Five years ago, I published my first article about our VC tech stack: The VC’s IT Tool Stack (2019). Back then, neosfer was still called Main Incubator, and I was an analyst there. A lot has happened since: I spent several years working at other VCs, gained a wealth of experience, and learned a lot along the way. This summer I returned—now in the role of Investment Manager. And the article from back then is hopelessly outdated. So it’s high time for an update: Which tools are we using today—especially as a Corporate VC? And where is the journey heading?

From sourcing to tools for exit: The current VC tech stack at neosfer

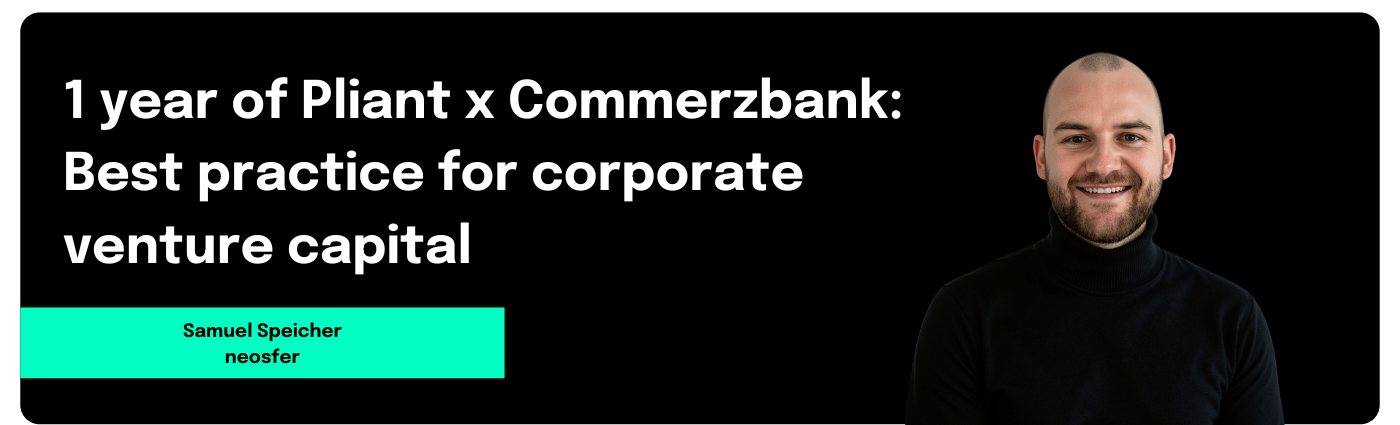

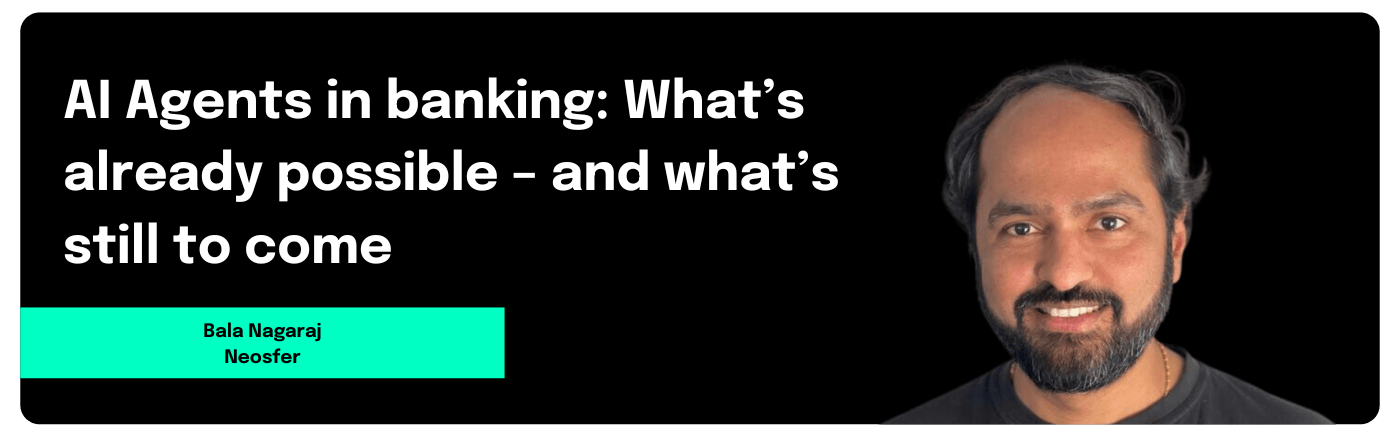

neosfer: Innovation unit and corporate venture capital investor of Commerzbank

neosfer is Commerzbank’s early-stage investor and innovation unit. Three teams work closely together here: Invest, Build, and Connect. Invest is responsible for startup investments, Build develops its own MVPs and prototypes, and Connect bridges startups, the bank, and the ecosystem.

