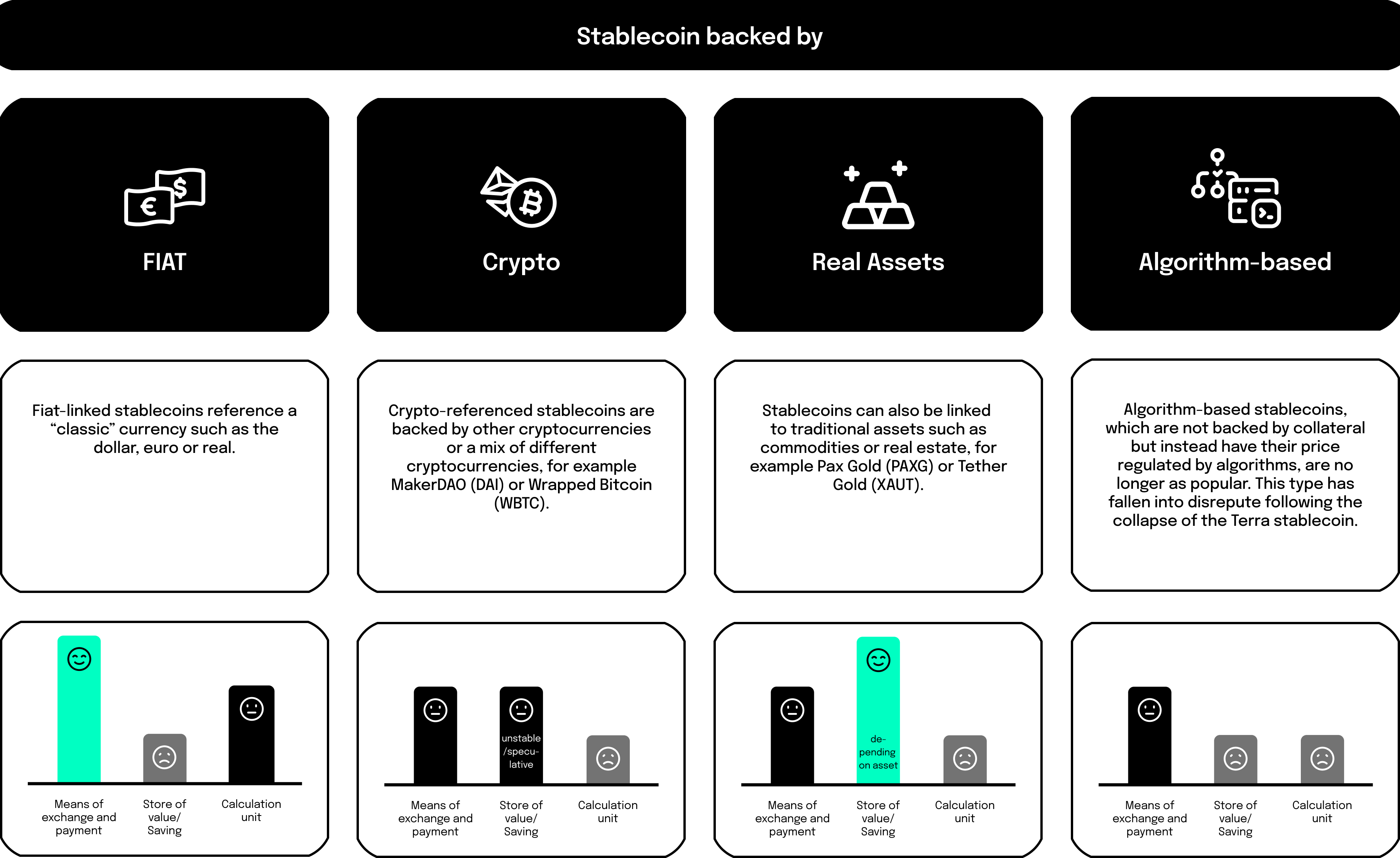

Just as there are differences and similarities between stablecoins and other cryptocurrencies, there are also differences and similarities between stablecoins and fiat money. Basically, the latter has three functions: It serves as a unit for counting and calculating (accounting), it is used to store value (saving) and is a universal medium of exchange (payment transactions).

Regarding the first function: Stablecoins are not really a separate unit of account, as their price is always directly linked to another. Since the EU regulation MiCAR, which came into force at the beginning of the year, it has also been clear that fiat-linked stablecoins are not (or no longer) suitable for saving or even speculating. Among other things, MiCAR prohibits incentives in the form of interest income, more on this below. Saving is only still a relevant function with some other types of stablecoins, see our chart.

