A new edition of our “Between the Towers” (#btt) took place at the beginning of March. For those who are not yet familiar with our event series: We dedicate the first Tuesday of every month to current and future trends in the financial services sector. This time, the focus was on the digital euro – a topic that is often overshadowed by the dominant discussion on artificial intelligence (AI), but which the European Central Bank (ECB) is currently investigating. However, the digital euro promises far-reaching changes and new opportunities that should be viewed independently of AI trends. Will we soon be moving away from cash and towards a purely digital form of payment?

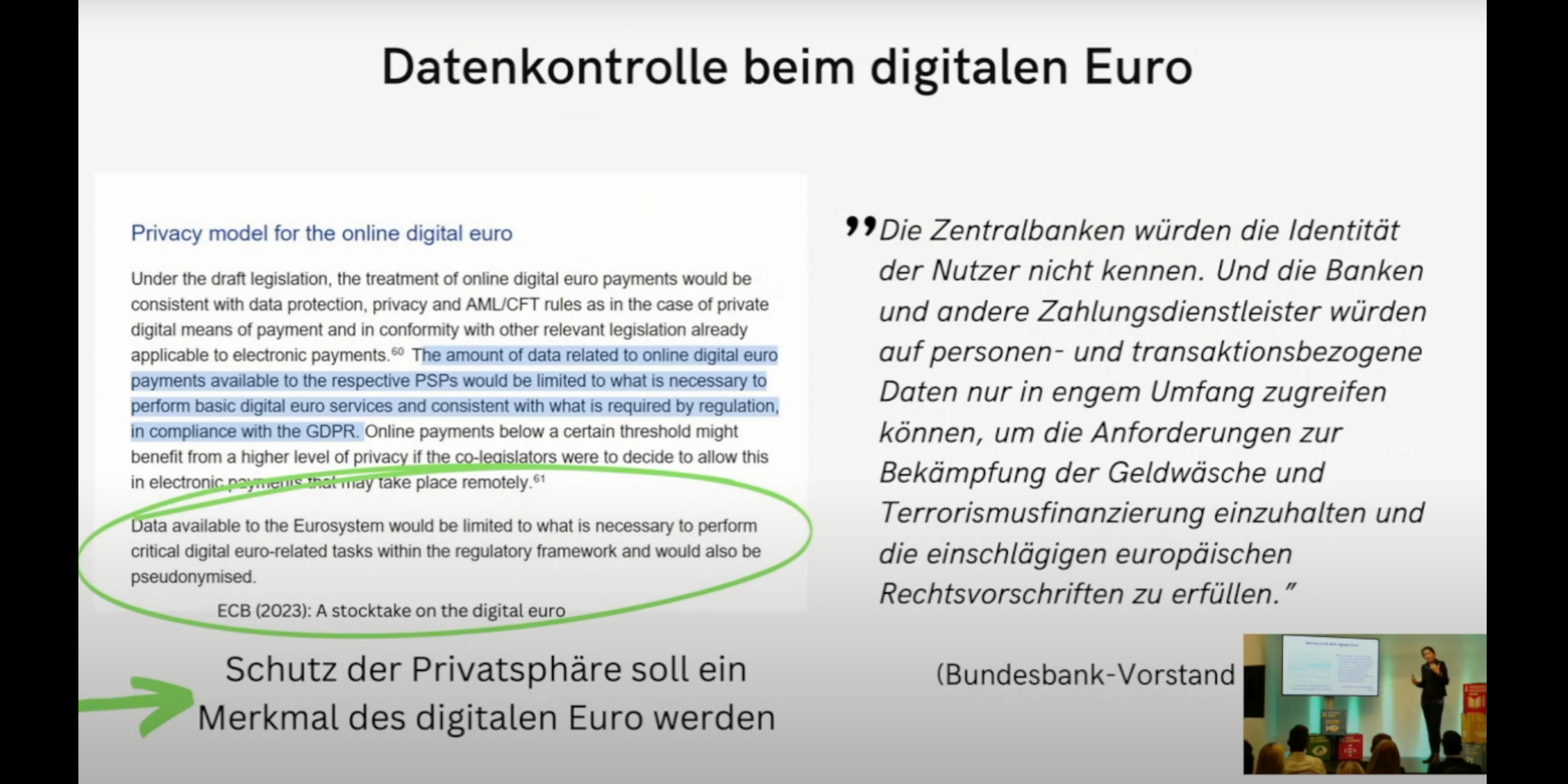

In a series of presentations, three experts shed light on the different facets and implications of the digital euro and discussed how its introduction is linked to the protection of privacy. Read for yourself!