Within the Invest team, we pursue not only financial returns but also strategic goals for the bank. Since we have only one LP—our parent company—that sets us apart from traditional VCs and makes us a Corporate Venture Capital firm (CVC).

In short: we invest in technologies and business models that transform both the financial sector and the bank. As a CVC, we go beyond pure financial investments: we align with Commerzbank’s strategic roadmap, involve business units, and translate new technologies into the corporate context. That makes neosfer not just a capital provider but also a strategic partner for startups, and for the bank an innovation radar and a bridge to the startup ecosystem.

This is precisely why our VC tech stack must not only cover the classic VC process but also address CVC and innovation topics.

The VC Tech Stack for portfolio management, sourcing and Co.: The foundation of our work as a venture capital investor

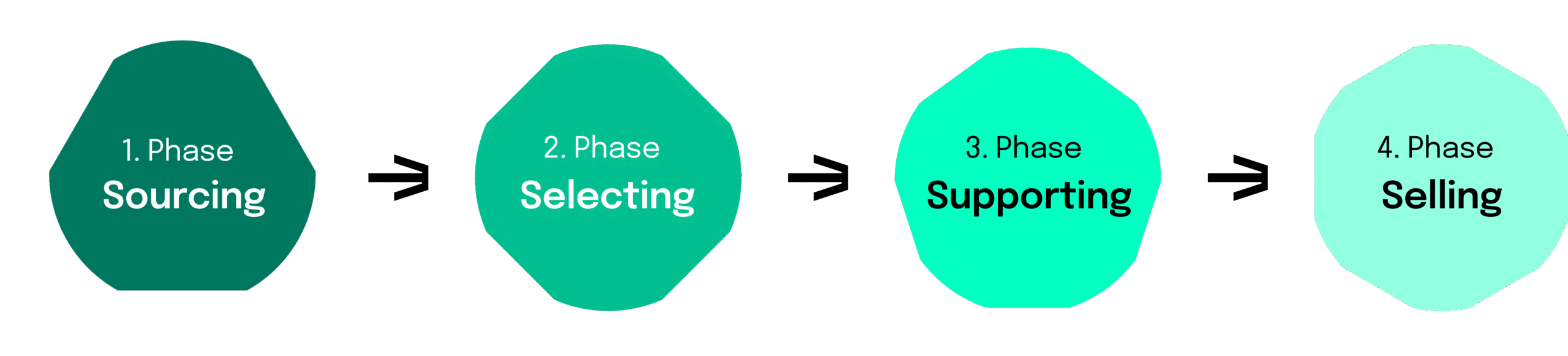

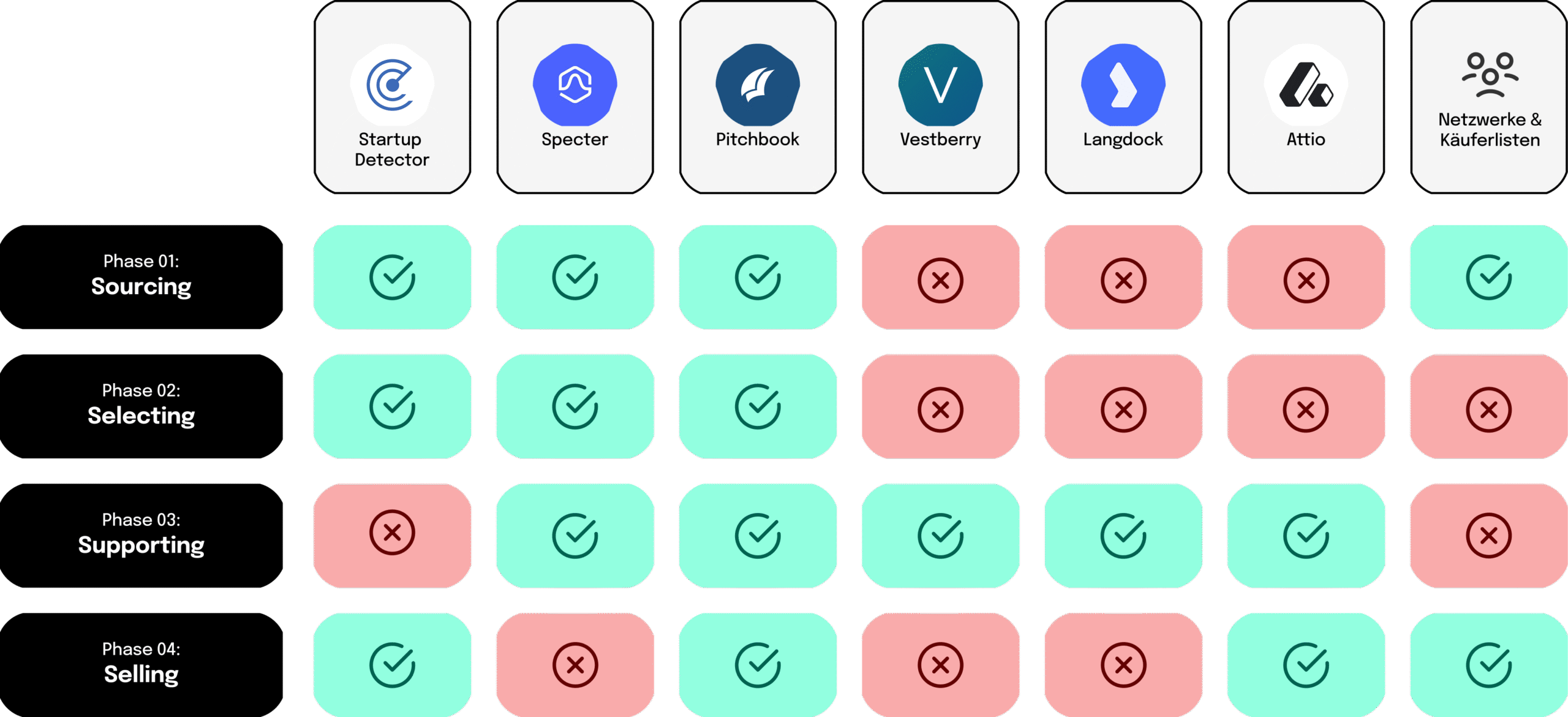

The classic VC process can be divided into four phases: Sourcing, Selection, Support, and Selling—the phases of identifying startups, selecting investments, supporting portfolio companies, and, hopefully, executing profitable exits. These four phases make up the 4-S model, which serves as both a mental model and a guide for our work—and our VC tech stack is built around it.

Sourcing

For scouting, we rely on a combination of three core tools:

- Startup Detector monitors the German commercial register and provides weekly updates on new incorporations, founding teams, and funding rounds. It has been an indispensable source for years, ensuring we spot new teams early.

- Specter is a research tool focused on international markets and stealth startups. Especially valuable is its tagging system and LinkedIn integration, which reveal network and talent signals in real time.

- Pitchbook is our data backbone for deals and funding volumes. Pitchbook helps us track trends across verticals and follow developments systematically.

