The landscape of venture building and startup support in Germany has undergone a remarkable evolution over the past decade. This journey not only reflects the changing attitudes towards entrepreneurship, but also the shifting focus of support mechanisms aimed at nurturing early-stage ventures. Let’s traverse through the significant milestones that marked this evolution.

Origin and Maturation of Venture Builders and Startup Studios

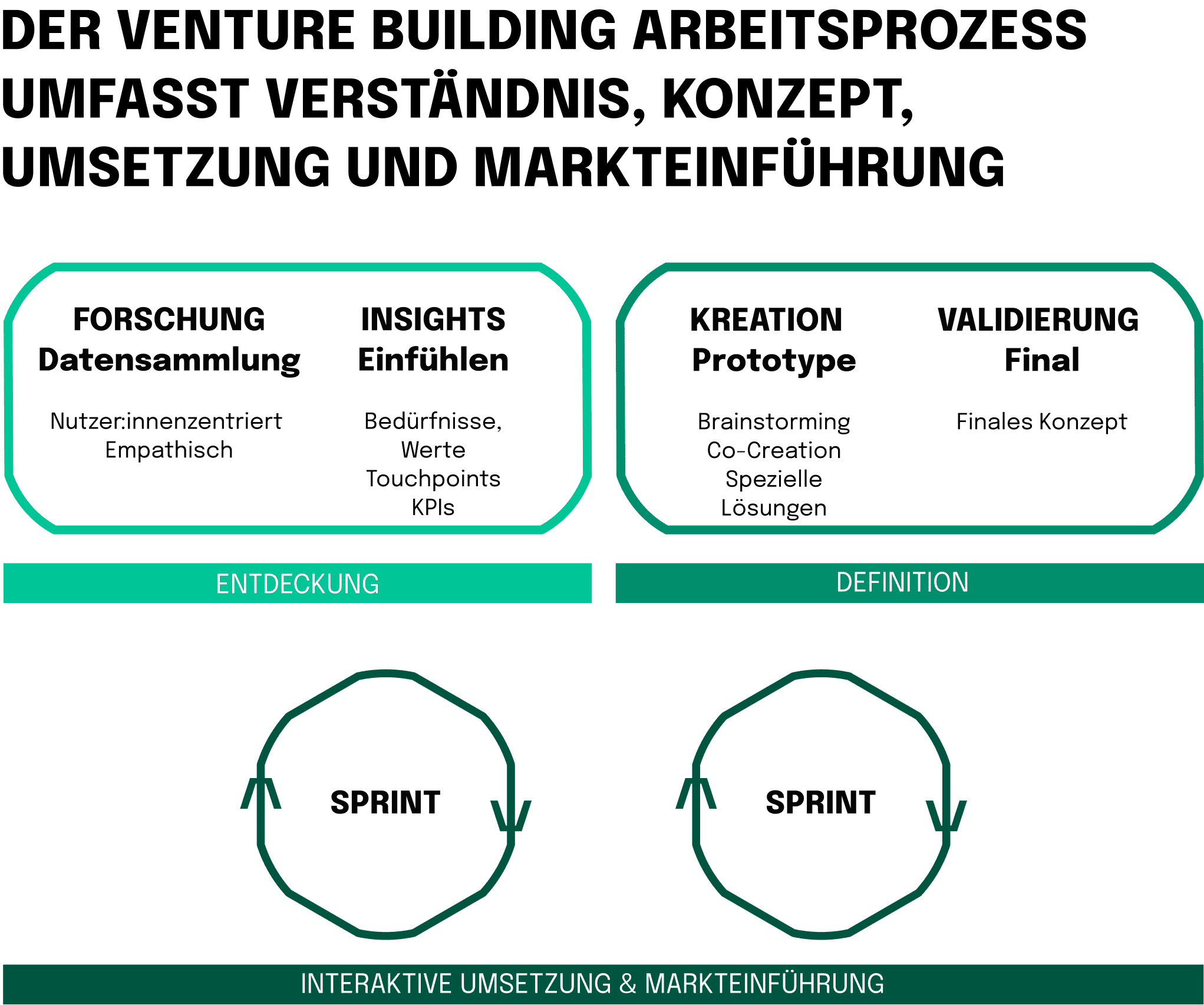

The concept of Venture Builders and Startup Studios emerged as a comprehensive response to the evolving needs of early-stage startups, offering more than just a financial lifeline. Their role in the German startup ecosystem started gaining prominence as they provided a blend of financial backing, strategic guidance, technical expertise, and operational support to fledgling ventures.

The early inklings of this model aimed at creating a collaborative environment, often likened to a startup studio, where multiple startups could grow under one roof, sharing resources, knowledge, and expertise. Over the years, the venture building model has matured and proliferated. From a handful of venture builders in the early 2010s, the number has grown significantly, with more than 200 venture builders now operating across Europe, many of them also in Germany.

Venture builders have made a significant impact on the startup ecosystem in Germany. They have a unique approach to company building, which involves working on a project from the problem-identification stage to launch. This model has proven successful, with startups that launch from studios seeing 30 percent higher company success rates. In fact, 84% of startups coming out of studios go on to raise a seed round, and 72% of those ventures make it to series A.

Prominent venture builders in Germany include Rocket Internet, which is often seen as the pioneer and holds more than 200 investments. In the fintech environment, FinLeap is probably the most known example and has founded 18 companies to date. These venture builders are not only investing but also acting as co-founders, providing the necessary tools for startups to grow and succeed.

The journey from a nascent idea to a thriving business is fraught with challenges and uncertainties. The venture building model has proven to be a boon for many entrepreneurs, mitigating risks, and significantly enhancing the chances of success.

