At first glance, it seems obvious: when companies find themselves in economic difficulties, they often focus on short-term efficiency rather than long-term innovation management. In the tense economic situation of recent years, companies are increasingly taking this approach and risk harming themselves in the long term. We share our view of (corporate) innovation in 2024.

State of Corporate Innovation: On the importance of innovation management in challenging times

Current challenges and uncertainties in innovation management

This fall was an up and down season for the startup scene in Germany and everyone involved in innovation management: In September, the then still intact federal government had announced the WIN initiative; a comprehensive package of measures that was to improve the framework conditions for growth and innovation capital in Germany. The importance of promoting innovative strength in the country and the EU was explicitly emphasized. However, the end of the governing coalition has already put the first damper on these plans. Just a few weeks later, Handelsblatt reported that fewer and fewer investors are active in Germany – this year alone, the number has fallen by almost 40 percent.

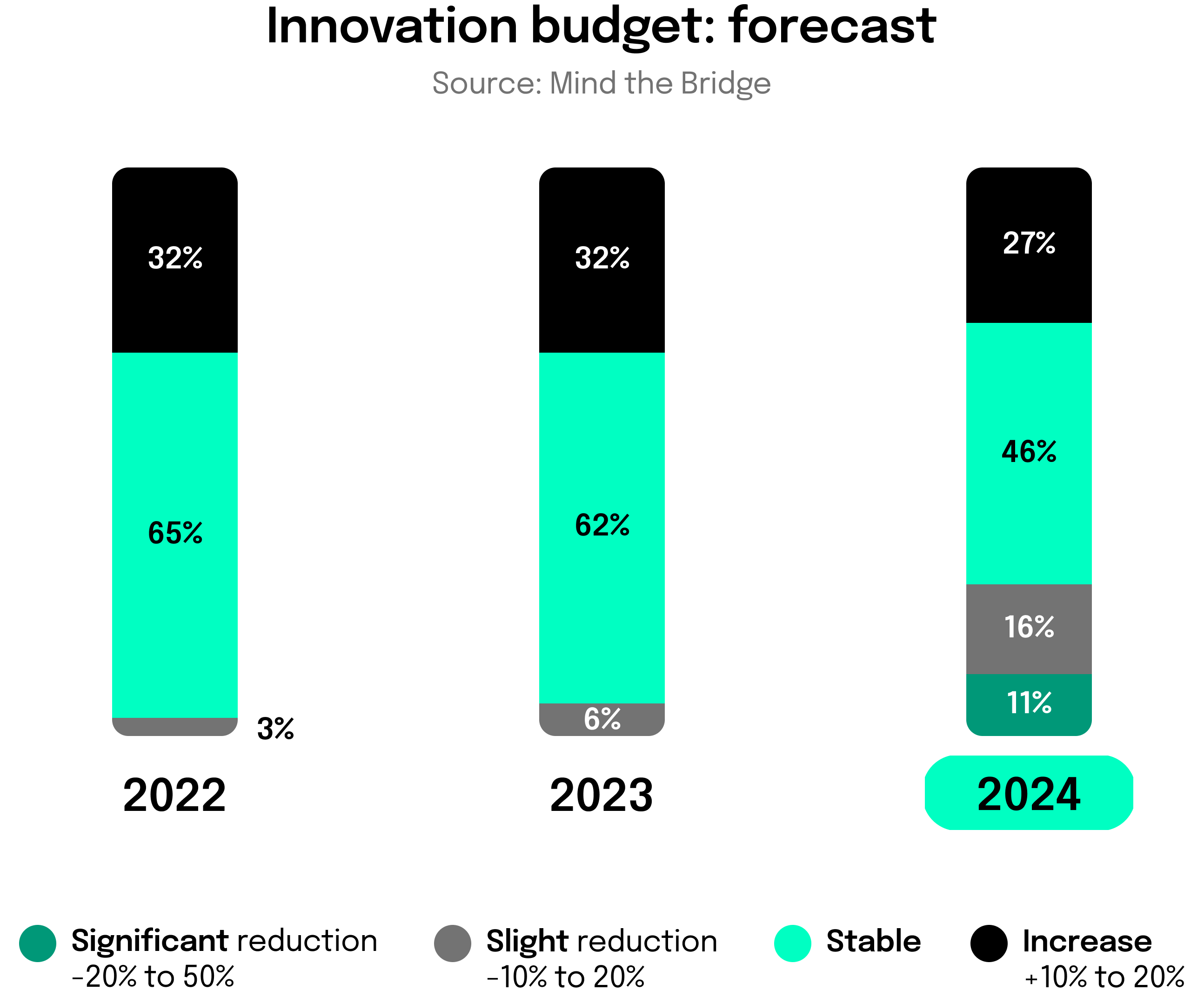

The result is a rather pessimistic mood regarding investments in innovation which also fits in with forecasts from 2023: In a preview for the new year, some companies already indicated that they intended to cut their innovation budget. This now seems to be confirmed. Time to talk about the importance of innovation again – even in uncertain economic times. Or perhaps precisely because of uncertain times.

