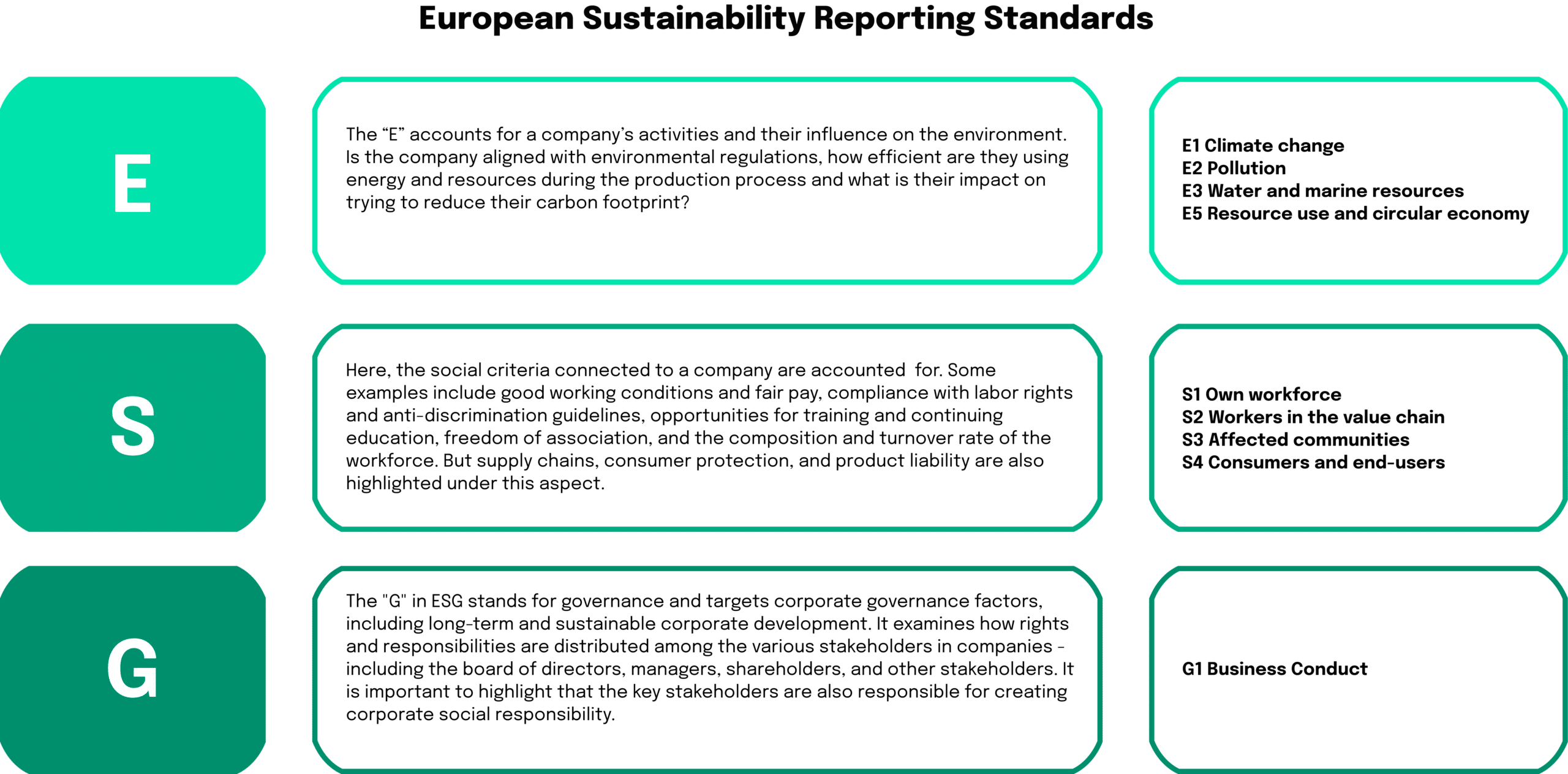

The first set of standards addresses two main concepts, namely double materiality and quality of information:

1. Double Materiality: Refers to the process of identifying all potential negative and positive impacts on society and the environment. This aspect is directly with a company’s operations and value chain.

