Bhagat, S. (2022, March 31). An Inconvenient Truth About ESG Investing. Harvard Business Review. Retrieved June 26, 2022, from https://hbr.org/2022/03/an-inconvenient-truth-about-esg-investing

Raghunandan, Aneesh and Rajgopal, Shivaram, Do ESG Funds Make Stakeholder-Friendly Investments? (May 27, 2022). Review of Accounting Studies, forthcoming, Available at SSRN: https://ssrn.com/abstract=3826357<>or http://dx.doi.org/10.2139/ssrn.3826357

Uhrynuk, M., Burdulia, A. W., & Agrawal, N. (2022, January 17). Leveraging Taxonomies: How Asset Managers Are Using New Sustainability Classification Systems – Part III. Mayer Brown. Retrieved June 25, 2022, from https://www.eyeonesg.com/2022/01/leveraging-taxonomies-how-asset-managers-are-using-new-sustainability-classification-systems-part-iii/

Uhrynuk, M. (2022, March 29). ICMA Identifies Usability Challenges – and Recommends Action – for Implementing the EU Taxonomy. Eye on ESG. Retrieved June 24, 2022, from https://www.eyeonesg.com/2022/03/icma-identifies-usability-challenges-and-recommends-action-for-implementing-the-eu-taxonomy/

Johansson, E. (2021, March 30). Credit implications of brown taxonomy greater than green version. Expert Investor. Retrieved June 25, 2022, from https://expertinvestoreurope.com/credit-implications-of-brown-taxonomy-greater-than-green-version/

Nicito, A., Koloskova, K., & Saygili, M. (2019, April). Brexit: Implication for Developing Countries (UNCTAD Research Paper No. 31 (UNCTAD/SER.RP/2019/3)). UNCTAD. https://unctad.org/system/files/official-document/ser-rp-2019d3_en.pdf

