Autumn has begun, and in October Between the Towers focused on important topics and exciting insights into the future of the financial sector. Experts shared their perspectives to show what impact new regulatory frameworks on open banking, FIDA and the like will have on banks and financial service providers and what innovations open banking offers.

PSD3, PSR, FIDA - meaning + comparison with PSD2 | Lorena Haist & Andreas Reuß, Deloitte Consulting

PSD3, PSR and FIDA are intended to create the necessary conditions for Open Finance and Open Banking and their APIS. Emphasize this Lorena Haist and Andreas Reuß, Deloitte Consulting very clearly in her presentation.

PSD2 alone did not achieve this, hence the new regulations as standard. What does this mean for banks, third-party providers and financial service providers? Clearly, they need to position themselves today and think about the role they want to play. Even if there is still time before the regulations come into force.

Watch the video to find out what changes will affect the industry and what opportunities this offers for payment transactions, the financial sector and financial data.

Open Finance - The most important use cases for payments | Carsten Muerl, Mastercard Germany

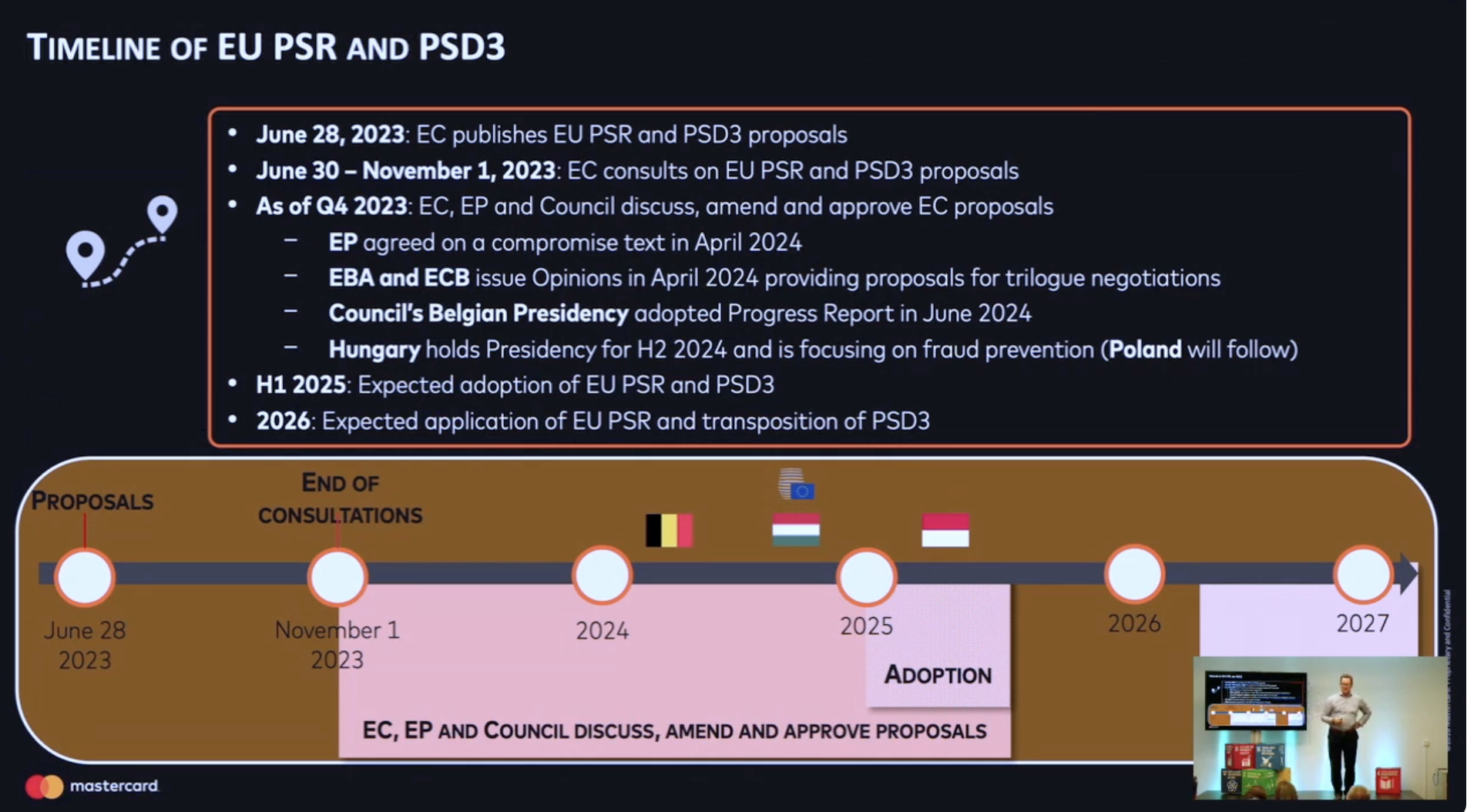

PSD3, PSR and FIDA will affect banks and financial services in different ways. Major financial service providers such as Mastercard are affected. How the major payment service provider is looking at the upcoming innovative developments is presented here by Carsten Muerl, Mastercard in his presentation.

An important point is the issue of liability for customer transactions and data. The new regulations and interfaces will make banks much more liable. The excuse “The customer should have recognized that” will no longer apply in the same way. Financial institutions must, for example, make greater use of innovative technical means to prevent phishing and other cyber fraud and protect consumers and their bank accounts.

You can find out more about the practical applications of the new regulations in his presentation.

Is the open banking breakthrough coming? Advantages and disadvantages of open banking | Discussion round

Matthias Lais (neosfer) discusses together with Andreas Reuß, Deloitte and Carsten Muerl, Mastercard about the future of open banking.

Many are hoping that new regulations – PSD3, PSR and FIDA – will lead to a breakthrough for open banking in payments. Is this realistic?

In the discussion, the participants explain how Germany compares internationally and which players in Germany are best placed to drive the topic forward innovatively. Carsten and Andreas also make it clear right at the start that there is not much more to be done about the general direction of regulation – at least on the part of the banks.

So enough time for them to prepare for what’s to come?

Would you like to be part of our next “Between the Towers”? Then we look forward to meeting you! Every first Tuesday of the month, we talk about all the topics that move the finance and tech scene. For each edition, we invite experts from the industry and discuss a focus topic. Afterwards, there is plenty of opportunity to network over snacks and drinks. Participation is of course free of charge.

Fancy more input on open banking, banking and regulation?