Arsova, S., Corpakis, D., Genovese, A. & Ketikidis, P. H. (2021). The EU green deal: Spreading or concentrating prosperity? Resources, Conservation and Recycling, 171, 105637. https://doi.org/10.1016/j.resconrec.2021.105637

Ashraf, N. & Bandiera, O. (2017). Altruistic Capital. American Economic Review, 107(5), 70–75. https://doi.org/10.1257/aer.p20171097

Clark, C., Lalit, H. & Rockefeller Capital Management. (2021, 8. Oktober). ESG Improvers: An Alpha Enhancing Factor. Rockefeller Capital Management. Abgerufen am 16. März 2022, von https://rcm.rockco.com/insights_item/esg-improvers-an-alpha-enhancing-factor/

Clark, G. L. (2005). Money flows like mercury: the geography of global finance. Geografiska Annaler: Series B, Human Geography, 87(2), 99–112. https://doi.org/10.1111/j.0435-3684.2005.00185.x

Cozier, M. (2017). The US withdrawal from the Paris Agreement: a global perspective. Greenhouse Gases: Science and Technology, 7(5), 774–777. https://doi.org/10.1002/ghg.1736

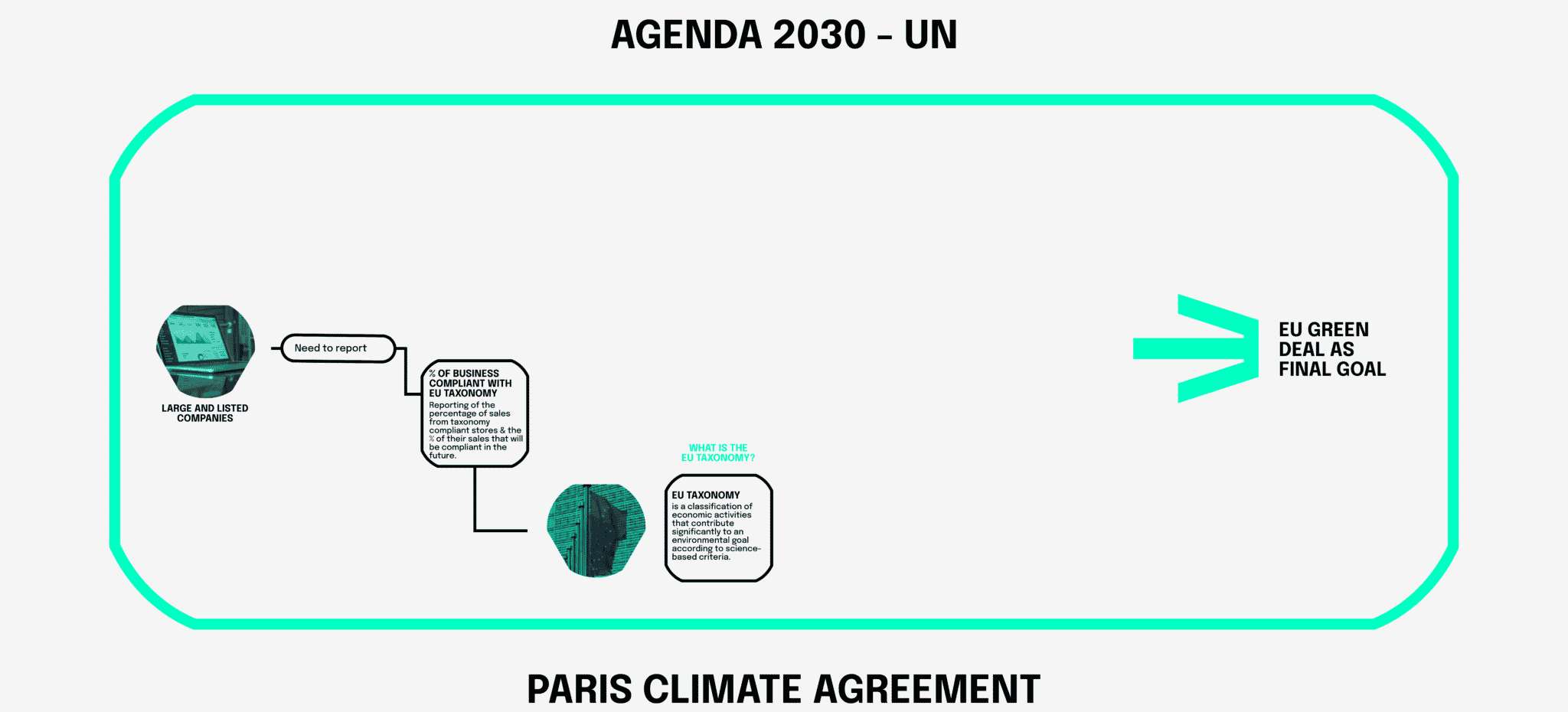

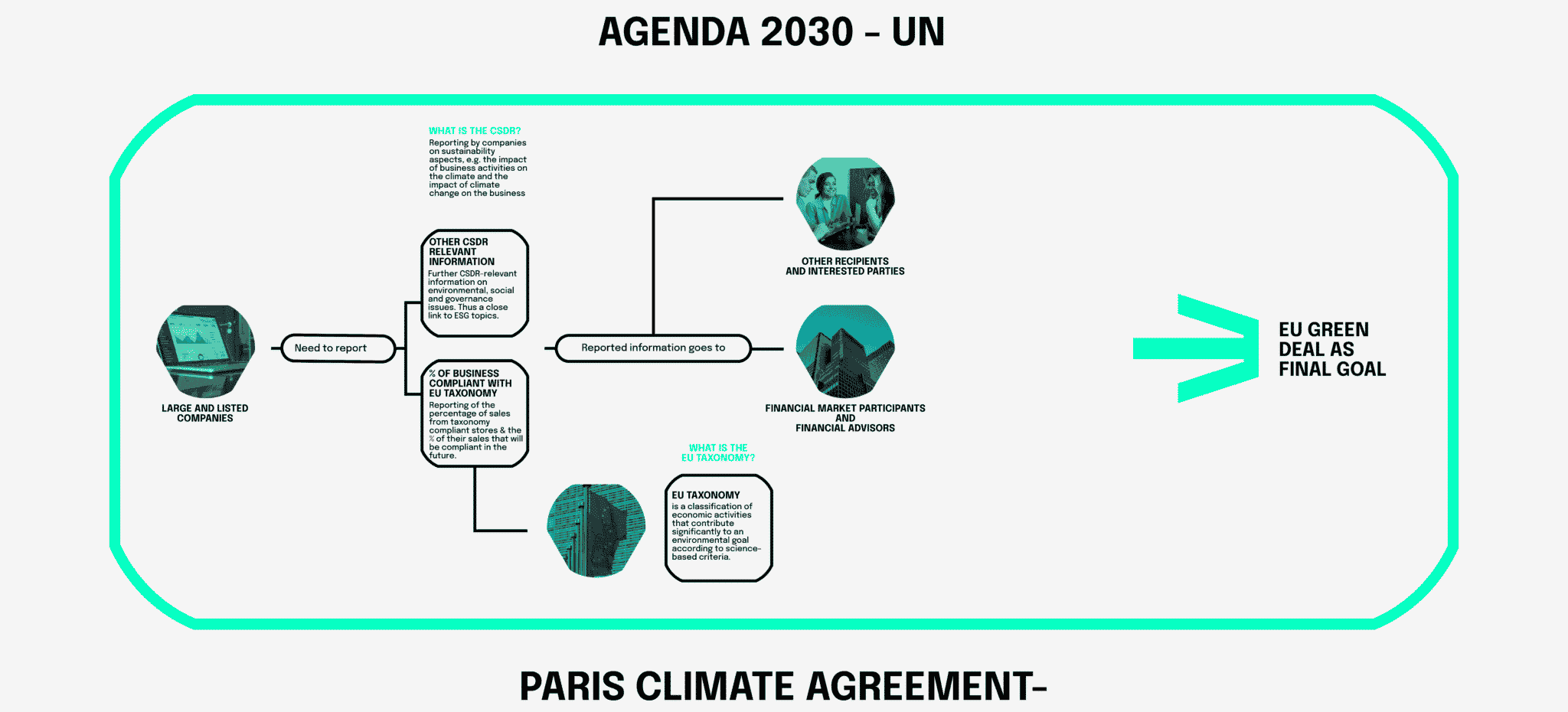

Giacomelli, A. (2022). EU Sustainability Taxonomy for Non-financial Undertakings: Summary Reporting Criteria and Extension to SMEs. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4012636

GSI Alliance. (2021, 1. Januar). GLOBAL SUSTAINABLE INVESTMENT REVIEW 2020. http://www.Gsi-Alliance.Org/. Abgerufen am 8. März 2022, von http://www.gsi-alliance.org/

Hainsch, K., Löffler, K., Burandt, T., Auer, H., Crespo Del Granado, P., Pisciella, P. & Zwickl-Bernhard, S. (2022). Energy transition scenarios: What policies, societal attitudes, and technology developments will realize the EU Green Deal? Energy, 239, 122067. https://doi.org/10.1016/j.energy.2021.122067

International Energy Agency. (2022, 8. März). Global CO2 emissions rebounded to their highest level in history in 2021 – News. IEA. Abgerufen am 16. März 2022, von https://www.iea.org/news/global-co2-emissions-rebounded-to-their-highest-level-in-history-in-2021

