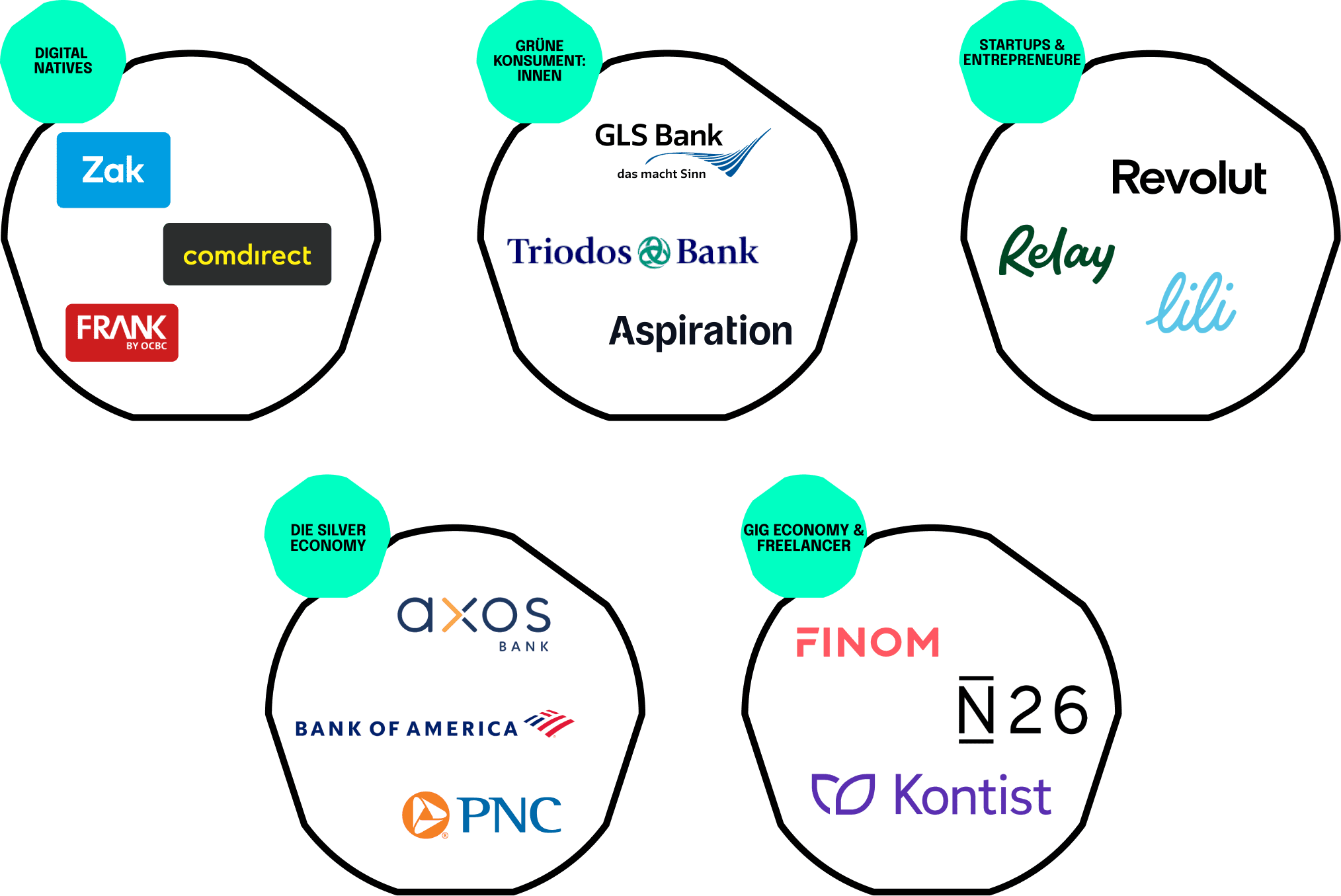

However, we are going to focus on three of the current most impactful verticals.

Digital Natives: Crafting Banking for the Online Generation

The segment of digital natives — those who have seamlessly integrated the internet into every aspect of their lives — demands a banking experience that mirrors the ease and intuitiveness of their digital world. To effectively serve this demographic, it’s essential to understand their unique journey, which is marked by a preference for digital-first interactions, comfort with online transactions, and expectations for quick, uninterrupted service. Banks targeting this segment need to ensure their digital offerings are not just user-friendly, but are also at the forefront of technological innovation to provide a secure, smooth banking experience.

