AI beats humans in many respects – lower training costs, simpler data collection, more precise evaluation of results, and much more. This is the basic message of Dr. Daniel Walther ‘s “pro AI” presentation.

Nevertheless, there are still areas where AI needs human support (for the time being). However, this is less due to the AI or the advisors, but rather to customer acceptance. When it comes to financial management, consumers are still happy to receive unautomated advice and refrain from implementing an AI strategy.

Actually, according to Daniel Walther, AI could already take over some applications in business processes today if enough resources were invested in this area. However, this is still happening too little. Insurance companies and banks have so far not stepped on the gas enough when it comes to AI innovations.

Is that changing now?

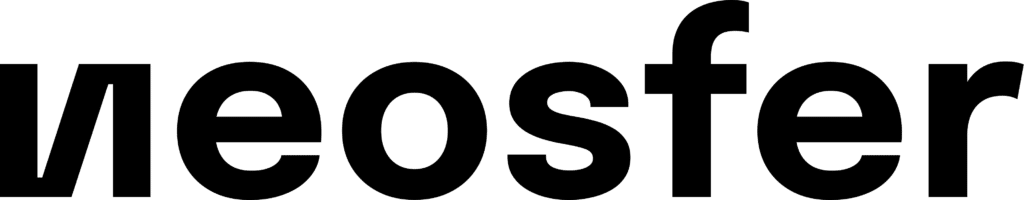

In the second presentation, it was then up to Fabian Behnke to respond to what had previously been said and to represent the “pro-human” side. He was able to point to impressive facts from Vanguard studies, e.g. that 93% of people would prefer human advice on financial matters in their own interest. This is not the case across all areas and advisory situations, but is particularly desirable in some processes, such as retirement issues or compassion for the current situation.

Another exciting aspect of the presentation: The studies found no difference between age groups! So, super-digital affine Gen-Z, virtual avatars can pack up after all?

Would you like to be part of our next “Between the Towers”? Then we look forward to meeting you! Every first Tuesday of the month, we talk about all the topics that move the finance and tech scene. For each edition, we invite experts from the industry and discuss a focus topic. Afterwards, there is plenty of opportunity to network over snacks and drinks. Participation is of course free of charge.

It is common knowledge that banks are reducing the number of branches, meaning there are fewer and fewer advisors and processes are being automated. Dr. Jan Linsin backed this up with figures in his report: there are now fewer than 20,000 branches in Germany, a strategic halving since 2007. The number of people employed in the banking industry is also falling sharply.

This is of course suboptimal for a real estate services and investment company like CBRE, because if the banks are gone and there is a risk of vacancies, that’s bad. So it’s all the better that new use cases are possible in old bank branches, such as co-working spaces, pop-up stores, parcel hubs and much more!

You can see all the new business models and possible uses for “old” bank branches again in the video!

Would you like to be part of our next “Between the Towers”? Then we look forward to meeting you! Every first Tuesday of the month, we talk about all the topics that move the finance and tech scene. For each edition, we invite experts from the industry and discuss a focus topic. Afterwards, there is plenty of opportunity to network over snacks and drinks. Participation is of course free of charge.