- Impact materiality: Covers all environmental-related matters that are either affected by your business operations or impact your business. This includes carbon emissions, energy consumption, environmental footprint, among other dependencies. CSRD specifically emphasizes the primary environmental data from your value chain. Impact materiality also covers the approach to business ethics. This includes social considerations (working conditions, human rights, equal opportunities, etc.), value chain and overall company culture.

- Financial materiality: The second aspect of double materiality addresses the disclosure of all sustainability (ESG) issues that are likely to have a significant impact on your company’s financial and operational performance. To report upon the financial materiality, it is suggested to rely on non-monetary quantitative, monetary quantitative, or qualitative data. This is a particularly important aspect to investors.

2. Quality of information: Required standards on how you should ensure your sustainability information is of high quality (e.g., truthful representation, comparability, verifiability, etc.). Also explaining the standards for the general reporting and significant sub-topics. Some of the most critical sub-topics are climate change, workers in the value chain, general business conduct and environmental pollution. More generally, the standards can be structured into general, environmental, social and governance standards.

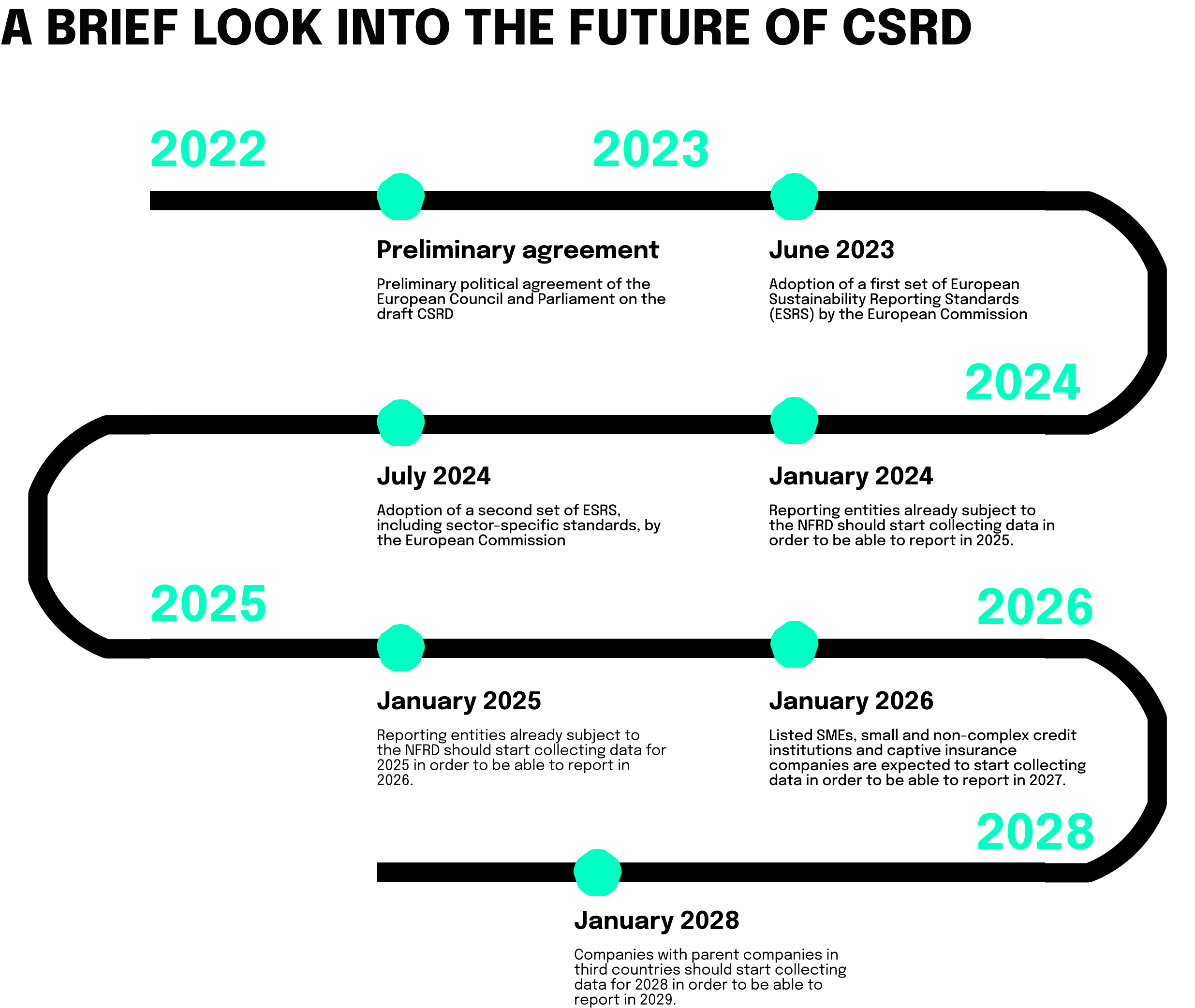

Consequently, the second set of standards will be adopted the following year, in 2024. The remaining conceptual guidelines go as follows:

- Connectivity: Anchor points to help companies connect financial reporting to sustainability reporting ad vise versa.

- Levels and boundaries of reporting: Assessment emphasizing the importance of the value chain in measuring and reporting social and environmental impact.

- Retrospective and forward-looking disclosures: Assessing sustainability targets and indicators set by companies, as well as the progress towards achieving them.

- Public good: Providing required standards for alignment and consistency between EU reporting standards and public policy agreements, goals, frameworks, and regulations.

- Anticipation of potential risks: This aspect refers to assessment of your adopted sustainability strategy and the current business model against the potential sustainability-related risks and climate scenarios. Under the scope of this requirement, the companies will be expected to address stakeholder engagement, strategy alignment with global climate targets, description of sustainability policies, governance processes, as well as the external and internal control and risk management.

Furthermore, the general ESRS outlined above will be complemented with sector-specific standards. Those mandatory industry-specific disclosures will apply to a broad range of sectors including IT, financial services, oil and gas, energy production and utilities, agriculture, pharmaceuticals among many others. The sector-specific standards will be developed by EFRAG over the course of 2023, and will be rolled out under the CSRD requirements by June 2024.

