VC serves as a vital artery fueling the growth and innovation within Europe’s bustling entrepreneurial ecosystem. As we stand at the brink of a new era for startups and the finance industry, it becomes pivotal to step back and analyze Europe’s VC landscape. It has been a bastion of tremendous growth, fostering innovations and nurturing startups into industry leaders.

We will rewind to witness its historic growth and then move forward to unveil the key players and hubs steering the industry. A focal point of this voyage will be a deep dive into sectors that have magnetized substantial investments – FinTech, HealthTech, and GreenTech, standing as pillars of innovation and growth. Simultaneously, we will dissect the regulatory milieu and its profound influence on the venture capital industry, followed by a panoramic view of the roles and impacts of various EU initiatives fostering this dynamic ecosystem. A look into the mindset of European VCs can be found here!

Emerging and evolving: The progressive trajectory of European VCs

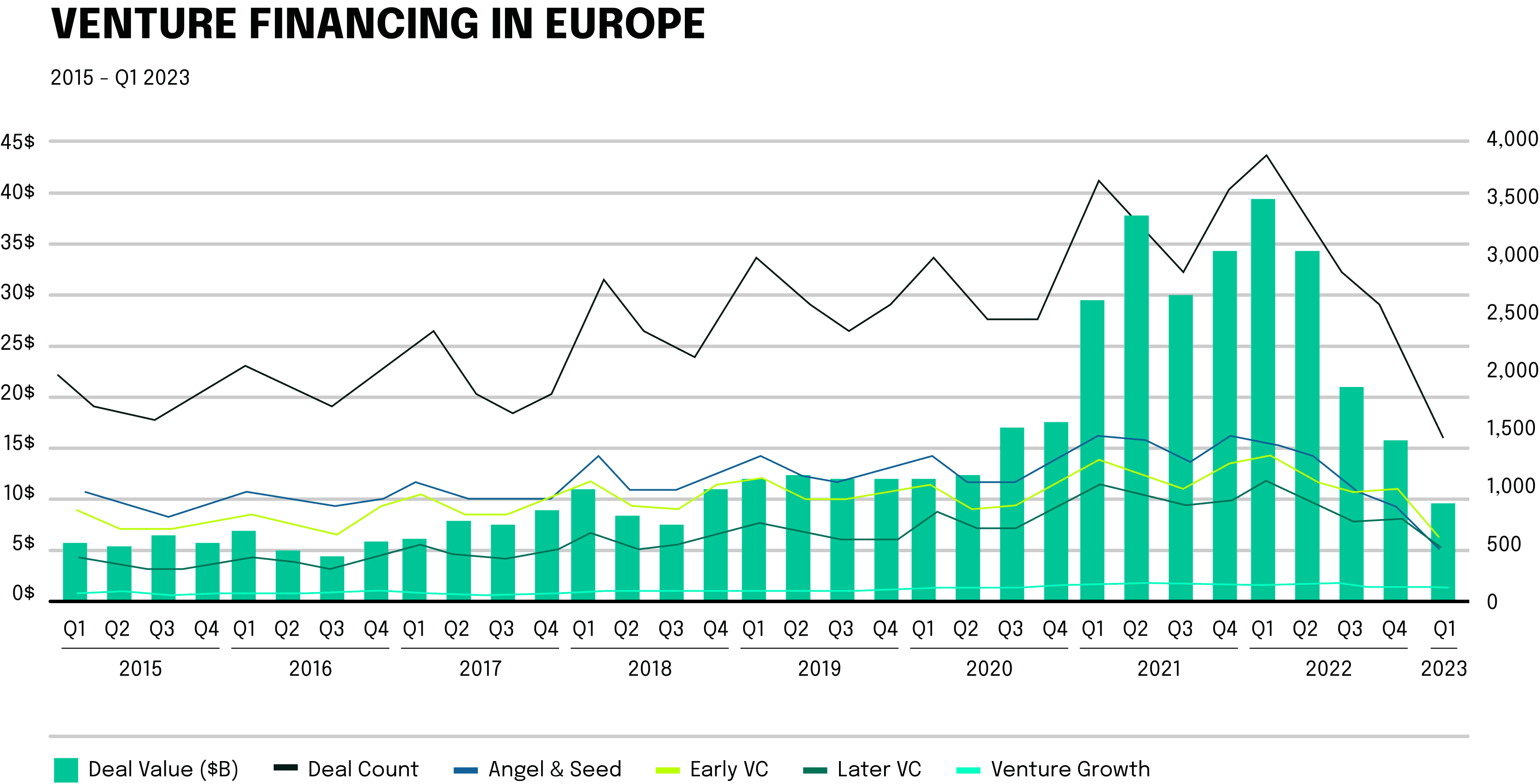

A keen analysis of recent developments in Europe’s fund generation showcases an impressive average fund size hovering around €120 million in 2023, with the front-runners commencing at a substantial €267.5 million marker. While these values might seem a bit restrained when compared to the monumental multi-billion dollar reserves cultivated by American peers, it undoubtedly heralds a forward momentum that promises larger strides in the near future. The graphic below illustrates the growth in the European venture capital scene.

