- Kyoto Protocol (1997/2005)

Until about ten to fifteen years ago there were various facets that had not been considered holistically from an environmental, social, and governmental view. One big factor therefore lies in the Kyoto Protocol which was adopted in 1997 and entered into force in 2005. The main goal of the protocol is to reduce global warming by reducing greenhouse gas concentrations in the atmosphere to “a level that would prevent dangerous anthropogenic interference with the climate system” (Article 2).

Starting here, the European Union (EU) has embarked on a transformative journey towards achieving sustainable regulation — a path characterized by a sequence of remarkable milestones. These milestones reflect the more widespread acknowledgment that sustainability holds pivotal significance not only for the environment but for economic advancement as well. As we dive into the timeline of the pivotal points in the sustainable regulation landscape, it becomes evident that sustainability has evolved from a peripheral concern to a central pillar, shaping the intricate balance between progress and preservation within the EU.

- The Non-Financial Reporting Directive (2014)

The demand for non-financial disclosure regulations has been rapidly growing over the past few years. Consequently, the Non-Financial Reporting Directive (NFRD) was born from this need.

The directive has been incorporated into national legislation by all 28 of the EU’s member states as of 2018 and has two main goals: 1) to urge corporations to take responsibility for social and environmental issues and 2) to make non-financial information available to stakeholders and investors for assessing the companies’ value creation and risks.

Has it been a success? Well, the Global Insights report from 2013 to 2018 shows that there has been a 72% increase in the number of non-financial disclosures. Over the past few years more regulations were adapted, and the NFRD is now one of over 4,000 different global disclosure requirements introduced over that time span.

- The Paris Agreement (2015)

