a and thus falls under energy efficiency classes D-H. By comparison, under current energy efficiency standards, a final demand of <=50 kWh/m2/a (energy efficiency class of A+ or A) is considered desirable. Currently, only about 7% of buildings achieve this.

Against this backdrop, it is logical that the focus of regulation and policy is on decarbonizing the building sector. Specifically, emissions in buildings are to be reduced by 46% by 2030 compared to the base year 2020. The Building Energy Law (BEG) plays a supporting pillar in this effort. The law was initially passed in 2020 and recently amended to catch up with the more stringent targets of the Climate Protection Act. The GEG deals with the energy requirements for buildings and aims to gradually increase the share of renewable energy in the heating of buildings by 2045. Thus, from 2024, newly installed heating systems are to be operated with at least 65% renewable energy. From 2045, the installation of new fossil-fuel heating systems (e.g. oil and gas heating systems) is even completely prohibited. Beyond the elements regulated in the GEG, however, there are a number of other ways to increase energy efficiency in buildings, for example by insulating facades, roofs and basement ceilings, or installing triple-glazed windows.

The role of banks as financiers of decarbonization

Significant investments are needed to decarbonize the building sector. According to projections by the German Housing Industry Association (GdW), it is estimated that EUR 125 – 182 billion in capital will have to be invested annually in energy-efficient building refurbishment. By comparison, only EUR 67 billion was invested in 2022. Financiers and banks thus represent a supporting pillar in the realization of building refurbishment. Many of them are already advertising low-interest conditions for refurbishment loans. These include refurbishment measures that lead to a final energy efficiency class of A+ or A (i.e. an energy requirement of <50 kWh/m2/a) for the properties concerned.

Banks aim to promote investment in energy-efficient buildings via these refurbishment loans. This in turn leads to a reduction in the financed greenhouse gas emissions in their own loan portfolio. The loan book of many banks consists to a considerable extent of construction financing. This also applies to Commerzbank’s portfolio. By providing loans for refurbishment measures, the bank aims to reduce emissions financed through construction financing by 57% by 2030 compared to the base year 2021.