Crafting Banking Services for Unparalleled Connectivity and Ease

To resonate with digital natives, banks must focus on services that champion connectivity and ease of use. But who are digital natives? Digital natives, a term coined by Prensky in 2001, refer to individuals born into an era steeped in technology, specifically post-1980, when environments conducive to technological growth became prevalent. This generation is distinguished by their intrinsic familiarity with technology, having been immersed in it from a young age. Recognized for their tech-savviness, digital natives represent a significant market segment for financial institutions, particularly in vertical banking, where user-friendly and engaging technological interfaces are key to capturing their interest and loyalty.

In creating solutions for digital natives, the focus goes beyond crafting robust online and mobile banking platforms. It’s about integrating these platforms effortlessly with varied digital payment systems and offering consistent support across digital channels. The objective is clear: enable smooth access to an array of banking functions, from simple transactions to complex investment strategies, through an interface that resonates with a tech-savvy audience.

Taking this a step further involves delving into ‘beyond banking’ solutions. Here, financial services merge with everyday activities like mobility and housing. Imagine banking interfaces harmoniously integrated with car-sharing services such as car2go or electric scooter options like Tier. This integration would provide a fluid payment experience in line with the digital native’s lifestyle. Similarly, in housing, banks could offer streamlined solutions for rent payments, utilities, or even smart home technologies.

Such integrations demand a deep understanding of the digital native’s lifestyle, hinging on insights drawn from mobile banking usage studies. By embedding banking into the fabric of daily life, financial institutions can offer more than just financial services; they can become an integral, indispensable part of the digital native’s world.

Spotlight on comdirect: A Role Model in Banking for Digital Natives

A stellar example in this realm is comdirect, which has carved a niche for itself by delivering a holistic digital banking experience tailored to the internet-savvy user. Notable for its user-centric interface, comdirect offers a suite of online services ranging from straightforward account management to sophisticated investment tools, all backed by real-time financial analytics. Their dedication to digital innovation and a customer-focused approach stands as a model of excellence in catering to the needs of digital natives, paving the way in the vertical banking domain. Comdirect is further innovating the space of vertical banking by launching a robo advisor called cominvest and incorporating a even an additional robo advisory called “cominvest green”, where customers have the opportunity to let their finances be managed in a sustainable manner with assets and security based on ESG criteria that meet the needs of the most investors.

The Green Consumer: Sustainable Banking for a Conscious Future

In today’s world, where ecological mindfulness shapes consumer preferences, the banking sector is evolving to meet the needs of the green consumer. This niche focuses on individuals who integrate sustainability into their financial decisions, a trend mirrored in the exponential growth of sustainable finance. The evolution towards sustainable banking is not just a trend but a paradigm shift towards a future where financial services contribute to environmental stewardship as much as they do to economic prosperity.

In the realm of sustainable investments, a substantial portion of retail investors are showing a keen interest. Surveys indicate that 65% to 85% of these investors are inclined towards more sustainable investment options. This trend is consistent with broader research, where interest averages around 70%. Interestingly, age plays a significant role in this inclination towards sustainability. Investors under 40 are particularly drawn to these investment choices. However, there’s a noticeable discrepancy between investors’ sustainability preferences and the advisory practices in financial institutions. Financial service providers often overlook these preferences, leading to misaligned recommendations.

Eco-Conscious Banking Products and Operational Practices

The move towards eco-conscious banking is both a reaction to market demands and a proactive step towards a greener future. Banks serving the green consumer are incorporating sustainable practices, from reducing paper use through digital solutions to using renewable energy in their operations. Their product offerings are equally green, featuring loans for eco-friendly projects and investments in sustainable enterprises, thereby meeting the environmental aspirations of their customers.

In aligning with eco-conscious banking, banks are increasingly tailoring their offerings to meet the needs of individual customers who prioritize sustainability. This shift is not just about adopting sustainable operational practices, but also about providing an array of green financial products that resonate with these environmentally-minded customers.

Key among these offerings are impact investing products, such as cominvest green, which allow customers to direct their investments towards sustainable enterprises and projects. These products enable customers to actively contribute to environmental stewardship while pursuing financial returns. Most of these products not only drive a more sustainable approach to investing, but also focus on younger generations, for which the desire to act in a sustainable manner is even higher.

