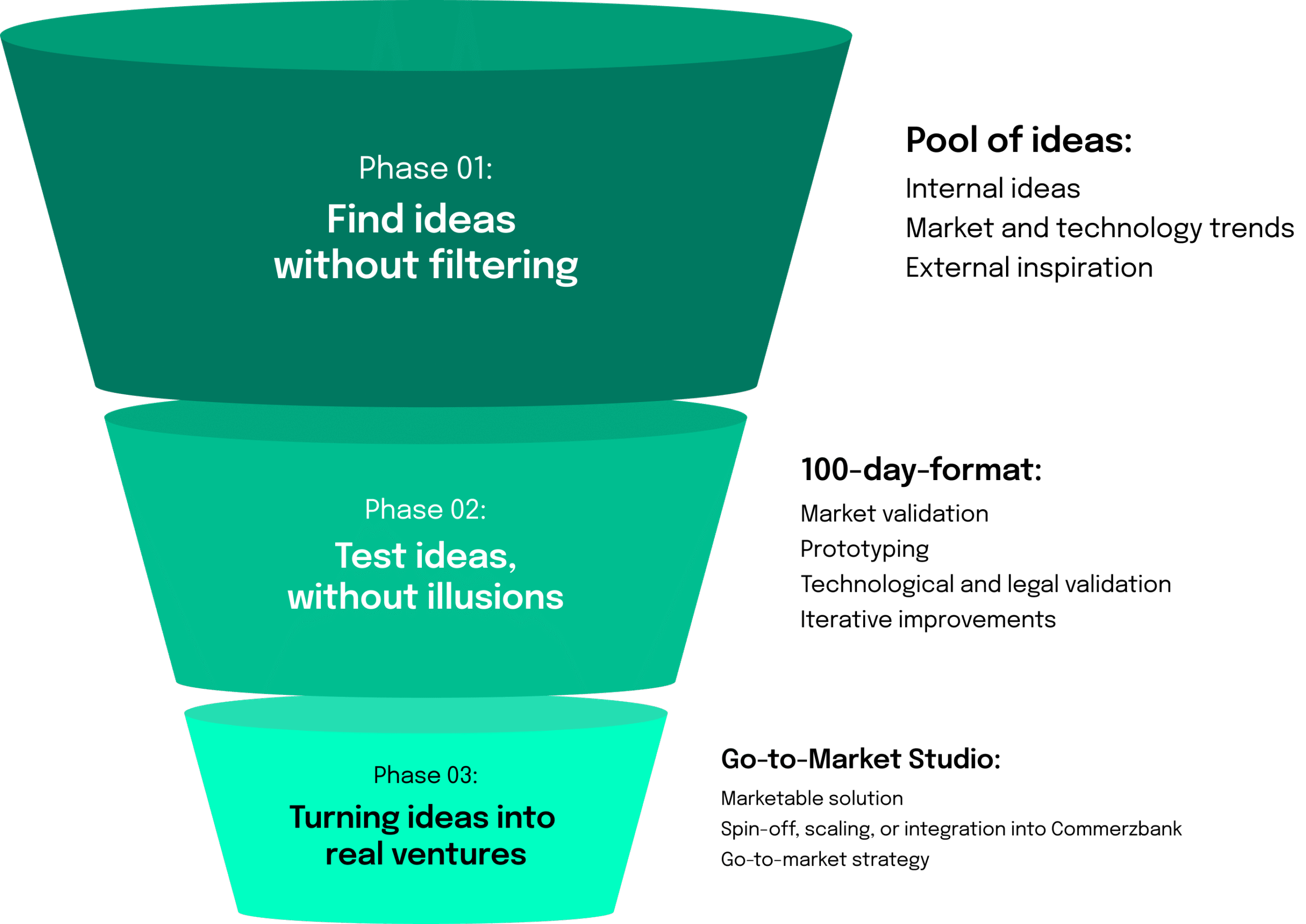

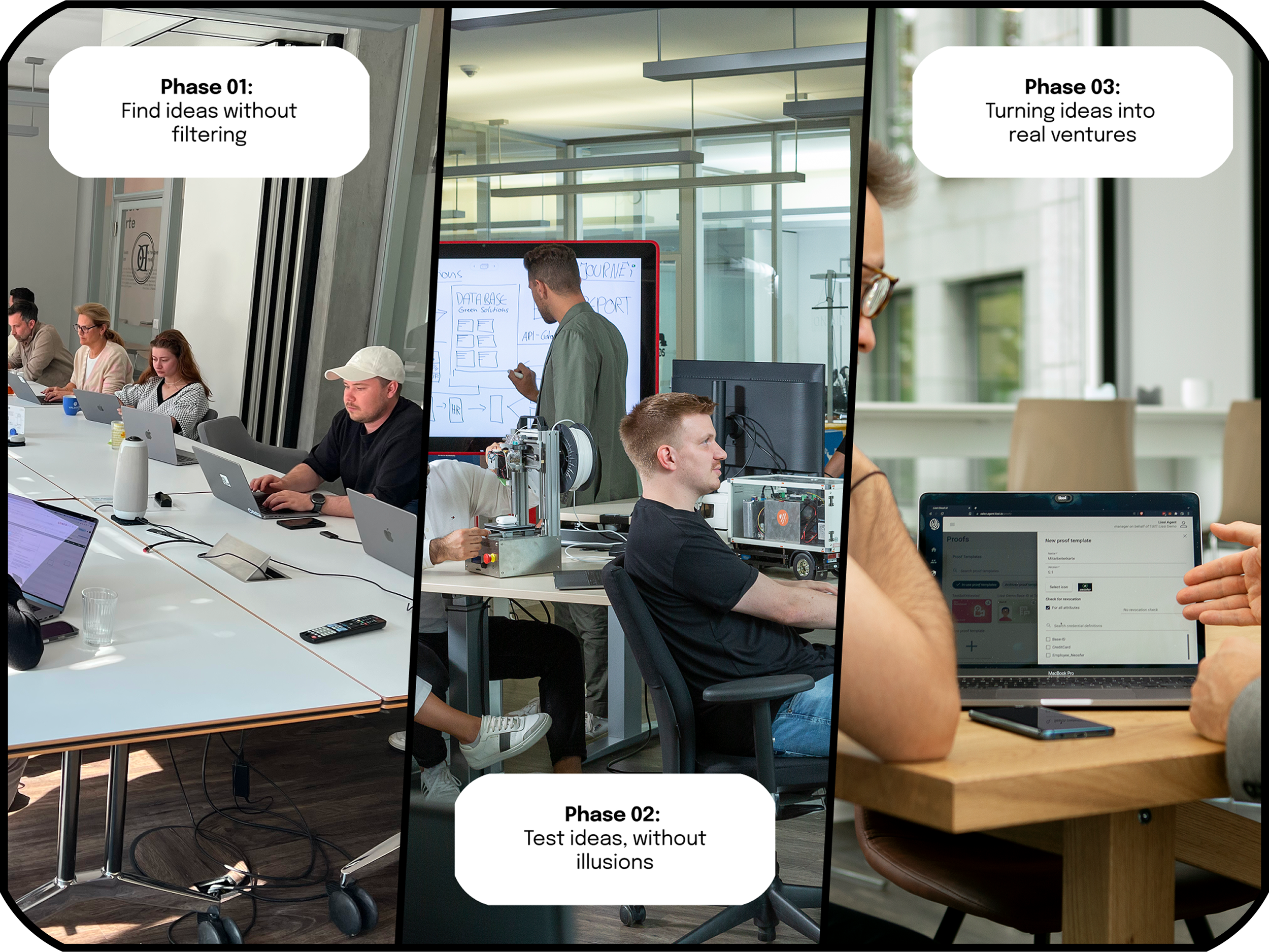

Innovation rarely happens at the push of a button. It needs space, friction and sometimes the willingness to run into a dead end. At neosfer, one of the ways we create this space is through venture building, a structured process in which new business ideas are identified, validated and – ideally – transformed into marketable companies.

For us, it is the tool of choice for our innovation process. In this article, our colleague Lily Sondhauß has written down more about the various open innovation tools that exist and that we already use.

Oftentimes, innovation processes in companies are very slow due to rigid structures and processes, countless PowerPoint slides and coordination meetings. Our motto, on the other hand, is “Build fast, learn fast, fail fast”. With Venture Building, we go from initial idea to prototype in less than six months. The agile, iterative process enables companies like us to experiment with low risk and use resources efficiently at the same time. We will explain below what our process looks like for this.