The fascinating world of generative AI in the financial sector: from pioneering developments at OpenAI to concrete applications. A look at current trends, innovative prototypes and the wait-and-see attitude of banks and fintechs. And why now is the time to not only utilize AI, but to actively shape the future!

Generative AI in Banking: Between Hype and Reality

Generative AI - a trending topic with great potential

Generative AI has been the dominant topic of the past year and events have come thick and fast. The chronology can be confidently divided into “before generative AI” and “since generative AI”. The US research company OpenAI marked a turning point on November 30, 2022, when it published ChatGPT. The subsequent development exceeded all expectations: Just two months after its launch, what is now the world’s most famous chatbot had already reached around 100 million monthly active users, making it the fastest-growing consumer application in the history of the internet, according to a study by UBS.

The results of ChatGPT were nothing less than astounding. If they hadn’t already done so, companies began to take a hopeful look at generative AI.

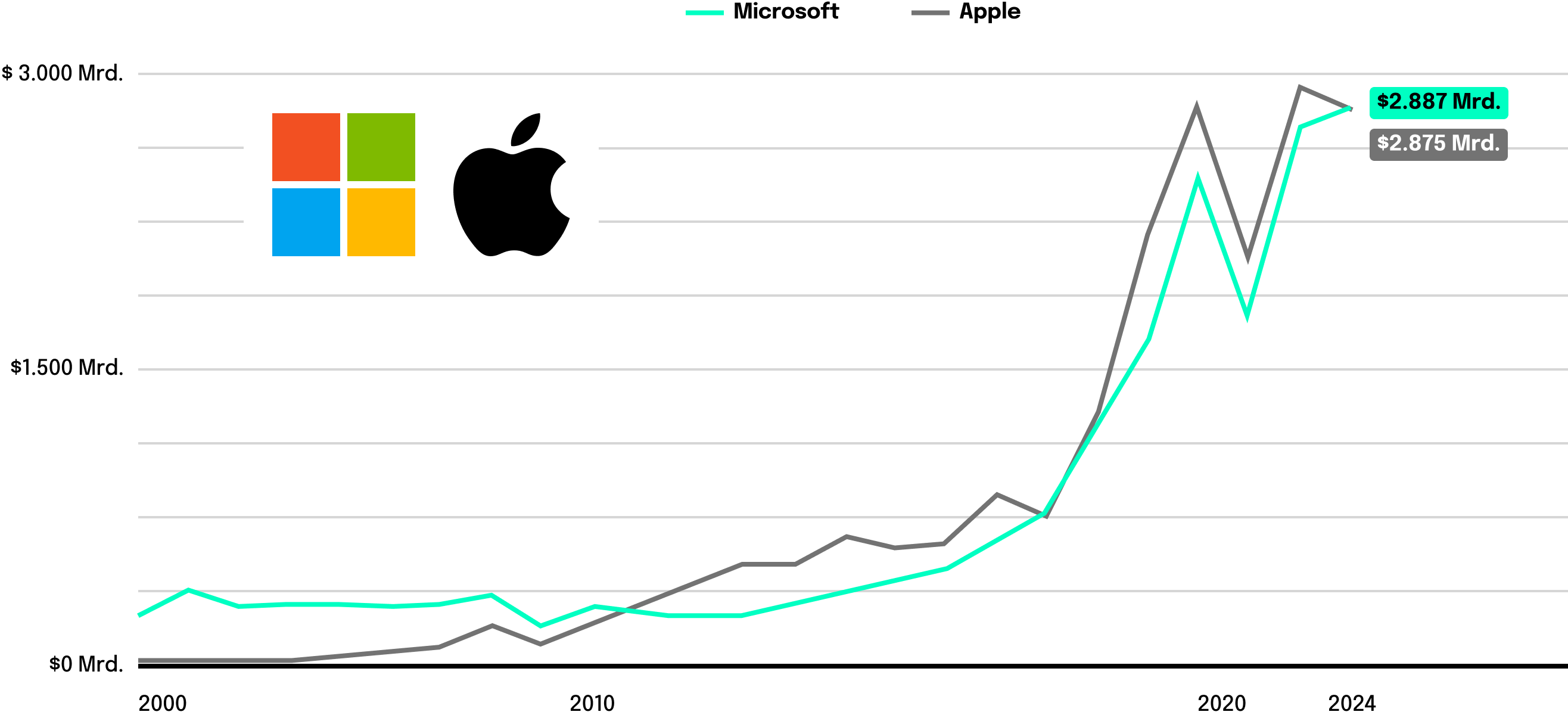

For Microsoft, these hopes have already been fulfilled: In January 2024, the technology giant overtook its long-standing competitor Apple in terms of market valuation. A development that is clearly attributable to Microsoft’s pioneering role in the field of generative AI. The company has positioned itself extremely well by investing in OpenAI at an early stage and is already successfully integrating ChatGPT’s LLM (Large Language Model, a highly developed algorithm that can understand and generate text) into its Bing search and the “Copilot” AI assistant within its OS.

OpenAI and Microsoft were the biggest, but by no means the only major companies to make waves with generative AI in 2023: Google also launched its own chatbot called Bard in the summer and followed this up with its generative AI Gemini in December. So far, Apple has not come up with anything new in this regard. However, rumors are circulating that many people are already working on this topic. And anyone familiar with Apple’s approach to new technologies knows that the company often waits and then causes a stir with a big surprise.

My personal tip: You should follow Apple’s WWDC developer conference very closely this year.

Generative AI examples from the banking world

In the financial sector as well, generative AI was the subject of intense discussion. A veritable gold-rush atmosphere spread. However, when viewed with a more objective perspective, tangible progress in the banking sector has been relatively modest thus far. Nonetheless, I’d like to emphasize two noteworthy examples:

(1) Erste Bank’s Financial Health Prototype: an interesting example of a prototype. Erste Bank, a savings bank from Austria, has developed a customer chatbot with AI, combining ChatGPT with expertise from both the website and the bank. The result is already pretty good and shows where the journey of generative AI might lead.

