The EU taxonomy at a glance

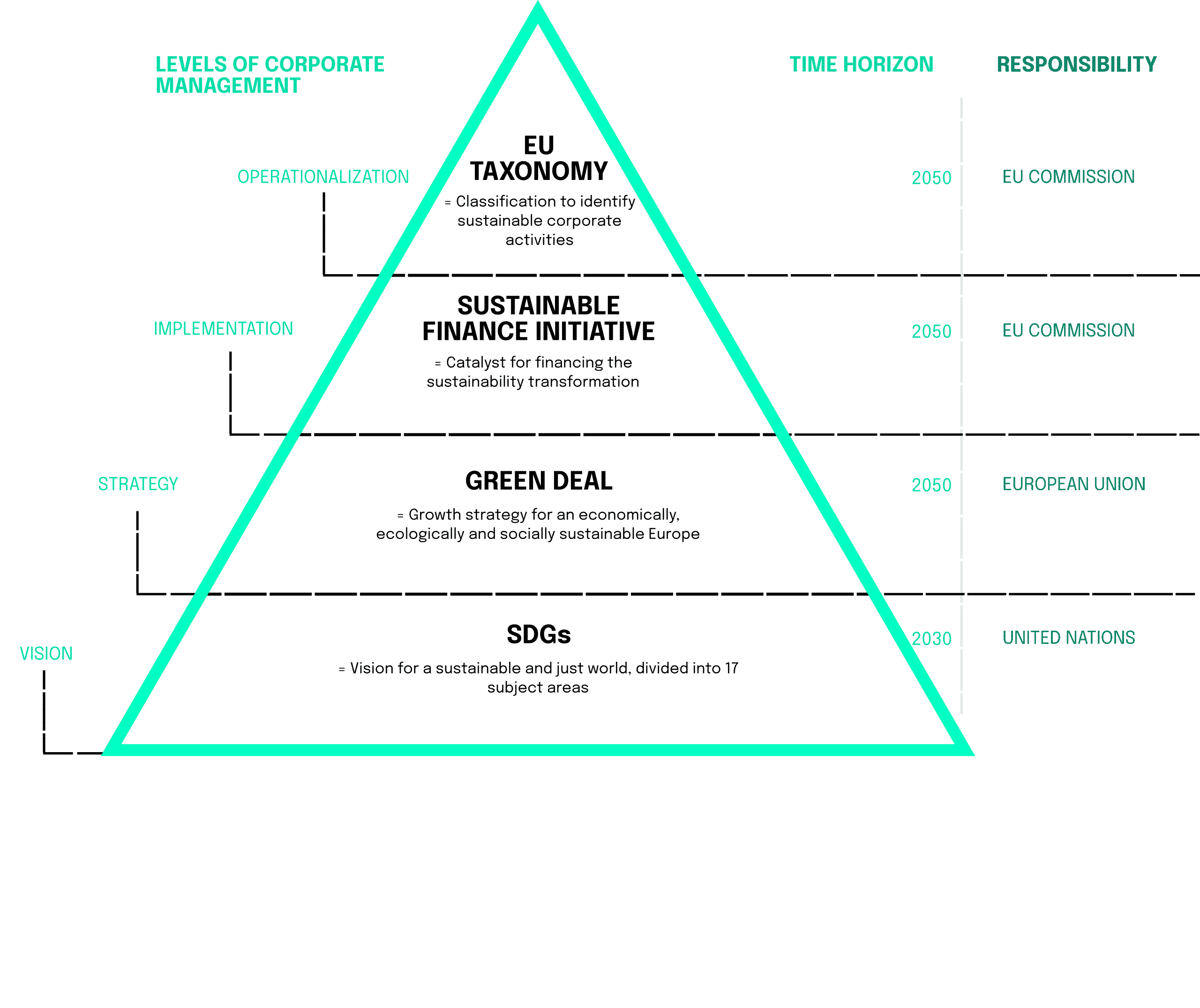

The European Union plays a proactive role in the global response to increased financial instability and recession. It has established a Taxonomy for Financial Regulation which allows a more sustainable approach to regulation and the prevention of regulatory arbitrage. The EU Taxonomy seeks to establish a common strategy to financial regulation at both the European and international level.

