CES in Las Vegas is the beating heart of technological innovation every year. As one of the world’s largest events for new hardware and software solutions, it attracts companies, visionaries, and tech enthusiasts from around the globe who eagerly follow groundbreaking trends and developments. Matthias Lais, CEO of neosfer, seized the opportunity to visit CES this January and shares his impressions and key takeaways for the financial industry.

CES 2025: Insights for the Financial Industry from the World’s Leading Tech Fair

The First Impression: AI Everywhere!

The new year began for me with an inspiring visit to CES. This January, one of the world’s most significant fairs for hardware and software innovations took place in Las Vegas. The event was massive and offered countless exciting discoveries – both on the exhibition floor and in the conference program. And I had one single question in mind: What are the latest trends and innovations, and what significance might they have for developments in the financial industry?

Before I delve into the details, I’d like to present three gadgets that provided me with initial inspiration and ideas about how technologies are transforming our daily lives and, ultimately, impacting the financial industry:

- AI-Powered Refrigerator. Model BCD-780W by Hisense. Manages groceries and reminds users of expiration dates.

- Face Authentication Display from automotive supplier Continental. Identifies users using a camera behind the display. Detects attempts at fraud.

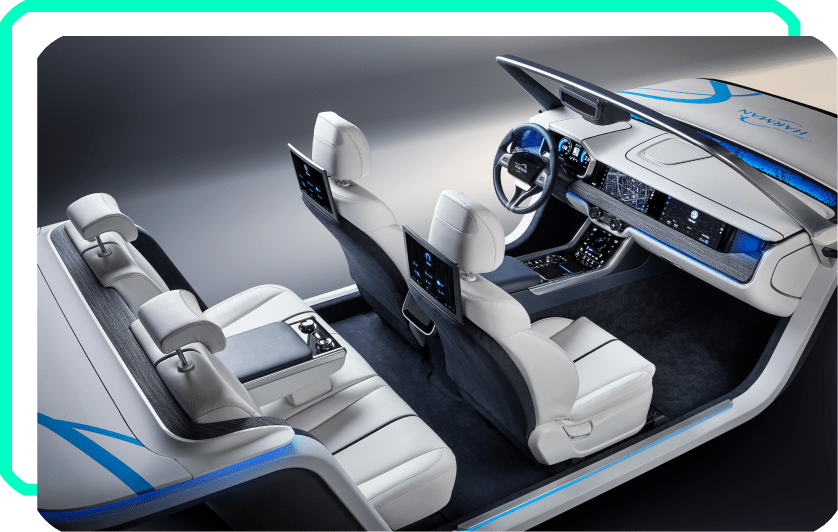

- Unified Cabin 2025, from the manufacturer Garmin. Offers infotainment functions on six screens, including an ultra-wide front display for 3D overlays, customizable light, AI-supported voice assistants and various safety functions.

Many household appliances I’ve purchased over the past few years are now Wi-Fi-enabled. In the future – and this was made very clear at CES – many devices will also be equipped with AI. A few years ago, I was still skeptical about Wi-Fi in refrigerators or washing machines, but today I genuinely appreciate the benefits of smart control. Will I feel the same about AI-powered devices? Probably yes, if they make my daily life easier and provide real value – for instance, by reminding me to finish the yogurt on time or automatically ordering more. I’m willing to give it a try. And if it wins me over, I’ll buy refrigerators in the future because they can reorder groceries, not because they have AI inside.

Applied to our financial industry: Do we now need new technologies like AI everywhere, and must they also be made visible? I don’t think so. First, AI should only be used behind the scenes in financial institutions if it genuinely leads to improvements. Second, customers don’t care whether their concerns are resolved with AI or through other means. What matters most is that the solution is efficient and helpful. That’s why practical and efficient solutions should always take precedence over hype-driven innovations.

Based on this perspective, I’ve identified four key AI trends for the financial industry.

