In a year’s time, Europe’s banks must accept the new European Digital Identity Wallet, EUDIW. Helge Michael and David Schäffler explain what the new era of digital identity entails, why it is more than just another login, and why banks urgently need to take action.

In a year’s time, Europe’s banks must accept the new European Digital Identity Wallet, EUDIW. Helge Michael and David Schäffler explain what the new era of digital identity entails, why it is more than just another login, and why banks urgently need to take action.

Digital Identity: Europe’s new wallet will change the financial world

Final call: Europe's digital identity is transforming the financial system

Europe is currently working on the digital project of the decade: a common infrastructure for digital identity. With the EU Digital Identity Wallet, or EUDIW for short, people in the European Economic Area will be able to use their smartphones to identify themselves securely and across borders from 2026 onwards, for example when opening bank accounts, dealing with public authorities, or concluding digital contracts.

The EUDIW is more than just a digital ID project; it is a kind of European liberation: the wallet is intended to enable independence from platforms such as Apple or Google, which are increasingly being used for identification purposes. However, their systems are operated outside the EU and are subject to the political and economic interests of other countries. One glance at Trump’s America right now is enough to understand why Europe’s striving for technological sovereignty is more important than ever.

The introduction of EUDIW is particularly relevant for banks, as they are not mere spectators. From the end of 2027, financial institutions will be obliged to accept the wallet as an official method of identification. It is therefore high time for banks to embrace this technology if they do not want to be left behind by newer players once again.

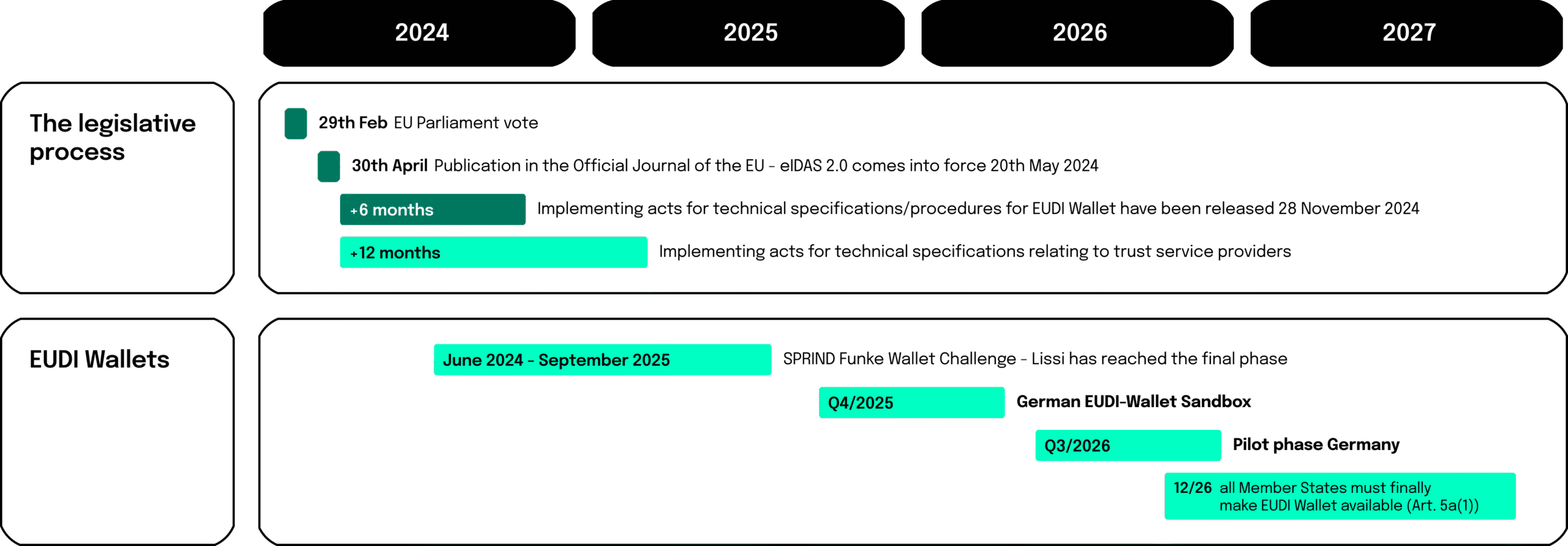

A Europe-wide obligation to accept digital identity is coming

However, before banks develop their own strategies, it is worth taking a look at the regulatory framework driving this development: the amended eIDAS 2.0 Regulation of 2024. It states that all countries in the European Economic Area – i.e., the EU plus Iceland, Liechtenstein, and Norway – must offer their citizens a EU Digital Identity Wallet by the end of 2026 at the latest.

It is important to understand that there is no single EUDI wallet. Each country provides one or more wallets that are based on the same European standards but take into account the different existing identity systems. Their use remains voluntary for consumers, who can continue to identify themselves as usual with their ID card.