This positive growth narrative is reflected harmoniously in the escalating total assets under management (AUM) overseen by European firms, steadying at a solid median of €300 million, and the upper echelon beginning at an impressive €750 million.

Embarking on early-stage investments: A marked preference in the European domain

One striking trend emanating from the European venture capital landscape is a significant penchant towards fostering nascent enterprises. Roughly 65 percent of VC firms in Europe demonstrate a preference for investing in Seed or Early-Stage (Series A) ventures. This tendency, although possibly influenced by the selection dynamics of firms and investors surveyed, seems to resonate well with the broader market viewpoint, which identifies a significant portion of growth capital originating from regions outside of Europe.

In the past, a rather limited faction of European investors took the helm in spearheading substantial Series C to pre-IPO rounds, a narrative that has gradually changed over recent years. As we find ourselves at a crossroad laden with macroeconomic complexities, the venture capital domain in Europe stands poised for potential shifts, keenly anticipated to observe if this emerging trend will sustain and continue to shape the venture capital discourse in Europe.

The industry focus of European VCs over the last decade

As previously detailed, the focus of the European venture capital industry has narrowed down to a few promising sectors in the past few years. Fintech has been a prominent sector, with startups emerging that revolutionize how financial transactions are conducted, steering towards a more inclusive financial ecosystem.

HealthTech has also seen a remarkable surge, with initiatives aimed at revolutionizing healthcare delivery, including telemedicine and AI-driven diagnostic tools, which became particularly crucial during the COVID-19 pandemic. Driven by the pandemic, in 2021 and 2022, over $5 billion was invested, with 2023 being on track to increase the investment sum.

Furthermore, the GreenTech sector has come to the fore, receiving substantial investments. This sector embodies the collective movement towards sustainable living, focusing on developing technologies that are environmentally friendly and can potentially combat the pressing issue of climate change.

FinTech: The new epicenter of finance

The European landscape has witnessed exponential growth in the Financial Technology, or FinTech, sector, garnering substantial investments and positioning itself as a leader in innovation. Between 2013 and 2022, this sector saw an influx of investments escalating year by year, with figures revealing a commendable jump in both capital infusion and percentage changes. When it came to fintech news, we saw a pretty sluggish first half of 2023, however, the numbers are still impressive! S&P Global published a report that highlighted the downturns in funding for global fintech companies. It dove 49% year over year, to $23 billion during the first half of 2023. Round values declined, on average, 12% for seed firms and 14% for early-stage firms in 2022. These negative numbers are largely driven by the missing mega rounds of funding that happened before and throughout the pandemic. One area in particular that had a positive upstream movement was B2B SaaS solutions. B2B SaaS attracted 44% of money invested in 2023, supporting the long-term trend of shifting away from B2C and moving into direct B2B in fintech.

Three companies that have notably shaped the contour of this sector include:

- Revolut: A veritable giant in the FinTech sphere, Revolut has redefined banking with its revolutionary approach. Revolut offers banking services including GBP and EUR bank accounts, debit cards, currency exchange, stock trading, cryptocurrency exchange and peer-to-peer payments. Revolut’s mobile app supports spending and ATM withdrawals in 120 currencies and transfers in 29 currencies directly from the app. With over 19 investment rounds, and over 52 investors, the company has been a value driver for a lot of stakeholders.

- Adyen: Renowned for offering seamless payment experiences, Adyen has cemented its position as a frontrunner in the financial technology space. Ayden offers end-to-end payments, data, and financial management in a single solution. The company continues to carve niches by enhancing its technological footprint, offering integrated payment solutions that are both efficient and secure. Ayden has attracted a lot of institutional investors, the extensive list of different shareholders and their stake in the company can be seen here.However, also Ayden lost over a quarter of their valuation, after missing financial KPIs in the first quarter of this year.

- Klarna: With its innovative take on e-commerce and retail banking, Klarna has emerged as a force to reckon with in the FinTech landscape. The company has managed to foster a robust presence in 2023, characterized by its user-friendly payment solutions that are reshaping the retail experience. Last year, Klarna raised $800 million of funds at a valuation of $6.7 billion, down around 85% from the $46 billion price-tag it attracted last year. This also shows that investors are more conservative with valuations now, and even larger VC-backed companies need to pay closer attention to cost control and profitability. The topic of buy now, pay later is of high interest to us at neosfer, so we have dedicated a whole podcast to the topic, so listen closely.