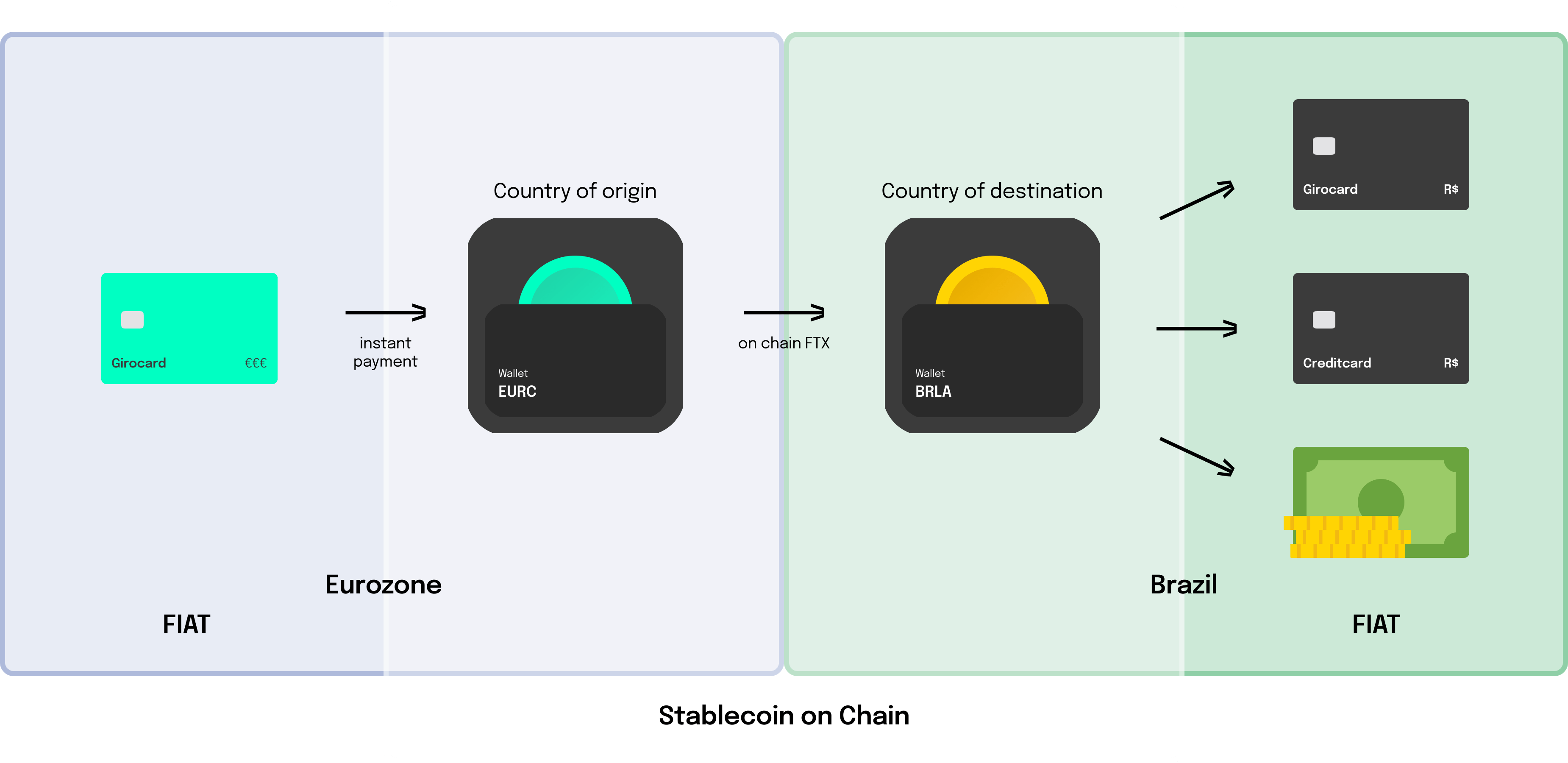

What remains is the function of the universal medium of exchange, and this is in fact the main purpose that stablecoins linked to fiat currencies have and should have. They are used in the short term and then converted back into other values. There are stablecoins that are converted several times a day and exchange hands. This shows how agile, simple and efficient a transfer with stablecoins is. Achieving a comparable speed with fiat money is hardly possible.