Furthermore, banks are integrating ‘beyond banking’ solutions that extend the realm of traditional financial services. A prime example is the inclusion of CO2 calculators within banking apps or platforms. These tools empower customers to track their carbon footprint associated with their spending habits. Banks are taking this a step further by offering customers the option to offset their carbon footprint. This is achieved through automatic payments to carbon-neutralizing funds, linked to the CO2 calculator. Such payments are often proportional to the carbon impact of the customer’s transactions, making sustainability a seamless part of their financial activity.

By offering these targeted products and services, banks are not only catering to the growing demand for sustainable financial options but also helping individual customers make a tangible impact on environmental conservation. This approach reflects a deeper commitment to sustainability, extending beyond the bank’s internal practices to empowering customers in their pursuit of eco-conscious lifestyles.

GLS Bank: One of the Leaders in Sustainable Banking

A prime example of this vertical is GLS Bank, which stands as a testament to the power of sustainable banking. Committed to ethical banking values, GLS Bank’s portfolio includes green investments and financing for renewable projects, aligning its business with the environmental objectives of its clientele. GLS Bank’s approach sets a benchmark in the sustainable banking sector, showcasing the impactful role financial institutions can play in promoting ecological responsibility. In 2022, they increased their sustainable investemnts again, reaching EUR 1.4 billion, an increase of around 11 percent from 2021.

Startup and Entrepreneurial Ecosystem: Customized B2B Banking Services

In the entrepreneurial world where innovation and agility are paramount, the banking sector has evolved to meet the distinct needs of startups and entrepreneurs through a dedicated vertical. This sector is not just about providing banking services but about creating a financial ecosystem that nurtures the growth and dynamism of these ventures.

Tailoring Financial Solutions for Startups and Entrepreneurs

Startups and entrepreneurial ventures often navigate a financial landscape marked by unique challenges and opportunities. From startup-friendly account structures that accommodate the fluid nature of early-stage businesses to flexible lending options designed for high-growth potential entities, these services are crafted to support the dynamic financial requirements of startups. By providing tailored banking services, this vertical plays a pivotal role in nurturing and sustaining the growth of entrepreneurial ventures. Here are some of the relevant services a startup might look for when choosing a bank:

- Startup-Friendly Account Structures: These accounts offer low fees and flexible terms, crucial for businesses with fluctuating cash flows. They often include features like easy online access, multiple currency options, and integration with accounting software, simplifying financial management for busy entrepreneurs.

- Flexible Lending Options: Recognizing the variable funding needs of startups, these banks can provide flexible lending solutions. This includes lines of credit that can be tapped as needed, short-term loans to cover immediate expenses, and longer-term financing to support growth initiatives. These lending products are designed with lenient eligibility criteria to accommodate the often-limited credit history of new businesses.

- Equity Financing Support: Banks in this vertical often assist startups in preparing for equity financing rounds, offering advisory services and connecting them with potential investors.

- Technology Integration: Startups thrive on technology, and banks cater to this by offering advanced digital banking platforms, API integrations, and tech-driven financial tools.

- Cash Flow Management Tools: Tools that help monitor and manage cash flow, including predictive analytics, can be critical for startups to navigate their often unpredictable financial landscape.

Revolut: A Bank focused on Early-Stage Startups

A standout example in this vertical is Revolut. Known for its innovative approach to banking, Revolut offers a suite of services specifically designed for startups and entrepreneurs. Their offerings include flexible account structures, easy international transactions, and financial management tools. Revolut’s success in this sector underscores the demand for specialized banking services that align with the unique financial dynamics of the startup and entrepreneurial ecosystem. Currently, they sign up over 10.000 businesses every month. Underlining the impact that vertical banking can have on company success.

In an age where customer demands are as diverse as they are dynamic, the banking industry stands at a pivotal crossroads. The imperative to integrate vertical solutions in banking is not just a response to evolving market conditions; it’s a strategic maneuver to stay relevant and competitive. But why is this shift crucial, and how does it redefine the traditional banking landscape?

In an age where customer demands are as diverse as they are dynamic, the banking industry stands at a pivotal crossroads. The imperative to integrate vertical solutions in banking is not just a response to evolving market conditions; it’s a strategic maneuver to stay relevant and competitive. But why is this shift crucial, and how does it redefine the traditional banking landscape?