The growing toolbox of innovation management

But what does corporate innovation even mean? Strategic innovation management or corporate innovation is the process of using a company’s existing resources, skills and infrastructure to explore and develop new business opportunities, products or services (exploration) and to optimize and redesign existing processes, products or business models (optimization). This includes both the implementation of new activities and the modification of existing processes in order to increase the degree of innovation and enhance the company’s value.

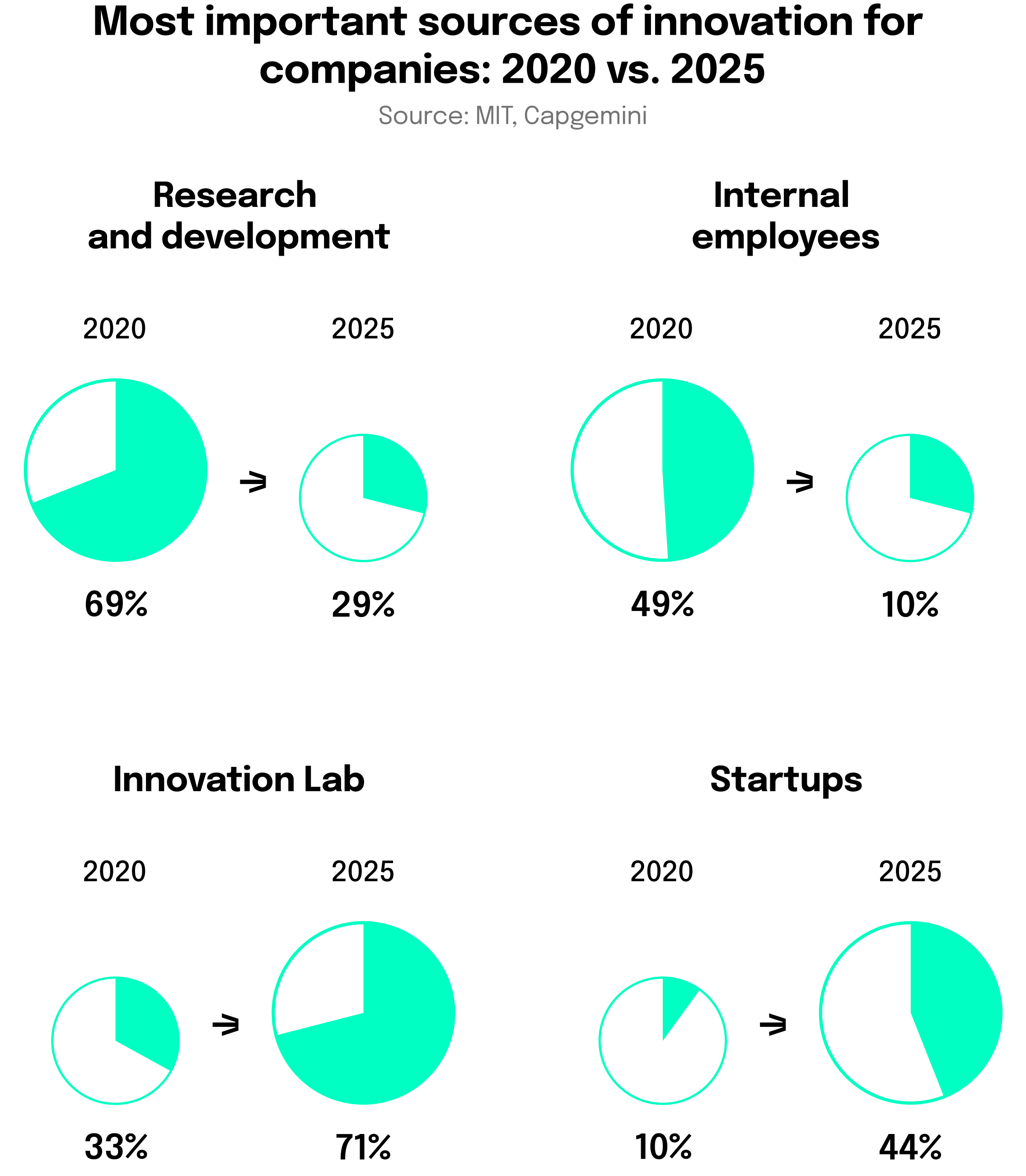

The importance of innovation is well known and has led to companies seeking many different ways to become more innovative over the past decades. They are also increasingly using innovation impulses that can be found outside their own company boundaries, keyword: open innovation. It seems that new open innovation approaches emerge almost every year to support the “incumbents” – the large established players – on their path to new products, offerings, etc. and, in the best case, to protect them from disruption.