(2) Morgan Stanley’s chatbot for wealthy private clients: Morgan Stanley is moving in a similar direction with its chatbot for employees. The bank has been working with OpenAI since the summer of 2022 and has made notable progress. In this case, generative AI is not only being tested, but has long been operational in the day to day business. Use cases include summarizing advisory meetings, sending follow-up emails, updating the customer database and supporting advisors in managing complex assets in areas such as taxes, pensions and inheritance. This is a great example of how deeply generative AI can be integrated into a bank’s value creation processes as a technology. This project could serve as a blueprint for the entire industry! (You can read more about this case in this article in English or this one in German).

In my opinion, however, such examples are still rather rare. To a certain extent, this is understandable: Banks tend to only introduce technological innovations reluctantly. After all, their end customers’ trust – the highest good – is at stake. Therefore, they are largely waiting to see how generative AI is received and how it will be regulated. It seems that no one wants to be the first to introduce a ground-breaking AI innovation.

Fintechs and investors in a waiting position

It is noteworthy that it is not only established banks that remain in this wait-and-see position. The same goes for fintech companies such as neobanks, which actually address target groups with a much higher affinity for technology. It is reported that they are waiting for the “AI Act”, i.e. the European Union’s law on the regulation of artificial intelligence, to gain clarity on what will and won’t be allowed.

Generative AI has not yet triggered any hype among fintech investors. They were already working with artificial intelligence before ChatGPT, mainly with predictive AI in connection with fraud detection, investment decisions or risk assessment. Both generative and predictive AI are now being used by start-ups, albeit as a function rather than a product. This is because AI still makes mistakes which is particularly painful because in banking, customers’ money is at stake.

Once again the question is: Product or function? After years or even decades of digitalization, we have realized that financial technology innovations do not necessarily have the potential to sustain an entirely independent start-up. Instead, these innovations rather find their way to the customer as a function integrated within a larger product or portfolio of established players. That is why – in times of AI-washing and funding crises – founders must face this question head on.

Research & development on Generative AI at neosfer

We at neosfer have been dealing with the topic of artificial intelligence since before the hype surrounding generative AI began. After all, there were already exciting AI use cases in banking before that. Yet, like many others in 2023, we have asked ourselves how this new technology’s potential can be realized and what new use cases there might be. We used our structured innovation process to approach this challenge.