Khan, M., Serafeim, G. & Yoon, A. (2016). Corporate Sustainability: First Evidence on Materiality. The Accounting Review, 91(6), 1697–1724. https://doi.org/10.2308/accr-51383

Maule, S. & Egli, F. (2017, 21. März). Missing in Action – The lack of ESG capacity at leading investors. E3G. Abgerufen am 10. März 2022, von https://www.e3g.org/publications/missing-in-action-the-lack-of-esg-capacity-at-leading-investors/

Och, M. (2020). Sustainable Finance and the EU Taxonomy Regulation – Hype or Hope? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3738255

Pacces, A. M. (2021). Will the EU Taxonomy Regulation Foster Sustainable Corporate Governance? Sustainability, 13(21), 12316. https://doi.org/10.3390/su132112316

The Paris agreement on Global Climate change cannot be fully enforced, because this is an incomplete agreement. (2020). Earth & Environmental Science Research & Reviews, 3(2). https://doi.org/10.33140/eesrr.03.02.11

PRI. (2017, 12. Oktober). The SDG investment case. Abgerufen am 10. März 2022, von https://www.unpri.org/sustainable-development-goals/the-sdg-investment-case/303.article

Puaschunder, J. M. (2016). On the Emergence, Current State and Future Perspectives of Socially Responsible Investment (SRI). SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2720686

Rivas, S., Urraca, R., Bertoldi, P. & Thiel, C. (2021). Towards the EU Green Deal: Local key factors to achieve ambitious 2030 climate targets. Journal of Cleaner Production, 320, 128878. https://doi.org/10.1016/j.jclepro.2021.128878

Tóthová, D. (2022). Measuring the Environmental Sustainability of 2030 Agenda 2030 Implementation in EU Countries: How Different Assessment Methods Affect Results? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4025884

United Nations. (2017, 17. Oktober). The SDG investment case. PRI. Abgerufen am 16. März 2022, von https://www.unpri.org/sustainable-development-goals/the-sdg-investment-case/303.article