At neosfer, we are strategically focused on exploration and use the instrument of corporate venture capital investments from the open innovation toolbox, among other things. We invest in early-stage start-ups, thus obtaining innovation impulses from outside and making them accessible to our parent company, Commerzbank. We are also a think tank and develop innovative concepts ourselves that we can make available to the Group and market.

External hurdles for innovation activities: Geopolitics and technological challenges

Rapid technological developments, as we have seen in recent years in particular, are a great opportunity – but also a challenge – for innovation work. Some companies seem to hope that artificial intelligence (AI) can solve all their innovation problems. This is of course illusory, especially as many large companies in this country are still dealing with their digital transformation. The resulting pressure of expectations on start-ups and innovation departments is therefore immense.

It goes without saying that the global situation is also affecting innovation management. There is general tension in Europe, triggered by geopolitical tensions and the recession following the Russian invasion in Ukraine. We are experiencing a fundamental fragmentation of the political landscape and society and are struggling with the global challenges of climate change.

All of this always has a direct impact on the actions of companies and their investment activities – and therefore also on their innovation management.

Internal stumbling blocks: Budget cuts and changing expectations

As already mentioned, this year we have seen that budgets for innovation have become tighter in many places. Innovation tools that cannot have a direct, measurable impact are being questioned in their right to exist, now more than ever.

In addition, we have seen a steady increase in the number of open innovation tools available in recent decades. Many large companies are doing well with integrating one or more of these tools and using them as precisely as possible. However, the multitude of options can be overwhelming for companies and, in the worst of cases, lead to them questioning innovation all together or even reducing activities as a result.

A strategic view of the meaningfulness and relevance of the use of open innovation tools is completely legitimate and fundamentally necessary. However, it is important to understand that there have to be different standards and expectations of innovation management compared to the core business. After all, innovation is a long-term investment that cannot (and should not) come up with the short-term results of the core business.

Nevertheless, it remains a familiar pattern that corporate innovation takes a back seat for many companies in economically difficult phases or in volatile global situations such as those we are currently experiencing. However, this is precisely when it is important for companies to develop further.

Strategies and solutions for sustainable innovation

If we look at the situation of innovation management in 2024, there are various options for innovation departments and units to respond to the changing approaches and expectations: One option is to use somewhat lower-risk strategies for investing in innovation, for example LP investments. This refers to limited partners, i.e. investors who provide their capital to funds that in turn invest in start-ups. This approach was increasingly observed among CVCs in 2024, who spread their risk through such investments. According to the motto: it is better to invest strategically in a broad technology sector or vertical than in individual start-ups.

It’s also possible to minimize your risk with another open innovation tool that is becoming increasingly important: venture clienting. It involved corporates becoming clients of startups and thus gaining access to their innovative solutions. This gives companies access to solutions for their identified needs or problems even without a direct investment in the startup. In the recent past, companies have increasingly decided to expand their open innovation activities with a unit dedicated to venture clienting or to choose this option as an entry into the world of startup collaboration.

Venture clienting is a sensible solution, especially in the current market conditions, and it is understandable that this tool is becoming increasingly popular. However, those responsible for innovation should also bear in mind that the initial development of solutions needs to be financed and supported, too. Corporate venture capital for early-stage startups plays a relevant role in the development of the startup landscape in general. After all, corporates can only engage in venture clienting if solutions are sufficiently developed to even be able to serve incumbents as customers.

Another way to streamline innovation management in difficult times is to align the work more with the strategies and goals of the parent company or client. Again, this is about demonstrating your own added value beyond hard KPIs and understanding how best to position yourself to make a greater contribution to the company’s goals.

If you are in the right position, this strategic alignment also means helping the company to understand what innovation means and that it requires freedom, flexibility and a long-term view rather than short-term metrics. I am convinced that good innovation management thrives through a continuous dialog. This is the only way to find out which tool fits a company’s strategic ambitions and goals, because not every measure is suitable for every company. Without constructive discussions, it can happen that expectations diverge too far and both sides end up losing out.

Conclusion: Innovation management as the key to securing the future

In principle, decision-makers should be aware of this at both corporate and economic level: Those who invest less money and/or attention in innovation in the current phase increase the long-term risk of losing market share and being outperformed by newer, more innovative players. The fact that this is already happening now also has to do with the fact that many companies tend to plan for the short term, but transformative innovation require a look at least five to ten years into the future.

At neosfer, we firmly believe that the financial services sector must transform and that we should continue to move towards digitalization and sustainability. Whether through the use of numerous strategic innovation tools or the targeted use of a few – staying innovative is the key to long-term connection and success.

Link tips

For more thoughts on the use of strategic innovation tools, I recommend these profiles:

Do you want to read more about innovation?