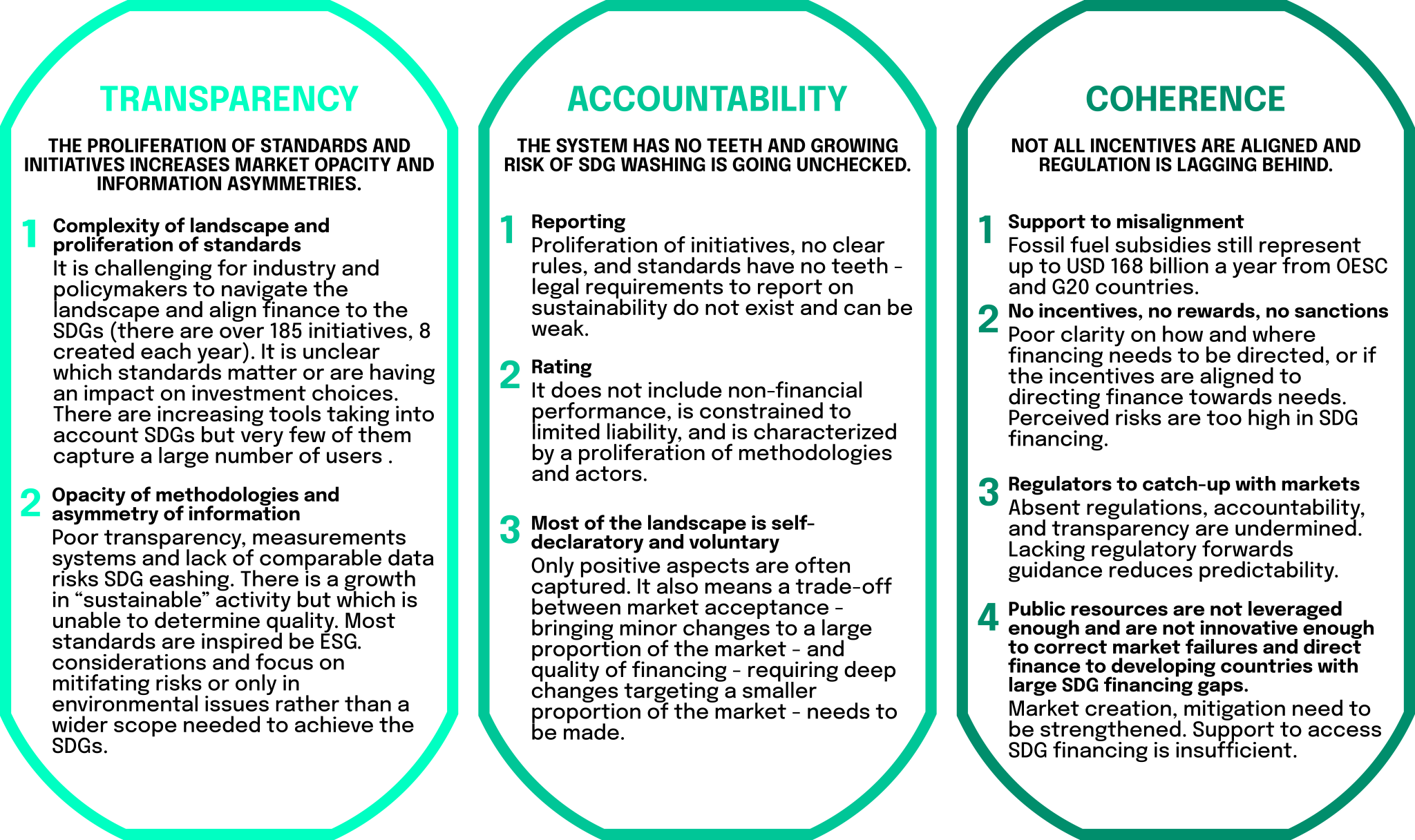

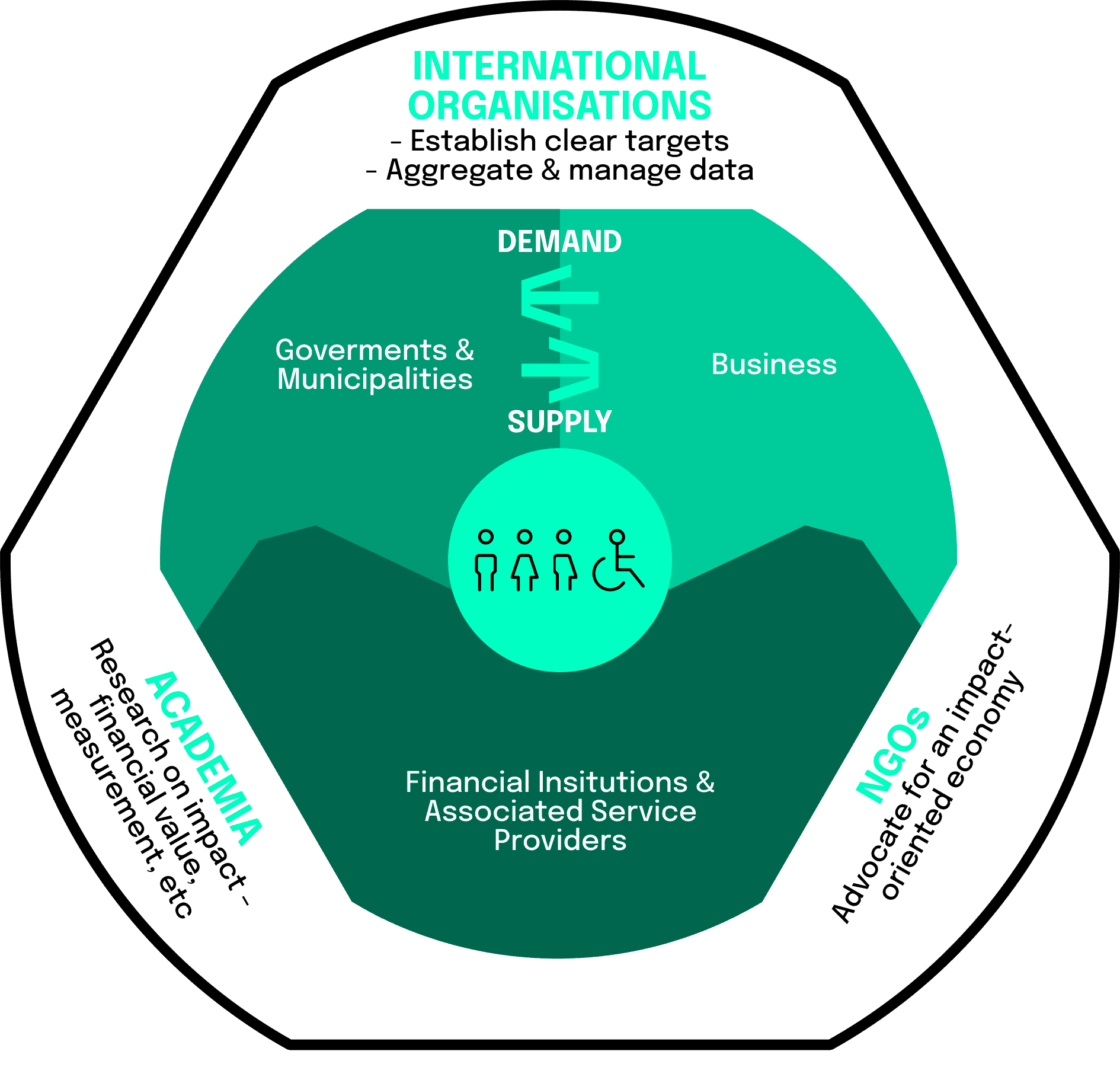

UNEP FI & Société Générale. (2018, November). Rethinking Impact to Finance the SDGs (No. 978–92-807-3724–0). UNEP FI. https://www.unepfi.org/wordpress/wp-content/uploads/2018/11/Rethinking-Impact-to-Finance-the-SDGs.pdf