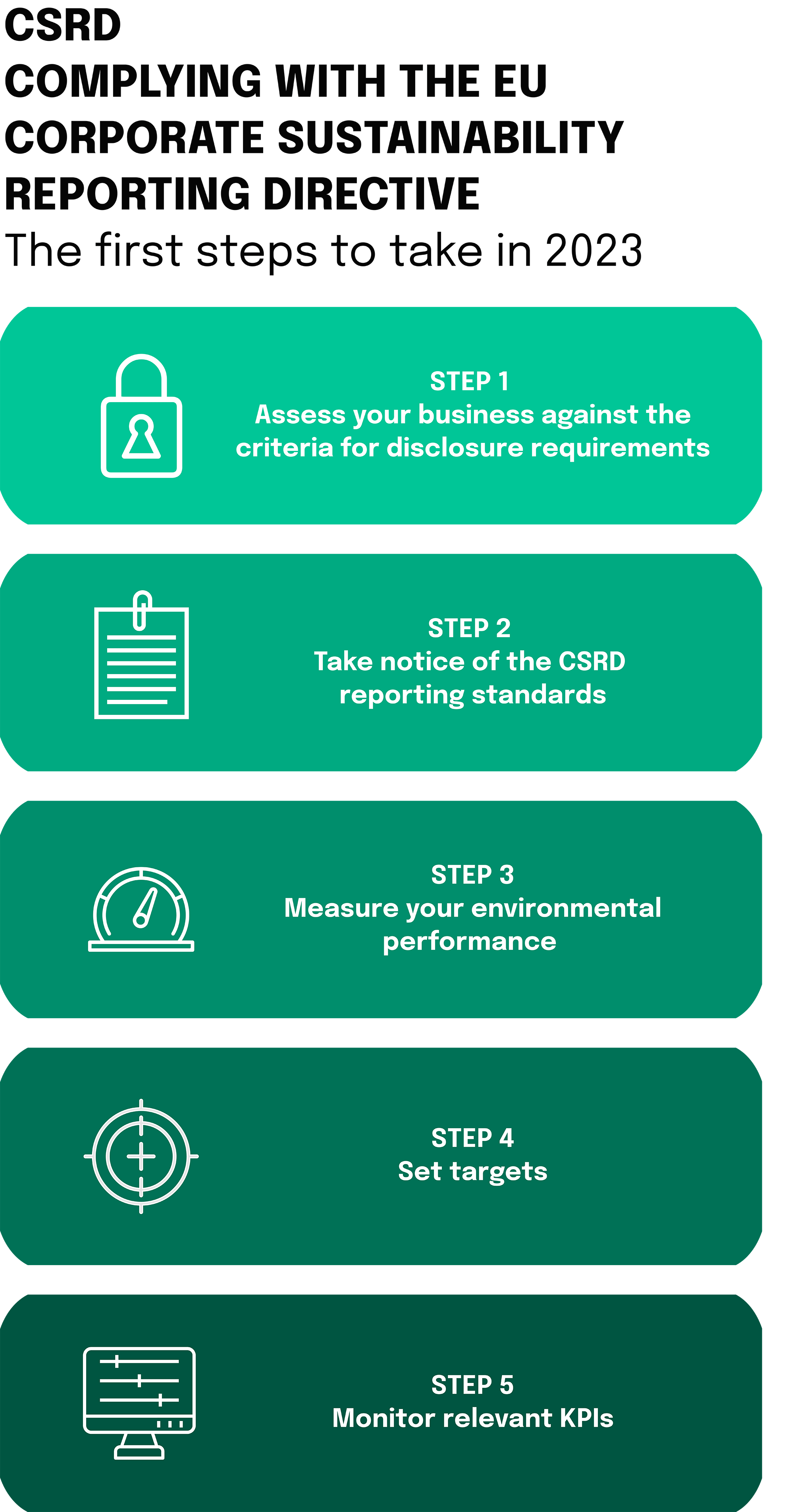

Step 3 — Measure your environmental performance

According to the CSRD proposal, it will follow the TCFD, which implies that the companies will have to report their emissions in compliance with Greenhouse Gas Protocol (GHG). However, as previously mentioned in the article, CSRD expands beyond climate alone. The directive follows EU Taxonomy, addressing the six criteria of that framework related to the information on the environmental impact. Therefore, a full environmental footprint of a company needs to be measured to accurately assess the full scope of impact. For that purpose, it is recommended to follow the scientific footprinting method of Life Cycle Assessments (LCA).

Step 4 — Set targets

Once you established a measurement system of your company’s footprint (e.g. GHG), it is time to define clear environmental reduction targets. Multiple aspects can be factored into this decision process. For instance, which part of your supply chain shows the biggest impact? Additionally, set targets on how to improve the social aspects of your business.

Step 5 — Monitor relevant KPIs

ESG reporting is a hallmark of the investment world, providing a framework by which potential investors can gauge a business’ inherent risks. ESG reports show the environmental, social and governance factors that may affect a company’s performance. These risks could range from the inability to attract workers to environmental impacts, which may draw ire from customers. By showing that your companies monitors and continuously improves upon the mentioned KPIs, you have the chance to convince investors on your performance, while also showing that you lower investment risks. To further monitor the progress, it is essential to identify the relevant KPIs connected to your environmental, economic, and social impacts:

Environmental KPIs

- CO2 emissions reduction

- Energy consumption

- Water usage

- Waste reduction

- Compliance with chemical safety requirements

- Compliance with environmental standards

- Number of suppliers audited against environmental standards

Social KPIs

- Compliance with Code of Conduct

- Compliance with UN global conduct

Share of suppliers audited against CSR standards

- Compliance with safety and security requirements

- Work-life balance, working hours

- People development, learning hours

- Community engagement, volunteering hours

- Share of diverse suppliers in the supply base

- Share of suppliers that filled in self-assessment questionnaire (SAQ)