GreenTech: Steering the green revolution

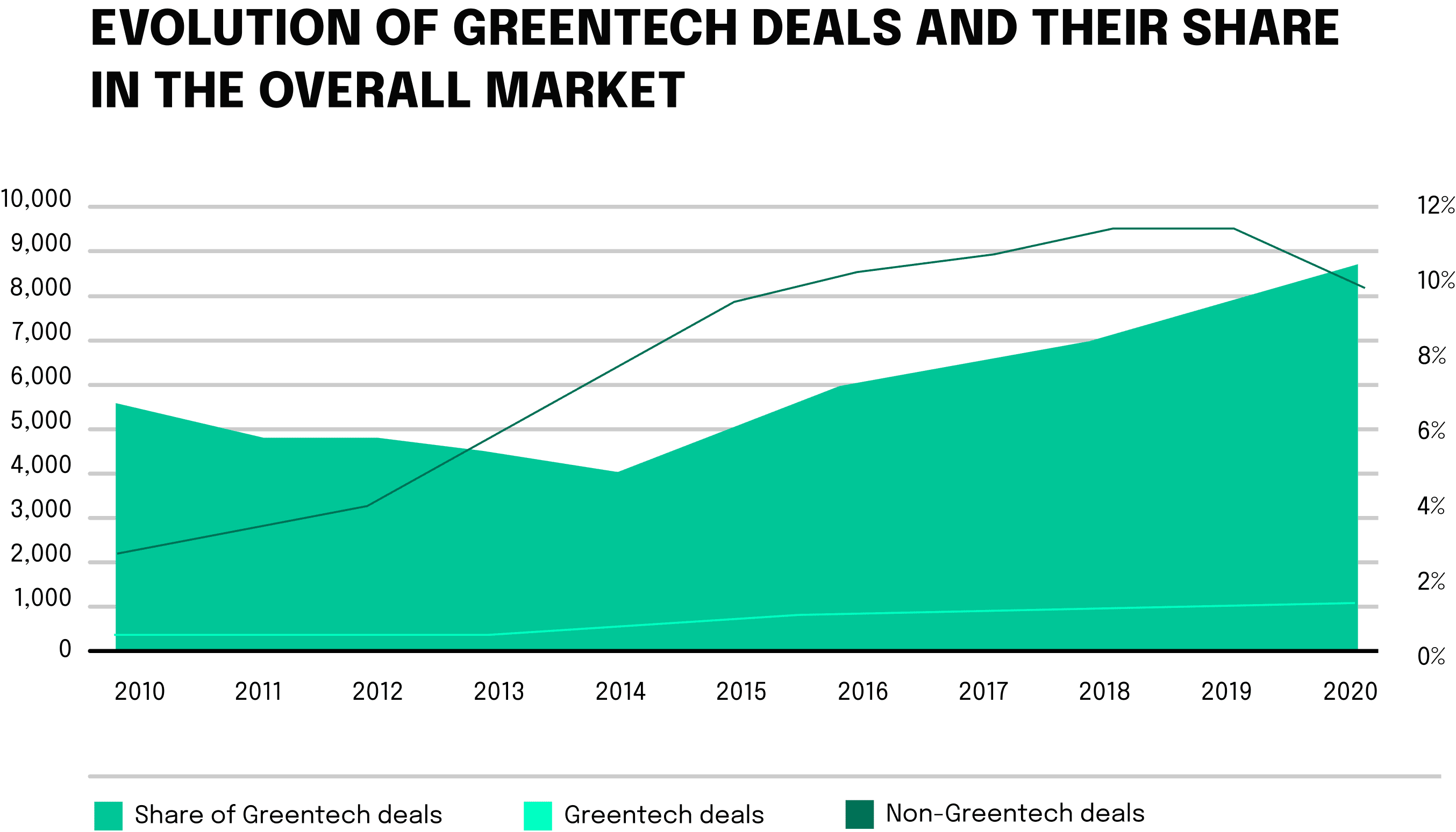

Investments in the GreenTech sector have seen an appreciable escalation, with figures indicating a robust growth in terms of both capital allocation and yearly percentage advancements. Here, Europe for sure is outpacing the US in investments. The US venture capital firms raised $43.9 billion in 2022 compared to $35.6 billion raised in Europe representing a 33% year-over-year increase in Europe, compared to only 7% in the U.S.! So, in Europe this vertical is growing 26% faster compared to the software-focused U.S. counterpart. Transport ($815 million), Energy ($647 million), and Circular economy ($438 million) attract the most funds in Europe. Even though GreenTech still plays a smaller role for the European VC landscape in total, steady growth in investments and funding amount can be observed. From 2013 to 2020, the share already doubled from 5% of all deals to over 10% being in the GreenTech industry.