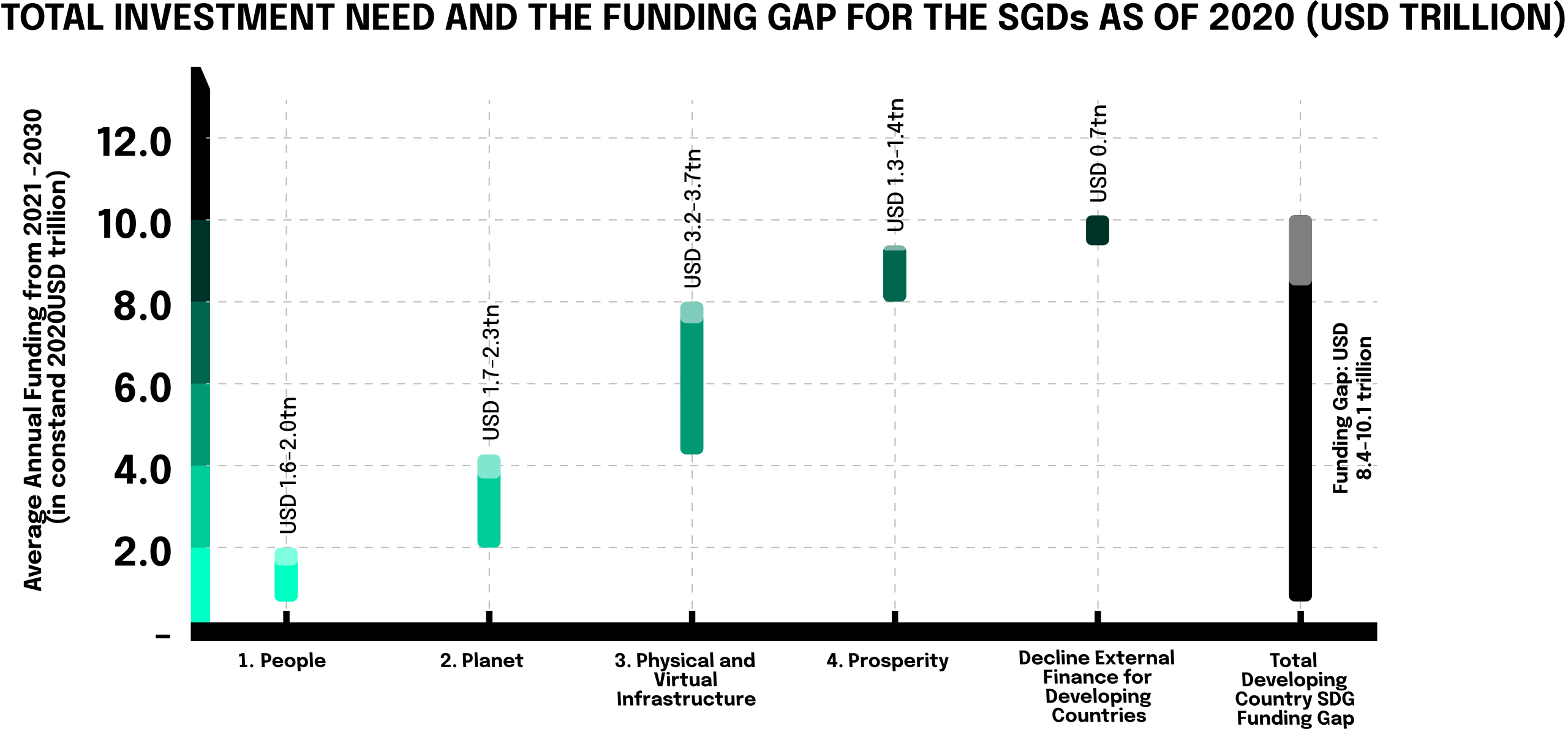

OECD & UNDP. (2020). Framework for SDG Aligned Financ. OECD. https://www.oecd.org/development/financing-sustainable-development/Framework-for-SDG-Aligned-Finance-OECD-UNDP.pdf

Flugum, Ryan and Souther, Matthew, Stakeholder Value: A Convenient Excuse for Underperforming Managers? (August 23, 2021). Available at SSRN: https://ssrn.com/abstract=3725828 or http://dx.doi.org/10.2139/ssrn.3725828

EFAMA. (2021, September 7). Brown taxonomy: An opportunity to transition away from significantly harmful activities | EFAMA. Retrieved June 29, 2022, from https://www.efama.org/newsroom/news/brown-taxonomy-opportunity-transition-away-significantly-harmful-activities

Robinson-Tillett, S. (2020, March 9). EU taxonomy advisors call for expansion from green to ‘brown’ in final report. Responsible Investor. Retrieved June 22, 2022, from https://www.responsible-investor.com/eu-taxonomy-advisors-call-for-expansion-to-brown-in-final-report/

Hawker, E. (2021, December 14). Taxonomy Delays Thwart EU Green Deal Momentum. ESG Investor. Retrieved June 22, 2022, from https://www.esginvestor.net/taxonomy-delays-thwart-eu-green-deal-momentum/

Alarcón, J. (2022, February 11). THE LEVERAGE OF THE TRILLIONS: The outlook on finance and investment for the SDGs. GlobalCAD. Retrieved June 27, 2022, from https://globalcad.org/en/2022/02/11/investment-for-the-sdgs/