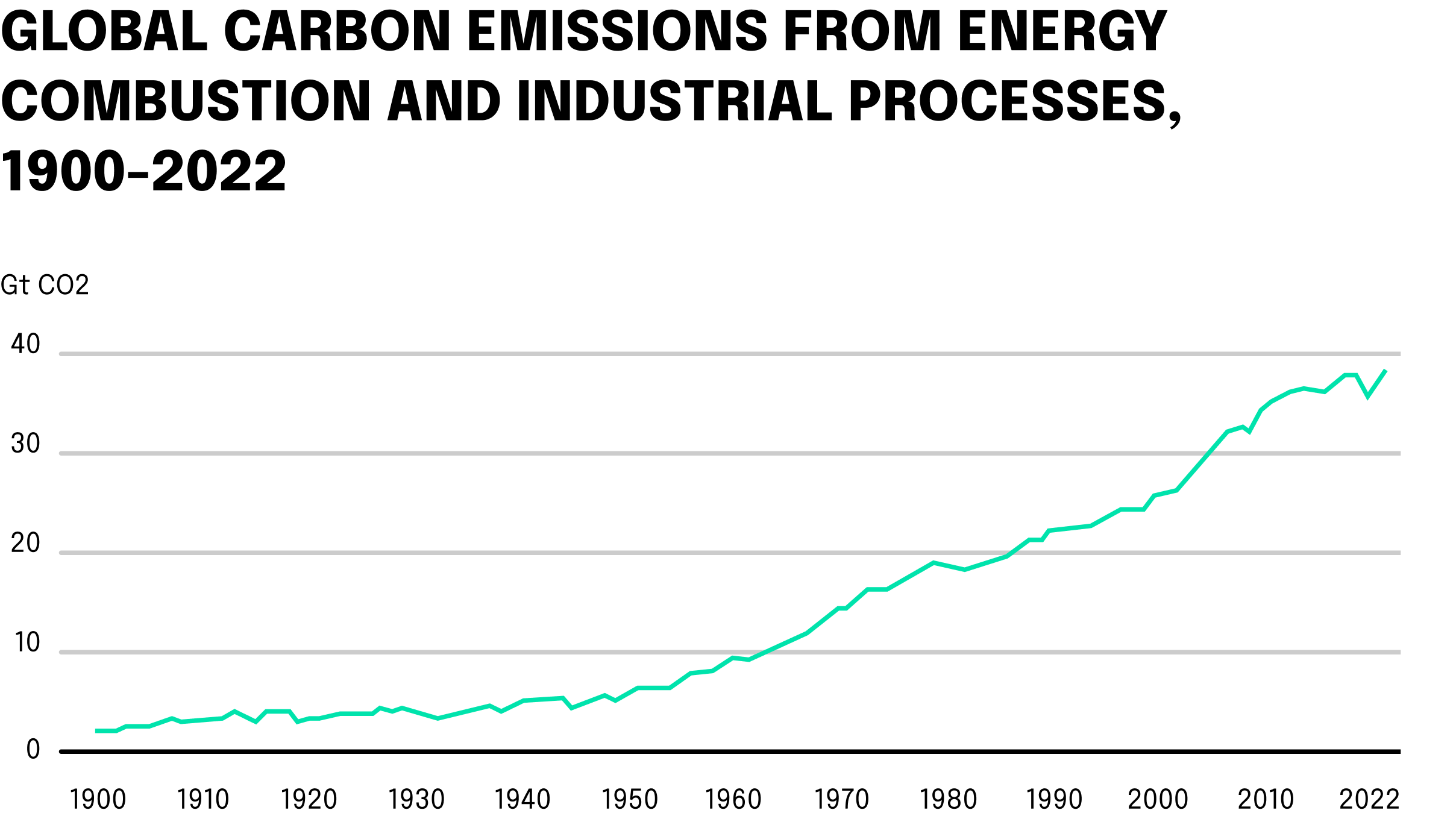

The Paris Agreement, which was struck out over the course of two weeks in Paris during the

UNFCCC’s 21st Conference of the Parties (COP 21), represented a historic turning point for

global climate action and was adopted on December 12, 2015. More specifically, the aim of

the agreement is to substantially reduce global carbon emissions in an effort to reduce the

global temperature rise to 1.5–2 degrees Celsius above preindustrial levels. As a part of this

endeavor, 177 nations — composing roughly 97% of the world’s climate pollution — announced

detailed national emissions’ reduction goals for climate action by 2020.

- The Action Plan on Financing Sustainable Growth (2018)

Following the groundwork laid out by the Paris Agreement, The Action Plan on Financing Sustainable Growth, introduced in 2018, marked yet another pivotal initiative by the European Commission aimed at aligning financial systems with the principles of sustainability. Rooted in the recognition that financial markets play a critical role in driving the transition to a more sustainable and low-carbon economy, the plan outlined a comprehensive framework to channel investments towards environmentally friendly projects and businesses.

In more precise terms, this ambitious plan consists of a series of interconnected measures, focusing on key areas such as improving the transparency of financial institutions regarding their environmental and social impacts, establishing a unified classification system for sustainable activities (taxonomy), creating sustainable benchmarks, and enhancing the integration of sustainability risks into investment decision-making.

- The European Green Deal (2019)

Shaped by the pressuring narrative of the 2030 Agenda and the Paris Climate Agreement, The European Green Deal encompasses a diverse array of initiatives spanning multiple sectors, including energy, transportation, agriculture, industry, and finance. Key goals involve attaining net-zero greenhouse gas emissions by 2050, driving the shift to renewable energy sources and energy efficiency, fostering a circular economy to minimize waste and enhance resource utilization and conserving biodiversity and ecosystems. Integral to the Green Deal is the mobilization of investments, both public and private, to fuel sustainable projects and innovations that underpin the transition to a greener economy.

Introduced as part of the EU Taxonomy Regulation in 2021, this foundational framework has become a core element of the EU’s sustainable finance strategy. It serves as a robust tool to classify economic activities based on their environmental sustainability, with the ultimate goal of facilitating sustainable investments and aligning financial activities with the principles of environmental protection and climate change mitigation.

The EU Taxonomy sets up a standardized system that assesses whether an economic activity significantly helps achieve one or more of the six environmental goals listed in the Taxonomy Regulation: (1) climate change mitigation, (2) climate change adaptation, (3) sustainable use and protection of water and marine resources, (4) transition to a circular economy, (5) pollution prevention and control, and (6) protection and restoration of biodiversity and ecosystems.

The classification framework has been designed to enhance transparency, provide investors and businesses with clear guidelines for sustainable investments, and contribute to the EU’s overall objective of becoming climate-neutral by 2050. By setting a common language for sustainable economic activities, the Taxonomy fosters consistency and accountability, thereby supporting the transition to a more sustainable and environmentally responsible economy within the EU.

- The Corporate Sustainability Reporting Directive (CSRD) (2021)

Building on previous efforts, the CSRD represents a significant step forward in sustainable regulation. It expands the scope of the Non-Financial Reporting Directive, requiring all large companies and all publicly listed companies to follow detailed EU sustainability reporting standards. The CSRD aims to improve the consistency and comparability of sustainability information, facilitating more informed decision-making by investors, policymakers, and other stakeholders.

- The Corporate Sustainability Reporting Directive (CSRD) (2021)

Building on previous efforts, the CSRD represents a significant step forward in sustainable regulation. It expands the scope of the Non-Financial Reporting Directive, requiring all large companies and all publicly listed companies to follow detailed EU sustainability reporting standards. The CSRD aims to improve the consistency and comparability of sustainability information, facilitating more informed decision-making by investors, policymakers, and other stakeholders.