Energetic building renovation as a bank venture capital investor

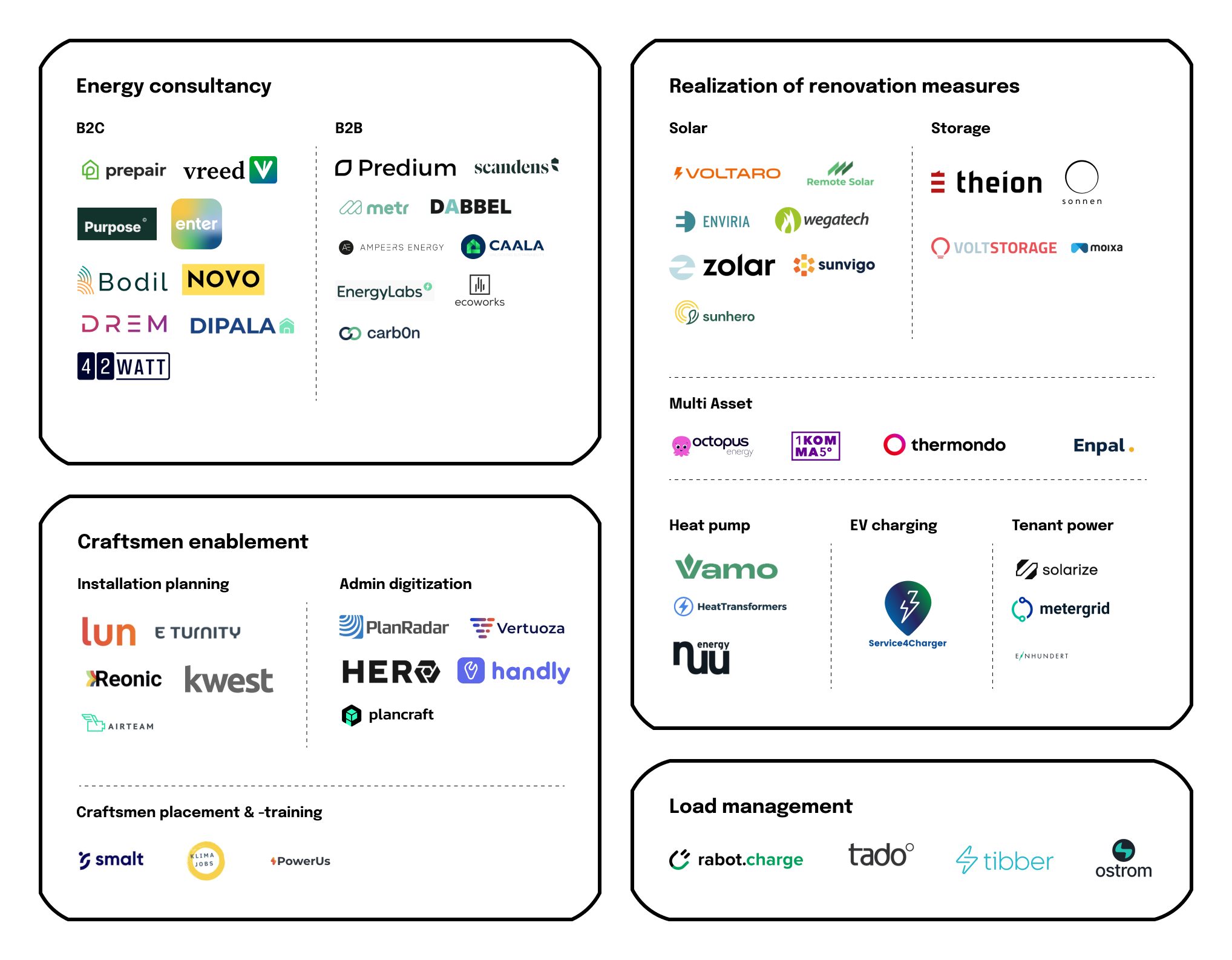

As an early-stage venture capital investor of Commerzbank, the topic of energetic building refurbishment is a focus of our current investment hypotheses in the ClimateTech area. In the following, we share our view on the market and give a classification of start-ups and solutions that innovatively play this market. But first of all, let’s take a look at the most promising start-ups in this sector:

1. Energy consulting services that provide an independent status quo analysis and assessment of which renovation measure makes the most sense for a given property.

Startups in this field determine which renovation measures make the most economic and ecological sense for the building in question. They take care of the application for state subsidies and help the building owner to find a craftsman for the realization of the renovation measure, as well as suitable renovation financing, if necessary.

There are a few startups that act as energy consultants and are primarily focused on one- and two-family homes. These include Enter, which raised EUR 20m in external capital in April 2023, or 42Watt, which released its seed funding round in September. Similar solutions, mainly focused on refurbishment planning and concept creation for multifamily and commercial buildings, include Predium, or ecoworks. The latter raised EUR 22m in July this year.

2. Start-ups that aim to implement renovation measures.

These are mainly craftsmen and plumbers who install low-emission heating technologies and technologies for the generation and storage of electricity from renewable energies. This includes, for example, heat pumps as green heating technology, as well as solar systems and battery storage for the production and storage of green electricity.

Vertically focused installers specialize in shoring technology. In the field of heat pumps, the startup Vamo is active, in whose EUR 3m seed financing round we participated in September. Providers active in the field of solar systems are Wegatech, Voltaro or zolar.

Horizontally positioned installers offer multiple technologies from a single source. This includes 1Komma5. They raised EUR 215m in equity in June 2023, making them a Unicorn. Enpal also raised a EUR 430m debt facility to refinance its solar assets in the same month.

The concept of tenant electricity is used as a decentralized energy supply for multi-apartment buildings. Locally generated electricity, mainly from solar energy, is supplied to various consumers on site – for the power supply of tenants as well as for the operation of further plant technology, for example heat pumps and charging stations for electric cars. Solarize or metergrid, which published a EUR 3m seed round in September 2023, are active in this field.

3. Active load management, which optimizes the emission output when consuming electricity to operate the building.

By the term load management, we mean the active management of electricity demand. Suppliers include dynamic green electricity tariffs in their offers, where the price for electricity purchases is linked to the current purchase price on the electricity market. If the proportion of wind and solar energy in the electricity mix is particularly high at the time, the price of electricity falls and vice versa. In combination with the use of a smart meter, demand can be controlled so that electricity is consumed at a time when it is as green as possible and therefore as cheap as possible. This further reduces greenhouse gas emissions in the operational use of the building. Startups occupying this space include Ostrom, which received a EUR 8m top-up on its A round in September, and Rabot Charge, which received EUR 5m this April.

4. Tools that increase the efficiency of craftsmen so that they can handle more projects.

The biggest bottleneck in energy-efficient building renovation is the availability of qualified craftsmen and installers who can install the respective technologies. To mitigate this problem, at least in part, there are software solutions that digitize the administrative preparatory and follow-up work around the actual installation. This business model aims to make the work of tradesmen more efficient. This includes, for example, feasibility and profitability analyses of a renovation, the dimensioning of a measure including parts lists, as well as the tracking of offers and the creation of invoices. This allows craftsmen to focus on the actual installation and to complete more projects in a given amount of time and with a given number of people. Currently, reonic, Airteam, Hero, Plancraft and Eturnity stand out on the German market. The latter recently raised EUR 8m.

5. Placement and training of craftspeople to mitigate the shortage of skilled workers

The greatest lever for mitigating the shortage of skilled craftspeople lies in the qualified training of craftspeople and their targeted placement in craft enterprises. One example is the PowerUs job portal, which raised EUR 24m in a Series B round as recently as September 2023.

Venture capital unfolds its potential in sustainable start-ups

VC investor investment has cooled significantly in recent months. According to data from Crunchbase, European venture funding activity plummeted by 50% in Q2/2023 compared to the same period last year – and that across all sectors. The aforementioned financing rounds show all the more the potential that fundamentally lies in the field of building refurbishment and in an investment in these business models.

We are therefore firmly convinced that the energy-efficient refurbishment of existing buildings will be one of the dominant themes when it comes to sustainable investment. This is not only because of the significance of the issue, but also because of the regulatory tailwind around sustainability. We also expect more business models and fields to develop in this market in the near future. If you would like to know which sustainable start-ups we have invested in so far, you can take a look at our current portfolio here. Are you a founder who can see yourselves here and are looking for investors? Then get in touch here.