Are we facing a wave of insolvencies in Germany? And what are insolvencies actually? One thing is clear: companies today are facing a variety of challenges, from rising insolvency figures to sweaty developments on the stock markets. While many companies find themselves in financial difficulties and often act too late to secure their existence, the capital market in Germany is showing impressive dynamism despite global crises. Whether it’s strategies for averting insolvencies or the prospects for IPOs in the coming year – you can find out all about the topic in this article from our Between the Towers (#btt) format.

Insolvency wave - What to do when it rolls towards us? | Christian Müller (FTI Andersch)

Success crisis vs. strategy crisis: Most companies run into the insolvency wave with their eyes wide open, but do something about it far too late and go bankrupt. Christian Müller (FTI Andersch) shares this key insight. Insolvency figures are on the rise. The optimal starting point for restructuring is actually in the success crisis, but this is where very few companies approach Christian and his colleagues. Many more companies only approach Christian when they are in a liquidity crisis. However, the options for action are naturally very limited in the case of corporate insolvencies. Nevertheless, there is hope. Watch the video to find out how insolvency can be averted.

IPOs instead of bankruptcy - Germany at the top in 2024! | Dr. Martin Steinbach (EY)

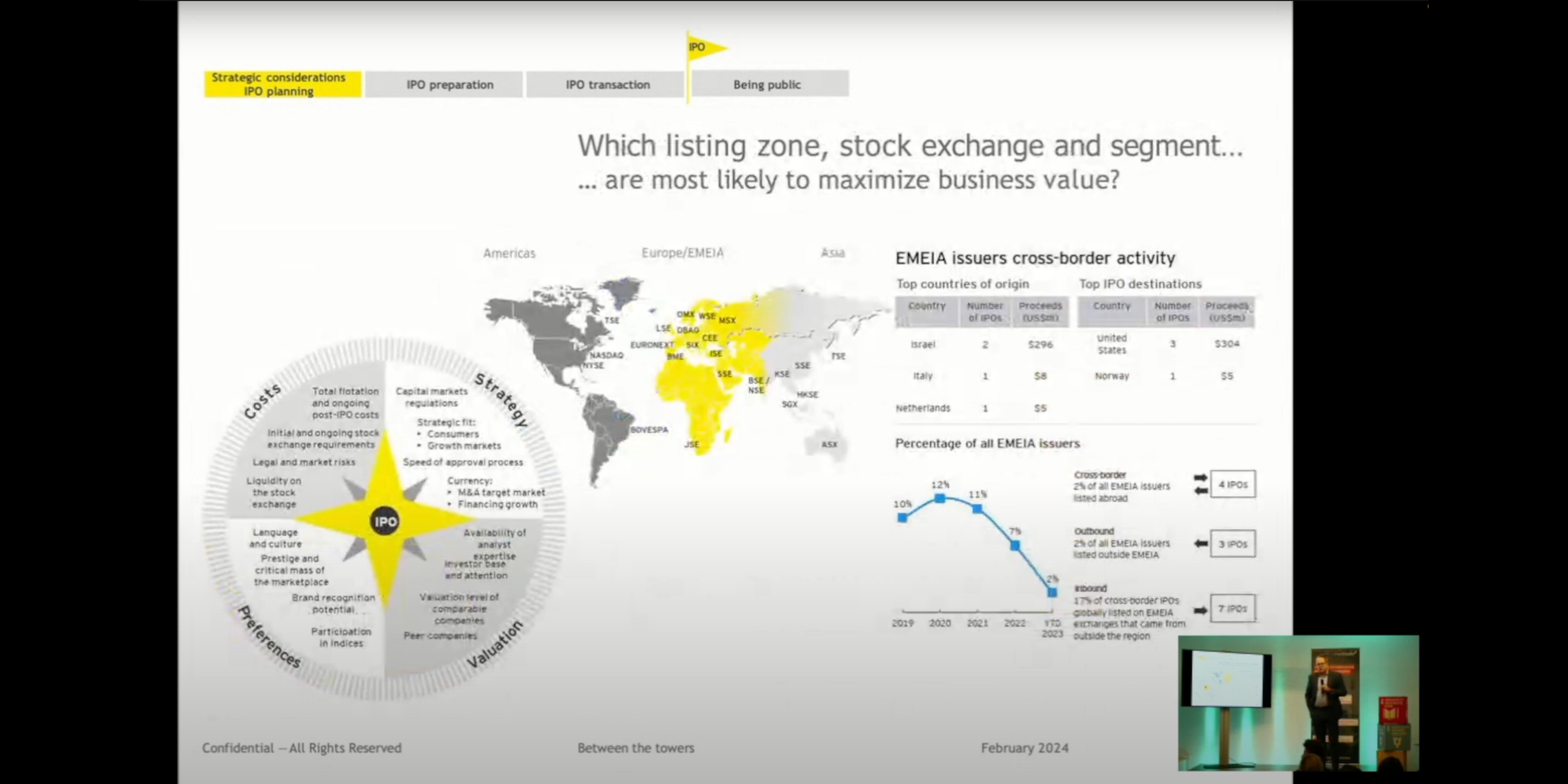

Crisis years can also be party years. At least on the stock markets. But first things first. Birkenstock went public on the NASDAQ in 2023! And the public outcry and headlines were huge: why in the USA and not in its home country of Germany? Despite all the astonishment, the sandal manufacturer is the exception. Just 2 percent of all IPOs do not take place in the company’s home country. Dr. Martin Steinbach (EY) explains this in his presentation. In addition, companies in Germany and the Frankfurt Stock Exchange in particular are in a much better position than their reputation internationally: Top 3 in various categories!

And the outlook for 2024? Surprisingly positive and high figures! After all, many stock exchanges, such as the DAX, are at record highs and are therefore attracting many new IPOs – the pipeline is full. And Dr. Martin Steinbach should know: After all, he accompanies scale-ups in the sector on their way to an IPO and the entire process can take up to 3 years.

Would you like to be part of our next “Between the Towers”? Then we look forward to meeting you! Every first Tuesday of the month, we talk about all the topics that move the finance and tech scene. For each edition, we invite experts from the industry and discuss a focus topic. Afterwards, there is plenty of opportunity to network over snacks and drinks. Participation is of course free of charge.

Fancy more updates from the financial sector?