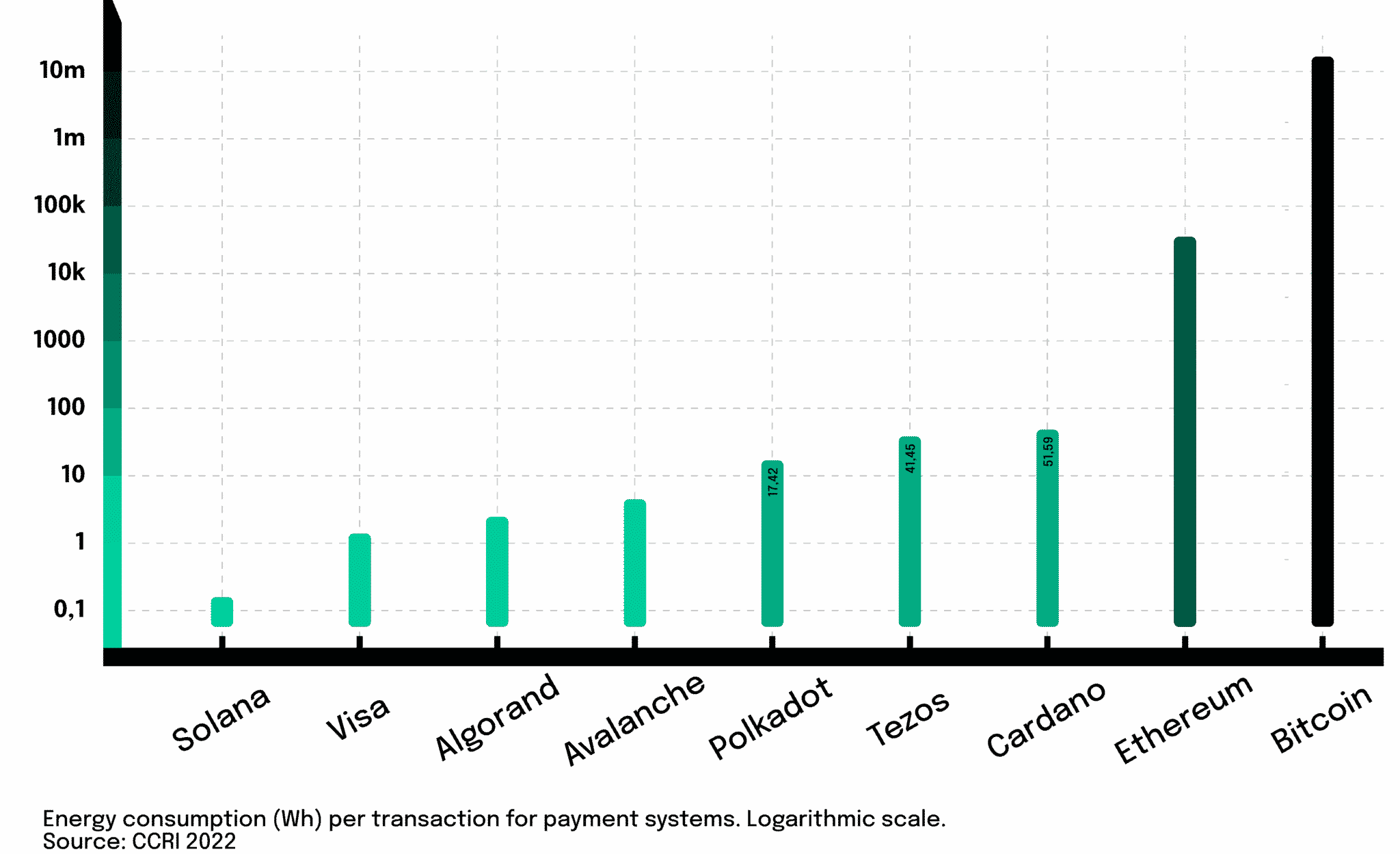

The energy debate about blockchains and in particular cryptocurrencies broke out in 2021 when China cracked down their miners of digital currencies (which ironically led to a surge of mining activities in neighboring Kazakhstan). At the same time, Tesla reversed its decision to take Bitcoin as a method of payment because of doubts regarding its energy consumption. The concerns are not unfounded. According to Digiconomist, Bitcoin mining consumes a similar amount of energy to an entire small country like the Netherlands or the Philippines. Other reports compare bitcoin’s annual electricity consumption to countries like Austria and Venezuela, Switzerland or even larger countries like Sweden or Argentina. The estimates for how much energy bitcoin mining consumes vary, ranging from 81.51 terawatt hours (TWh) annually to 117 terawatt-hours of electricity or even 148 terawatt-hours of electricity. Quickly, all blockchains were put in a bad light. Rightfully so? For instance, with one Ethereum transaction, a U.S. home can be powered for a week, whereas the energy required for a Bitcoin transaction could power a home for more than 70 days at a time. Nonetheless, there are also studies that indicate that the stock market’s energy consumption is higher than bitcoin’s and that the entire bitcoin ecosystem uses less than half of the energy banking systems required. So, are all blockchains energy consuming monsters?