Our goal: to gain access to startups as early as possible in their lifecycle—where risk and opportunity are at their peak. This clearly differentiates us from later-stage investors, who rely more heavily on watchlists and growth signals like rising headcounts.

Selection

In the selection phase, we rely on the same set of tools — just in a different combination.

- Specter and Pitchbook support our competitive analysis, identifying substitutes and complementary solutions that are often missing in startups’ own market slides.

- Startup Detector helps validate cap tables and financing details—an important supplement for realistic valuation assessments.

From this phase onward, we link external tool data with internal information. Why? Public data is often based on startups’ self-reporting—so caution is warranted. Internal data from our portfolio and network is essential to verify and contextualize external sources. In the early stage especially, informal signals often matter more than any database.

Support

Once we’ve invested, our goal is to support portfolio companies in the best possible way.

- Vestberry is used for portfolio reporting, capturing and analyzing KPIs at both company and portfolio level.

- Langdock makes knowledge about our portfolio companies instantly available via natural language queries.

- Attio is our AI-powered CRM. It integrates seamlessly with Google Workspace, streamlines communication, and supports network building and management—with M&A partners, investors, and beyond.

These tools are not an end in themselves: they form the interface to the bank, kick off proofs of concept (POCs), and orchestrate collaborations—creating value for both the bank and the startups.

Selling

In the selling phase, we don’t adopt new tools but instead use our existing systems differently.

- Networks regain critical importance, as personal relationships are key. Our tools help us manage and make these connections visible.

- Buyer lists are maintained with potential buyers—from M&A advisors to investors—and we stay in regular contact.

- Raising our portfolio companies’ market visibility is equally important. Monitoring and analytics tools help boost their reach and presence.

This sets the stage for well-prepared, successful exits.