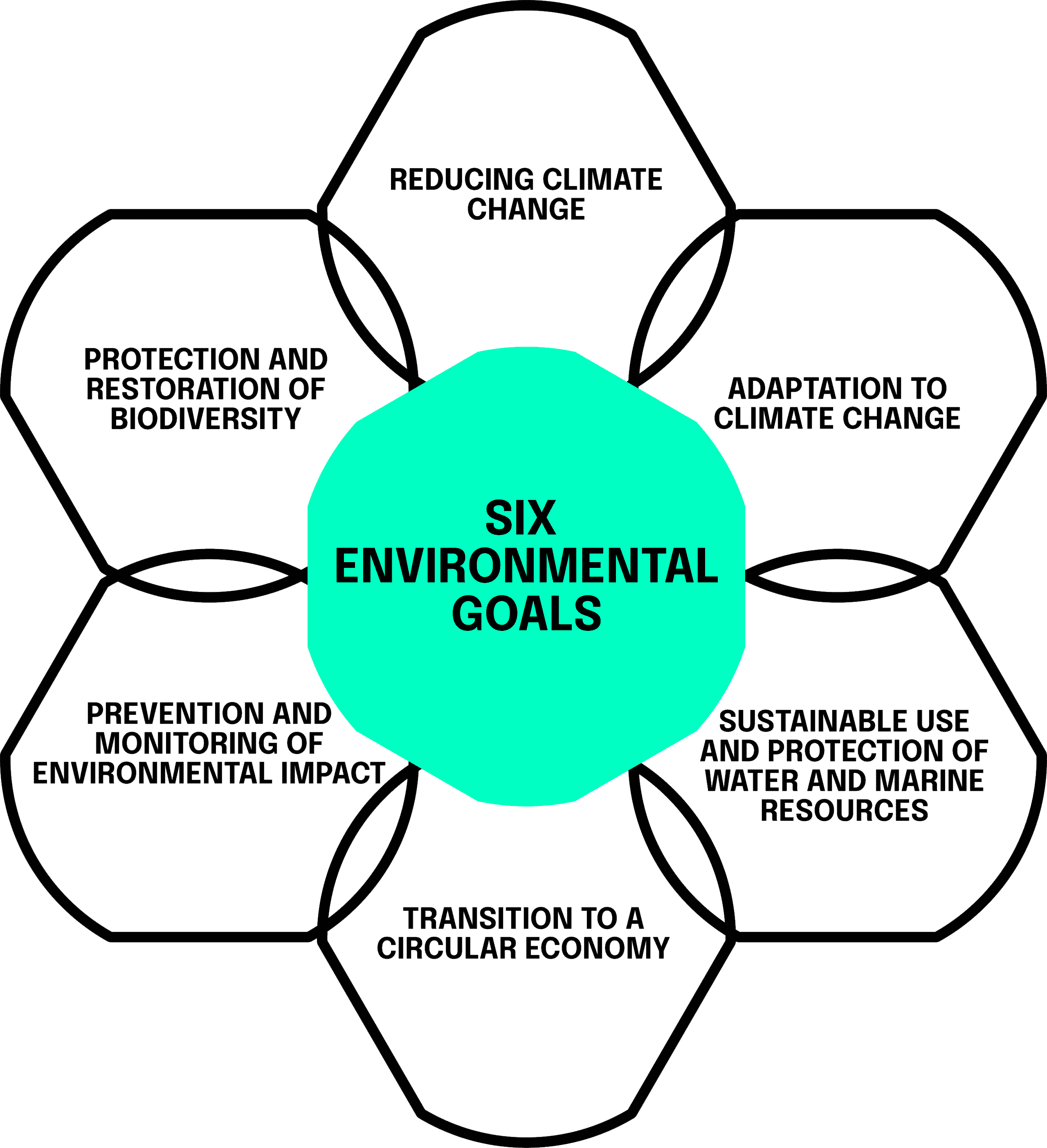

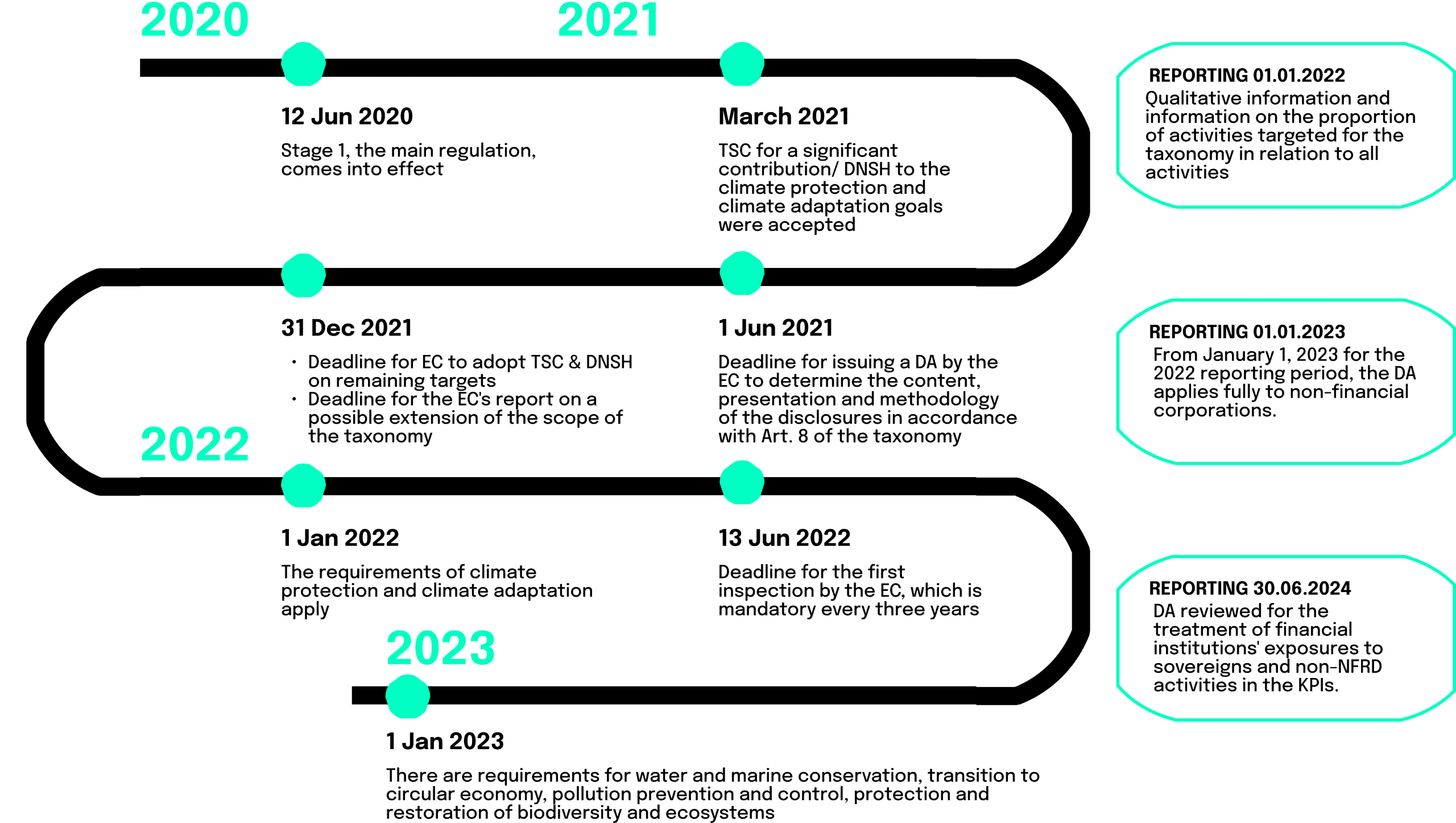

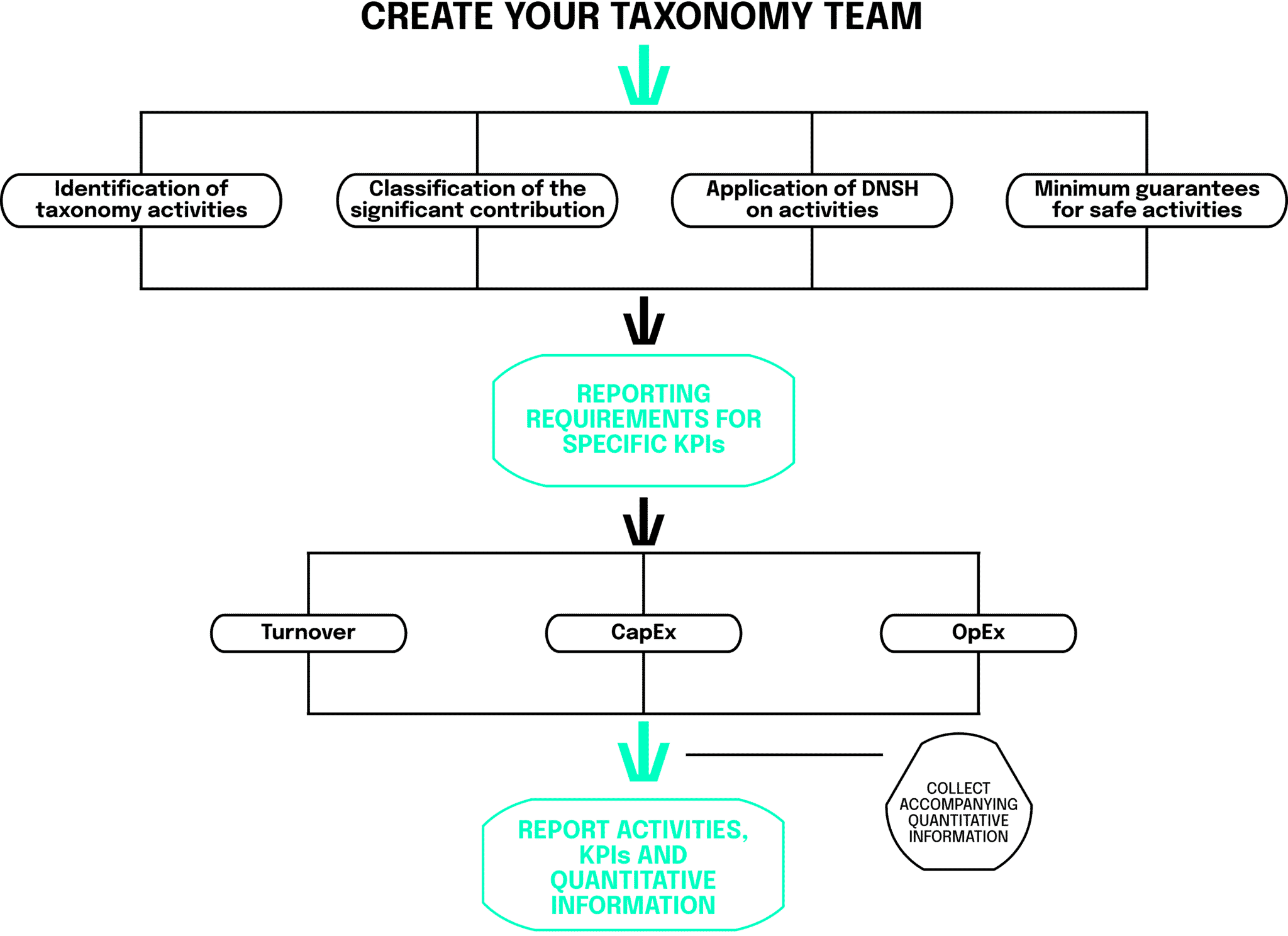

It offers a framework for higher quality, more efficient regulation by reducing regulatory arbitrage opportunities. Similar frameworks ha been used successfully to regulate the financial industry across regions and in the context of global regulatory reform. The Taxonomy is designed to support the EU’s 2020 climate-neutrality target and the European Green Deal objectives. It provides companies, capital markets, and policymakers with clarity about which economic activities are sustainable. In addition to supporting investment flows into those activities, it serves as a screening tool. It aims to connect large and listed companies with financial institutions and the European financial market. Therefore, it is considered to be a key piece to transforming the sustainable finance landscape in the EU. In this article will we present a strategy of how financial organizations can comply with the Taxonomy in eight steps. This strategy was first established by a company called Ecobio Manager, and we will use their insights and strategies to explain and structure a compliance process.