- Diversity, equity, and inclusion (DEI) survey result

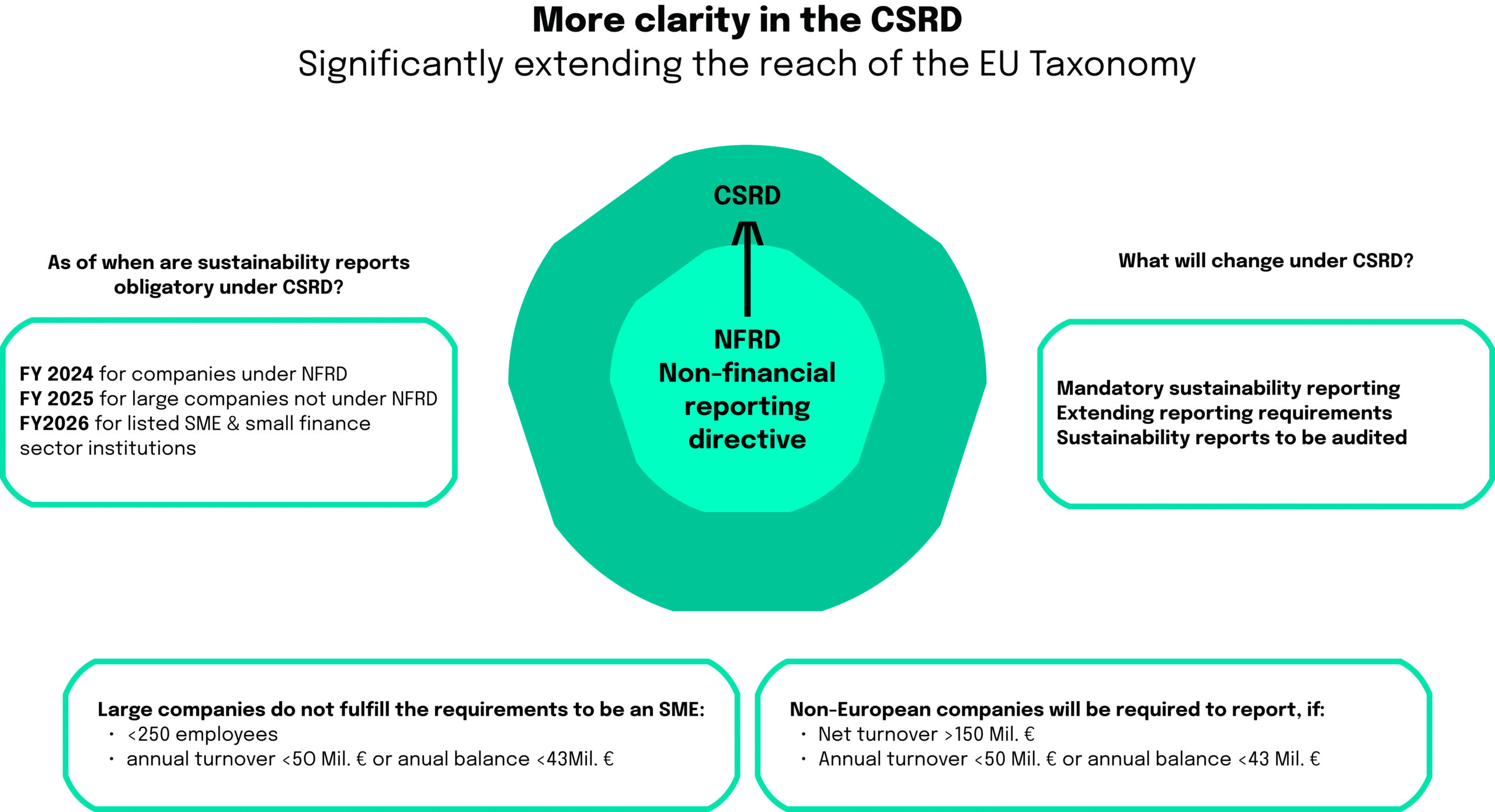

However, after aligning the reporting practices with the CSRD, this is only the start! With the following graphic, we highlight how CSRD affects company reporting practices for the next five years.