- The EU Sustainability Reporting Standards (ESRS) (2023)

There is an intrinsic connection between CSRD and the ESRS. While the former directive sets out the legal requirements, mandating a broader range of companies to disclose detailed sustainability information, thereby expanding the scope of reporting, the ESRS provides specific guidelines to ensure the compliance with the CSRD reporting. Together, the CSRD and ESRS represent a unified approach to enhancing transparency, accountability, and sustainability in business practices.

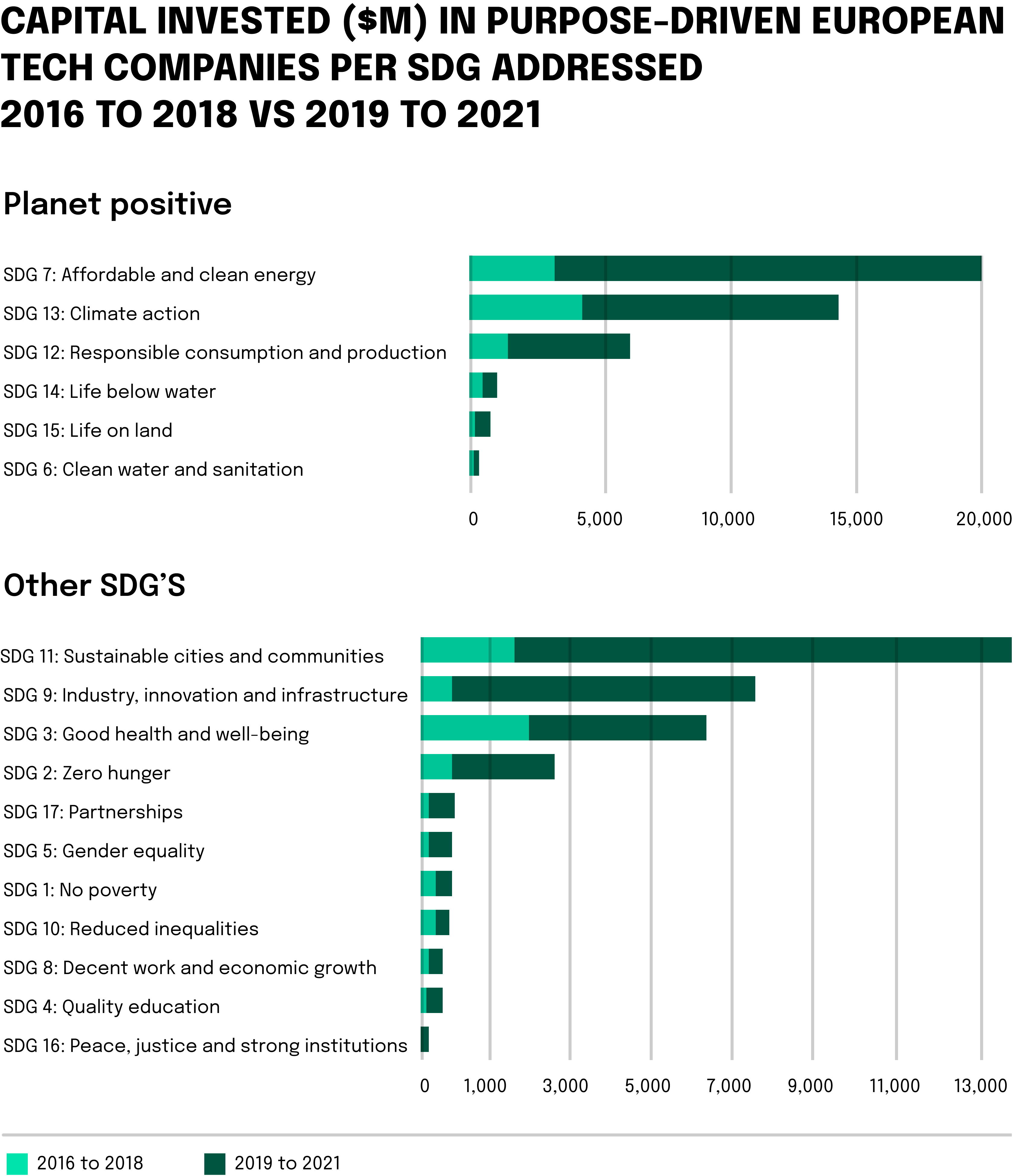

Some of these regulations particularly focused on creating a more innovative and sustainable economic environment. In the next section we’ll take a closer look at how innovation is created through collaboration and how this process has generated seven impactful sustainable innovations.