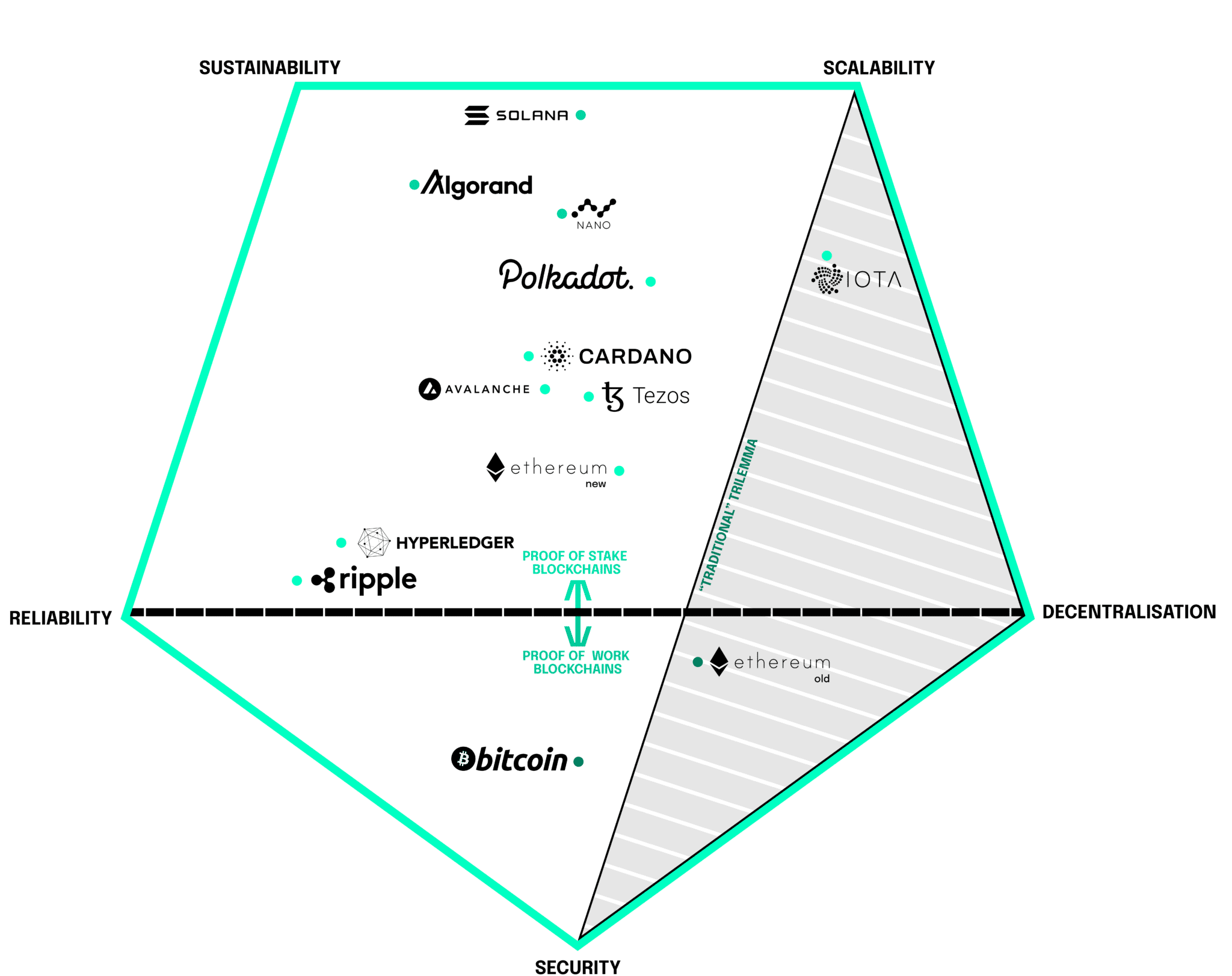

Our ambition for this article it not to exactly measure the energy consumption of blockchains like Bitcoin or Ethereum, but rather to a) outline what the current problems are (especially with the respective consensus mechanisms), b) what solutions exist to mitigate them and c) what ESG use cases are emerging in the realm of blockchains, Web 3.0 and NFT.