Four AI Trends in the Financial Industry

1) AI in 2025: Mainstream Applications Are Coming

As Kai and I already outlined in our article, Banking Trends 2025: Six Strategic Themes in Focus, AI will become widespread in the coming years, directly reaching customers in the financial sector. Areas such as customer communication, risk management, and process optimization will benefit significantly.

2) Future of Work: New Jobs, New Challenges

AI will undoubtedly reshape the workplace – including in the financial industry. While some jobs will disappear, many new ones will emerge. Companies face the challenge of preparing and supporting their workforce through targeted training and emotional empowerment.

3) Agentic Web: A New Ecosystem is Emerging

AI-powered agents capable of independently completing tasks are fundamentally altering the digital landscape. This ecosystem holds enormous disruptive potential for the financial industry, particularly in conjunction with Open Banking.

4) Hyper-Personalization: The Future of AI

Meeting individual customer needs with even greater precision will only be possible through AI. This will raise standards in the financial industry to an entirely new level.

In-Car Payment: The Automobile as a Payment Platform

At CES, I was one of over 140,000 attendees marveling at the latest innovations in electronics. Many gadgets on display had four wheels: numerous automakers now showcase their new models at the fair. It’s no surprise, as today’s cars are predominantly electric.

As vehicles increasingly blend hardware and software, they warrant closer examination. They consolidate various innovations, and from a financial industry perspective, one aspect stands out: cars are evolving into platforms for transactions. The integration of payment services into vehicles enables what is known as in-car payment – from toll fees and parking tickets to shopping options. Soon, every car will have its own wallet. However, it remains unclear whether users will prefer using the car’s onboard computer or their smartphone linked to the vehicle.

Automakers envision additional features being as simple as possible to book and pay for directly. Applications like paying for charging, parking tickets, or toll and ferry fees are obvious use cases. But the potential extends further: when cars not only charge at home but also discharge to serve as battery storage for smart energy management, entirely new payment needs arise.

This development positions the car as an early focal point for Embedded Finance.

Spatial Computing: A New Dimension of Customer Interaction

Although the hype around the Metaverse has subsided, virtual worlds are far from obsolete. In fact, spatial computing was a recurring focus at CES. This technology merges digital and physical worlds by tracking the position of objects and users in space and generating interactive digital content based on that data. Technologies such as Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), artificial intelligence (AI), sensors, 3D mapping, and edge computing enable seamless interaction between physical and digital environments.

- Input device, model Float from the manufacturer Naya. For precise control of 3D objects.

In the financial industry, we must closely monitor which financial services will be needed and utilized within spatial computing. Additionally, we should consider which new financial products might emerge from these new possibilities.

What’s Next? Quantum Computing!

Given the omnipresence of AI, one central question loomed at CES: What comes next? The answer was clear and consistent across stage programs and conversations with innovators: Quantum Computing. (Still no idea about quantum computing? Then change that here!)

Quantum Computing is based on the principles of quantum mechanics and uses qubits, which can exist in multiple states simultaneously. This property enables computational power far beyond the capabilities of classical computers.

For the financial industry, Quantum Computing opens new horizons:

- Improved Simulations: Highly complex models can provide more precise risk calculations, relevant for both insurers and banks.

- Cybersecurity and Encryption: Encryption will be particularly critical for banks. Quantum Computing, combined with AI, has the potential to break existing encryption methods – a cybersecurity risk. The answer may lie in developing more powerful quantum computers and better-trained AI models optimized specifically for banking and security applications.

Quantum Computing is still in its developmental phase, and patience is required. However, the question is no longer if, but when Quantum Computing will break through. The search for concrete use cases has already begun – a development reminiscent of the early days of blockchain technology.

Conclusion: Deploy Technology with Purpose and Foresight

CES 2025 has vividly demonstrated that technologies like AI, Embedded Finance, and Quantum Computing can and will change our world. However, it remains crucial to implement innovations thoughtfully and strategically. The financial industry has tremendous opportunities to leverage technological progress while keeping a clear focus on what matters most: effectively and sustainably meeting customer needs. The future looks promising – I’m looking forward to it!

Be one step ahead of others and find out what's happening in the financial sector!