Early 2010s: The Incubator Boom

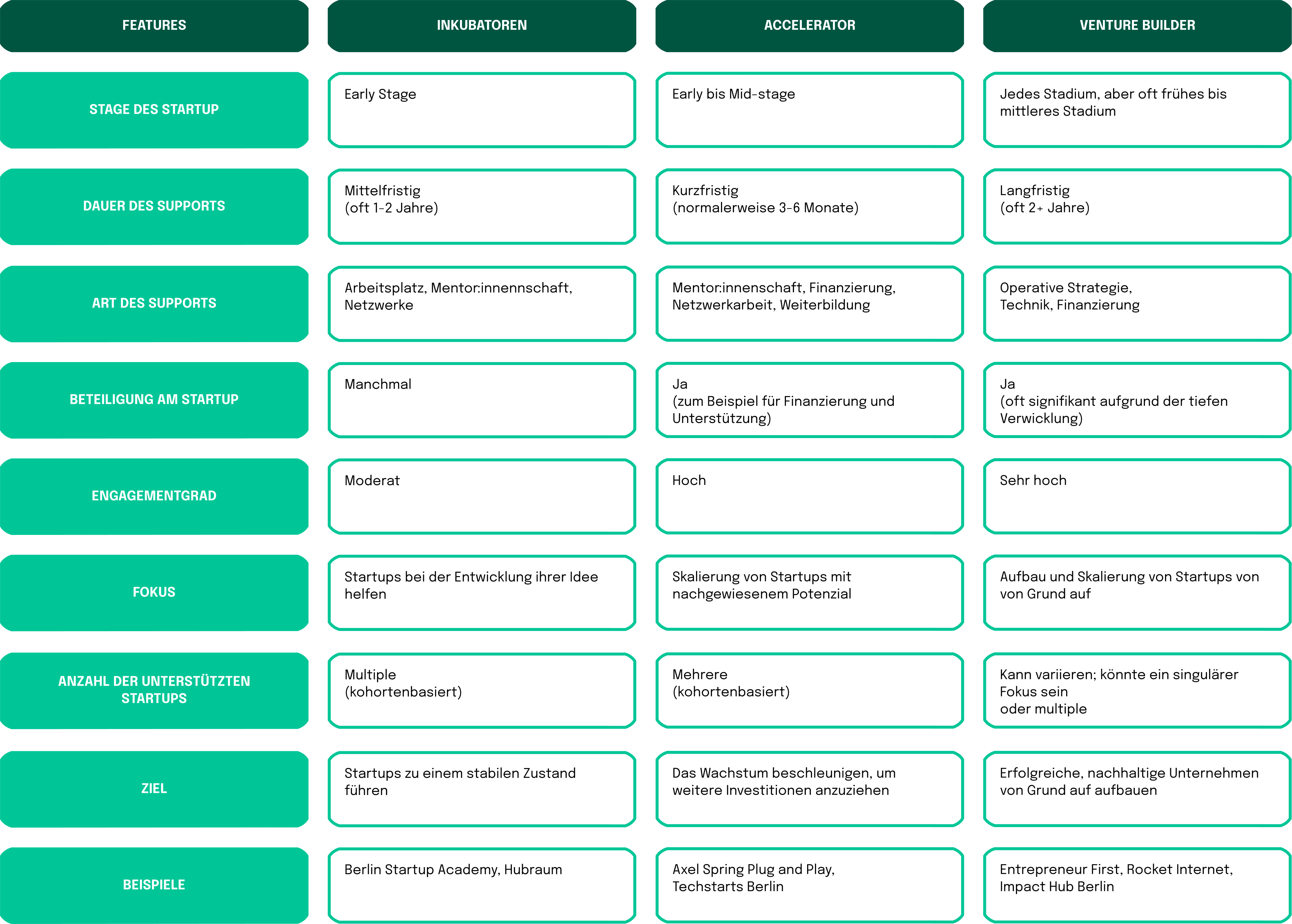

The dawn of the 2010s marked a significant surge in the establishment of incubator programs within Germany. Incubators such as Berlin Startup Academy and Hubraum by Deutsche Telekom, fueled by a desire to nurture early-stage startups, provided an environment where budding entrepreneurs could develop their ideas. These incubators offered a plethora of resources including workspace, mentorship, and often seed funding, creating a conducive environment for startups to flourish during their infancy. The success of many startups emerging from these incubators created a buzz around the model, attracting both domestic and international entrepreneurs to Germany.

Mid 2010s: The Rise of Accelerators

As the ecosystem matured, the focus shifted towards scaling startups that had validated their business models. This era saw the rise of accelerator programs aimed at propelling startups to the next level of growth. Prominent players like Axel Springer Plug and Play, and Techstars Berlin emerged as notable accelerators, offering intensive mentorship programs, networking opportunities with investors and industry experts, and a financial boost to help startups scale rapidly. The accelerator model became an attractive proposition for startups ready to take the leap towards scaling.

Late 2010s: Focus on Sustainable Business Models

The latter part of the decade witnessed a perceptible shift in the startup ecosystem towards embracing sustainable business models. The narrative moved from merely chasing rapid growth to building businesses with long-term viability and a positive societal impact. This shift was also mirrored in the venture building scene in Germany. Venture builders like Entrepreneur First and Rocket Internet began to emphasize the importance of sustainable growth, contributing to a broader discussion on responsible entrepreneurship. This period also saw the rise of impact-focused venture builders like Impact Hub Berlin, which centered on nurturing startups aiming to tackle social and environmental challenges.

The trajectory from incubators to accelerators, and finally towards a focus on sustainability, reflects the evolving ethos of the entrepreneurial ecosystem in Germany. Many venture builders emerged as a holistic support system, aligning with modern-day values of responsible, sustainable, and collaborative entrepreneurship. This progression has not only reshaped the startup support landscape but also set a strong foundation for the venture building model to thrive and continue evolving in response to the changing needs of the entrepreneurial community.