At Commerzbank, a list of more than 200 ideas was created with input from all business units. A particularly large number came from the areas of customer service, software development, risk and marketing.

Prototypes were then developed based on this list. We worked on these with a small, powerful team of developers – each in six weeks. Of course, we could have dedicated much more time to each prototype. However, they are all deliberately limited in terms of their function and scope, as our main aim is to gather experience. The six-week sprints may or may not result in usable solutions. Either way, for us as an innovation unit these prototypes help to raise awareness among our colleagues at Commerzbank of what is already possible with generative AI.

I would like to present three of these prototypes below.

Case #1 – Knowledge Retrieval

Software developers can ask questions in the style of ChatGPT. The whole thing is connected to an internal knowledge database for developers. Of course, this database is searchable, but after many years it is also expectedly complex and difficult to understand. The prototype accesses this database to answer questions and displays them in a comprehensible form.

Case #2 – Customer Chatbot

We developed another prototype in the area of customer service, where a chatbot was already in use. However, this was developed before the hype surrounding generative AI. In 2023, we created a chatbot with generative AI which afforded us a direct comparison: The development time has been reduced from months to a week, and the team required has been reduced from several dozen to a single developer. This is possible because the new technology is so different. Previously, a chatbot had to be programmed to respond to certain keywords. It needed a database with predefined answers, so-called structured data. Thanks to generative AI, this is no longer necessary because even unstructured data can be captured with little programming knowledge. This significantly shortens the development time – incidentally in all of the prototypes mentioned here – and allows unprecedented speed.

Our prototype is not yet ready for use, but only a proof of concept that shows what is possible. Sometimes, however, this is precisely our task as an innovation unit.

Colleagues at Commerzbank are also working on a chatbot, albeit not as a prototype, but for regular operation. Here, artificial intelligence is combined with an avatar, i.e. a digital representation of a person as a graphic symbol or figure in a digital environment. Bank customers can ask the avatar questions in natural language, obtain general information and receive personalized advice. The banking avatar is being developed for mobile devices and is based on Microsoft’s technology. I think that Commerzbank is one of the first movers, even if I am of course biased in my assessment.

Case #3 – Sectoral Risk Analysis

Our third and most recent prototype was technologically more sophisticated: a sectoral risk analysis with generative AI. Sectoral risk analysis involves the assessment of risks in specific industries or economic sectors. The aim is to better understand sectoral challenges and prepare for them accordingly. For our parent company Commerzbank, this is of particular importance and to a certain extent routine.

Together with the responsible business unit at the bank, we have built a prototype with generative AI. Although AI-supported analyses had already been used here before, the fact that the input can now be unstructured is another game changer. The data comes from many different sources, from PDFs and Word documents to websites. And the end result is an analysis as if created by a human.

The prototype also provides its sources so that we can understand and check the results. We do this regularly with random samples. Whether it is required by regulation or not, it is important to us that we can trust the results. Next, we will train the tool with real data from the past to further improve its performance.

Conclusion: It's time to build

From my perspective as an employee of Commerzbank’s innovation unit, it is very important not to rely exclusively on acquiring technologies externally. Instead, I believe it is crucial to drive forward our own developments internally. This enables us to build up the necessary expertise ourselves in order to develop a comprehensive understanding of the technology. This is the only way we can deal with it effectively and implement our projects successfully.

Of course, we cannot do everything ourselves, nor is it necessary. Nevertheless, we need to understand how these key technologies work, even if third parties are involved.

In the famous words of tech investor Marc Andreessen: “It’s time to build”. They stem from an essay that attracted a lot of attention in the global tech scene. Andreessen published it in April 2020, at the beginning of the coronavirus pandemic. The text was full of his frustration and helplessness at how unprepared Western societies were in the face of the novel virus and its consequences. The start-up investor’s answer at the time: new things have to be built! This includes the healthcare sector, education and transport, far beyond the tech start-ups in which Marc Andreessen already invests.

It is precisely this call to build something new that is needed for generative AI. The technology is there. Let’s use it to realize new potential!

Want to find out more about generative AI? Here we tell you what artificial intelligence actually is and where it comes from. If you want to know how companies can use AI for positive impact, you’ll find it here.