Beyond 4-S: Innovation Work at neosfer

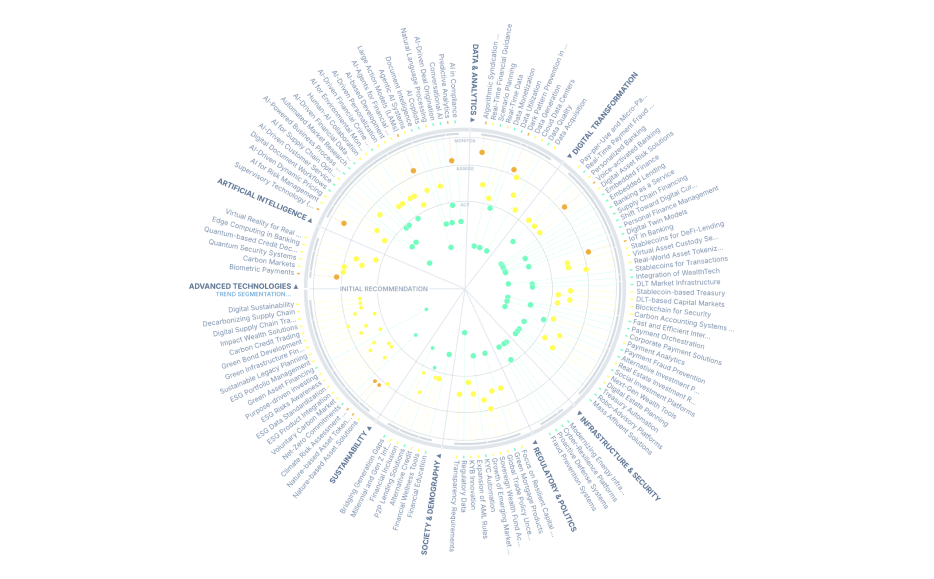

Beyond the classic 4-S activities, as a CVC we are tasked with continuously analyzing and processing trends—for both the bank and our VC efforts. For this, we use Itonics, an innovation operating system.

With Itonics, we identify and evaluate so-called “opportunity spaces” and systematically monitor technological developments. We create trend radars on topics like artificial intelligence or stablecoins, making them available across the organization. Insight feeds ensure we stay continuously updated on new developments.

The key is the combination: data-driven analysis as a foundation, complemented by human judgment and close collaboration with the bank’s innovation management team. This ensures our investment theses align with Commerzbank’s strategic roadmap, while keeping us flexible—whether proactively pursuing new themes or reacting ad hoc to requests.

How VCs Work Together—and Against Each Other

As VCs, we operate in a market full of frenemies—partners in one deal, competitors in the next. Great deals are scarce, and VCs compete fiercely for them. At the same time, funding rounds are almost always a team sport, with multiple VCs investing together.

This creates a market defined by co-opetition. Tools like ours level the playing field: those who use them smartly remain competitive, while those who don’t risk falling behind instantly.

But tools are just the foundation. The real differentiation comes from how we process external data internally and enrich it with our own insights.

For our portfolio companies, we offer a unique mix of capital, access to the Commerzbank network, and innovation expertise. That combination is neosfer’s USP in the early-stage VC market.

Why Personal Networks Remain Critical in VC

Despite all the tools, venture capital is still fundamentally a people business. Especially in the early stages, tool-based signals must be taken with caution. Most of the data originates—directly or indirectly—from startups themselves. Understandably, in such an early phase, there’s little historical data; nearly everything is forward-looking. That makes the human factor even more important: we need to critically assess signals from tools, pitch decks, and conversations.

Networking itself has changed dramatically since my first article five years ago. Today it takes place much more digitally, making it visible who has recently met or connected. From the outside this might look like pure gossip—but for us as venture capitalists, it’s a crucial part of the job.

Our takeaway: Tools provide data, networks build trust. Only together do they make the difference.

From External Tools to Internal Value Creation

External tools are our foundation—but what really matters is how we use them and build on their results. That’s where differentiation comes in.

We merge external data with our own portfolio insights and feed them into trend radars and insight feeds. These in turn flow back into our sourcing and selection processes. The result is a cycle where data and judgment reinforce each other.

AI plays a special role here—especially with unstructured information, where AI shines. Those very signals are often decisive in venture capital.

Beyond this, we develop our own solutions. Alongside no- and low-code approaches, we increasingly use vibe coding. My colleague Robin Rehbein recently wrote an insightful piece on this: Vibe Coding at neosfer.

This way, we create room to go far beyond mere tool usage—turning data, networks, and technology into real value for everyone involved.

From Status Quo to the Future

AI will transform our business—in every phase, from sourcing to selling. It makes processes faster, data more transparent, and information more accessible. But data is only the beginning. What matters is how we read it, combine it, and connect it with our networks.

That makes one thing clear: tools provide the foundation, but differentiation comes from smart use, internal workflows, and personal networks. Even in the AI era, that remains our key success factor.

In the end, it’s not just about tools, but about creating more space for what truly matters: Sourcing, Selection, Support, and Selling.

Wanna dive into more insights?