The world of work is evolving, and the shortage of skilled workers is accelerating this transformation. “New Work needs New Pay” is a popular demand that highlights the need for modern work models to also have flexible and contemporary compensation structures. New Pay refers to salary models that are tailored to the individual needs and life situations of employees, rather than strictly adhering to traditional, rigid salary structures.

The financial industry is not just an adopter of New Work; it can also be part of the solution with FinTech innovations. Flexible Pay is about giving employees access to a portion of their salary before the regular payday. These solutions must be secure, legally compliant, and practically implementable to meet the needs of the modern workplace.

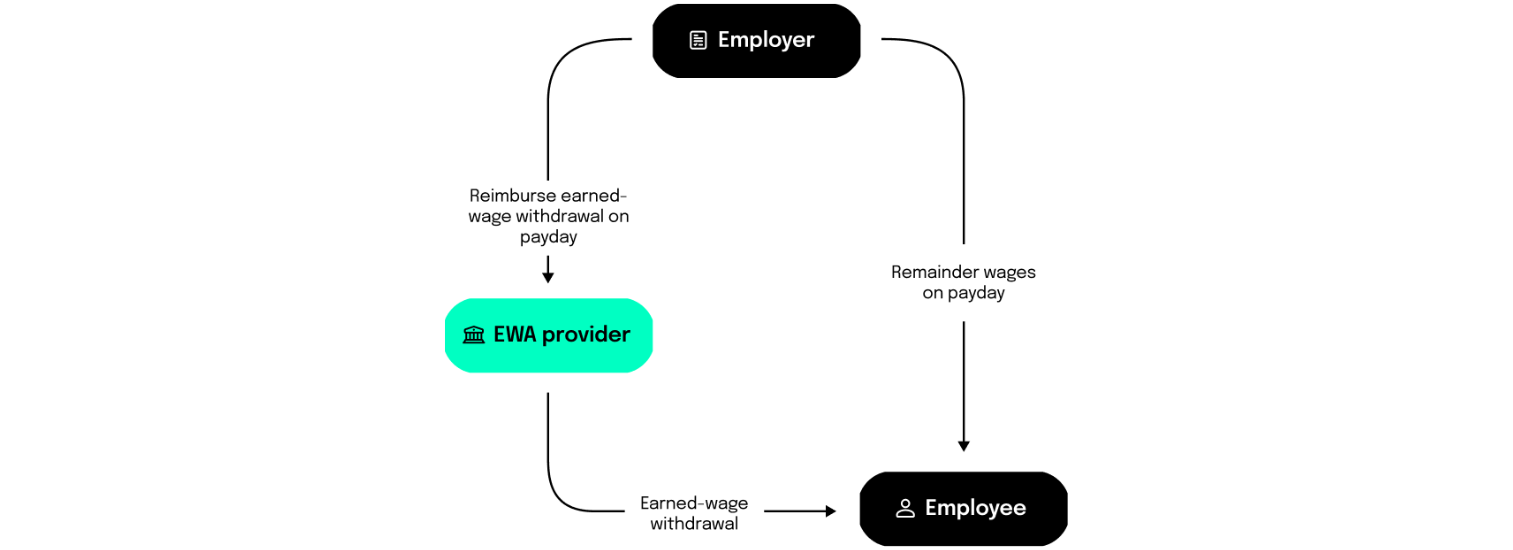

One form of Flexible Pay is Earned Wage Access (EWA). This refers to a solution that allows employees to receive a portion of their already earned salary early, before the usual payday. Legally, this is not considered a loan. However, if more than the earned salary is paid out, it falls under Early Wage Access. Although these terms sound very similar, they have significant practical implications due to regulatory differences.

This article focuses exclusively on pure Earned Wage Access, which literally means access to earned wages. This model originated in the gig economy, a segment of the labor market characterized by short-term and flexible employment relationships. It has become established internationally, particularly in the U.S. and the UK. EWA helps avoid financial shortfalls and reduces the need for loans. Employers benefit from reduced absenteeism and increased productivity. Wage advances have been around much longer than EWA, but they are not well-regarded because they involve high administrative costs due to being labor-intensive individual cases. EWA addresses this issue by automating the process with technological solutions, thereby saving costs. Although EWA is still new in Germany, it could gain importance in the face of rising living costs and a worsening shortage of skilled workers.