However, public authorities, administrations, and financial institutions will be required to accept them; public authorities from next year, and financial institutions from December 2027.

The EUDIW comes at the right time

This obligation to accept the EUDIW is already driving innovation: unlike when the German eID was introduced 15 years ago, this obligation is ensuring that many companies are already developing specific use cases. In addition, the German government will introduce a sandbox – a test environment – this year in which financial institutions and other private companies can experiment with the EUDIW. When the European wallet becomes available next year, there will already be numerous possible uses on the supply side.

According to the Max Planck Society, only one-third of the German population currently uses eID. Other EU countries, on the other hand, are already very far ahead: Belgium introduced itsme in 2019, Sweden launched its BankID all the way back in 2003. In both countries, citizens use those digital identity several times a day. Additionally, identity wallets are also on the rise internationally.

Now the EU is also pushing the topic, and the timing couldn’t be better considering how AI is increasingly being used to create deepfakes, making it easier than ever to manipulate identities. In addition, there are a long list of use cases in the public and private sectors where reliable identification is important: for example, when dealing with government agencies, for the sale of alcohol, or for age-restricted online content in gaming, streaming, or social media.

Why financial institutions urgently need to address digital identity

It is also clear that if financial institutions wait until they are forced to comply with EUDIW from December 2027, there will be fintech competitors who are already far ahead of them at that point.

If the competitive advantage is not enough of an argument for addressing this issue, let’s take a look at what EUDIW actually means for banks. First of all, it is primarily used to validate identifications within the framework of Know Your Customer (KYC). However, it also serves, for example, for authentication in online banking or when concluding contracts and signing documents. Opening an account is much faster thanks to immediate, seamless identity verification, while costs are significantly lower. Identification with the wallet is many times cheaper than VideoIdent, for example.

At the same time, the EUDI wallet enables electronic retrieval of additional documents (e.g., tax certificates, registration information) in an interoperable EU-wide system. This greatly simplifies onboarding processes for banks. If payments via the wallet also become possible in the future—which is currently being tested—this will further increase customer loyalty.

In addition, the EUDI wallet offers a possible solution to a problem that is becoming increasingly serious for banks: there are more and more cases of fraud, database hacks, and deepfake fraud. Identity systems are evolving toward so-called zero-trust systems: to avoid fraud, no one is trusted anymore, not even one’s own databases. Customers already have to authenticate themselves repeatedly, often via facial scanning, but in the age of deepfakes, institutions can no longer trust even that. This is where EUDIW comes in, because with the help of wallets, authentication works with modern cryptography.

And last but not least, banks should take note when it comes to compliance: if they are not prepared in time for the mandatory integration of the EUDI wallet, they will simply be non-compliant from the end of 2027.

Germany's leading role from research to implementation

We are very passionate about this topic, as neosfer has a special relationship with the EUDI wallet: As part of our innovation work, the Lissi product was created in 2019 – Lissi GmbH was then spun off in 2023 with the vision of becoming the leading software provider for trustworthy interactions between organizations and EUDI Wallet users. Lissi also led the IDunion research project funded by the German Federal Ministry of Economics, which laid important foundations for the protocols and trust mechanisms of the EUDI wallet. Today, the team supports banks, companies, and public authorities in integrating the wallet into their systems at an early stage, thus enabling them to take the step into practice.

Germany plays a central role in the EUDIW research process: many of the wallet’s technical concepts were developed in this country and tested in pilot projects with partners such as Bosch, Siemens, the Technical University of Berlin, and the Bundesdruckerei. To ensure high security standards for the wallets, the Federal Office for Information Security (BSI) is also actively involved in the development of the wallet, thereby helping to shape security standards for the whole of Europe. This clearly positions the German research landscape as one of the pioneers of secure, Europe-wide digital identity.

Challenges on the path to wallet reality

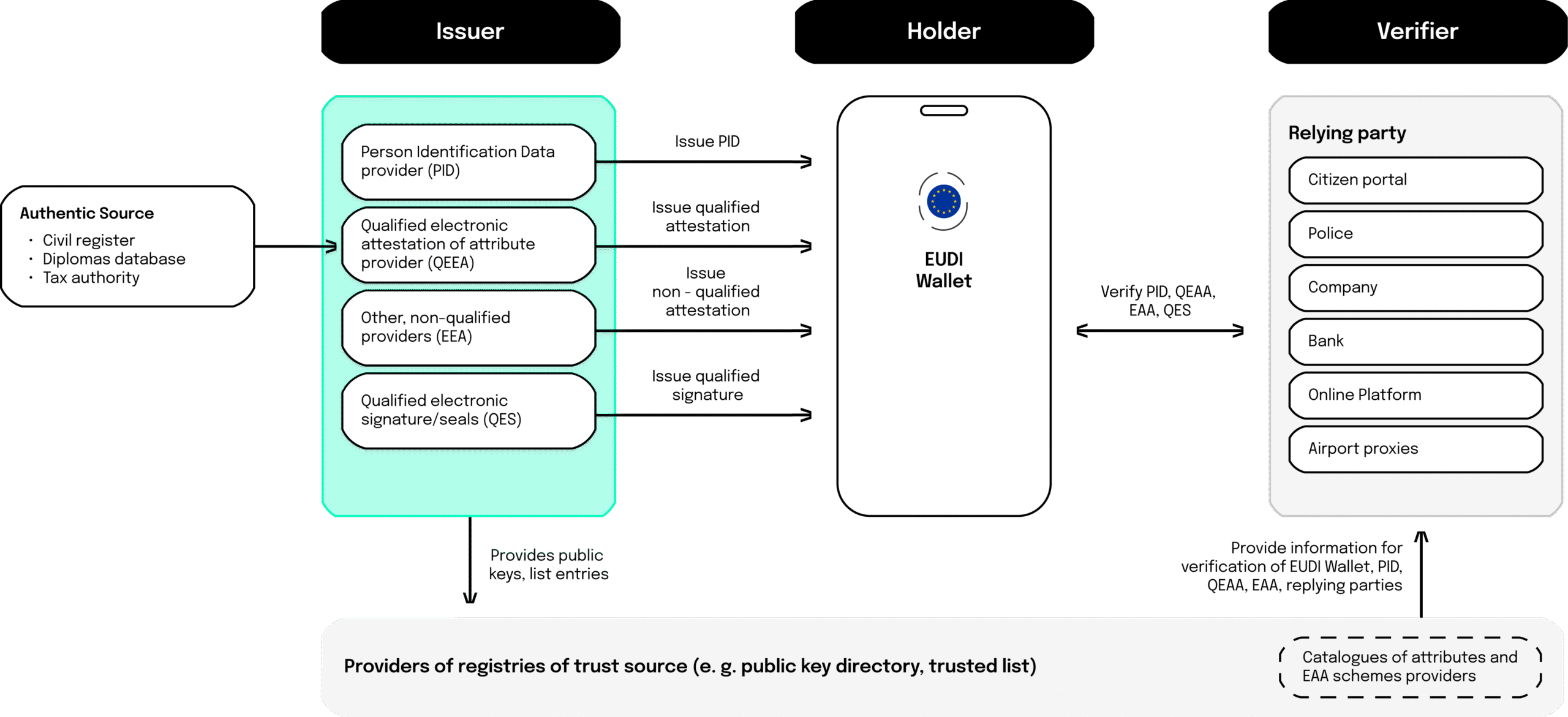

Following the development and research phase, the actual implementation is now beginning, involving three stakeholder groups: issuers such as public authorities or banks, which provide digital credentials; citizens, who store these credentials in their wallets; and acceptance points – such as companies or administrations – which verify them and use them for their processes.

To ensure that this works smoothly, existing IT systems must be adapted so that they can communicate with the wallet ecosystem. At the same time, the protection of sensitive data, secure communication, encryption, cryptographic procedures, and protection against attacks must be ensured. Since the wallets have national specifications, individual adaptation to the respective country-specific wallets is also necessary. A whole new ecosystem of specialized providers is emerging around EUDIW, including Lissi, which significantly simplifies the implementation process for companies: With ready-made interfaces and connectors, banks and authorities can integrate the wallet without major development effort.

In addition to the purely technical challenges, there are also organizational ones: Internal business processes and use cases need to be rethought, for example, how onboarding works via wallet or how data transmission and verification should take place.

Looking ahead

EUDIW is at the heart of the EU’s digital agenda. This is also reflected in the digital goals for the entire decade, which were presented in 2021: These state that 100 percent of citizens should have a digital ID by 2030. The conditions for this are currently being created, and the scope of the EUDIW project is comparable to the introduction of the euro.

In the medium term, the EU wants to turn the wallet into a kind of Swiss Army knife that goes far beyond traditional proof of identity. Driver’s licenses and university degrees are also to be stored in the wallet (as well as many other use cases), and there are already pilot projects to use EUDIW for payment transactions. In the long term, the EU’s vision is that EUDIW will eventually be usable beyond the borders of the EU.

First, however, digital identity still has a few hurdles to overcome before it can achieve 100 percent penetration. At present, the private sector and the financial sector are open and motivated, but public administrations and local authorities often lack resources, clear guidelines, and a central platform. There is an urgent need for support from the Federal Ministry for Digital Transformation in this area in the coming year.

While the public sector still needs to create structures, banks could already demonstrate that they have recognized the signs of the times. This is not their first major technical change in this century, with PSD2 being a notable example. Hopefully, German financial institutions will soon finally understand the significance of European digital identity: those who continue to put off addressing this issue risk not only competitive disadvantages, but simply non-compliance. By 2027 at the latest, all banks must support the wallet – and they shouldn’t just be getting started when the regulators are already knocking on the door. In short: It’s about time!

| Tip: You can try out an initial demo of the wallet on the Lissi-Website! |

More about digital Identity and Innovation!